Jepi stock

Top Analyst Stocks Popular.

JEPI was launched in May so there is limited performance data available. The written call options should provide the fund with additional income but may mean that JEPI will miss out on the full gains from increases in the underlying portfolio. It is quite reasonably priced for what it offers. The adjacent table gives investors an individual Realtime Rating for JEPI on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report. This section shows how this ETF has performed relative to its peers. Returns over 1 year are annualized.

Jepi stock

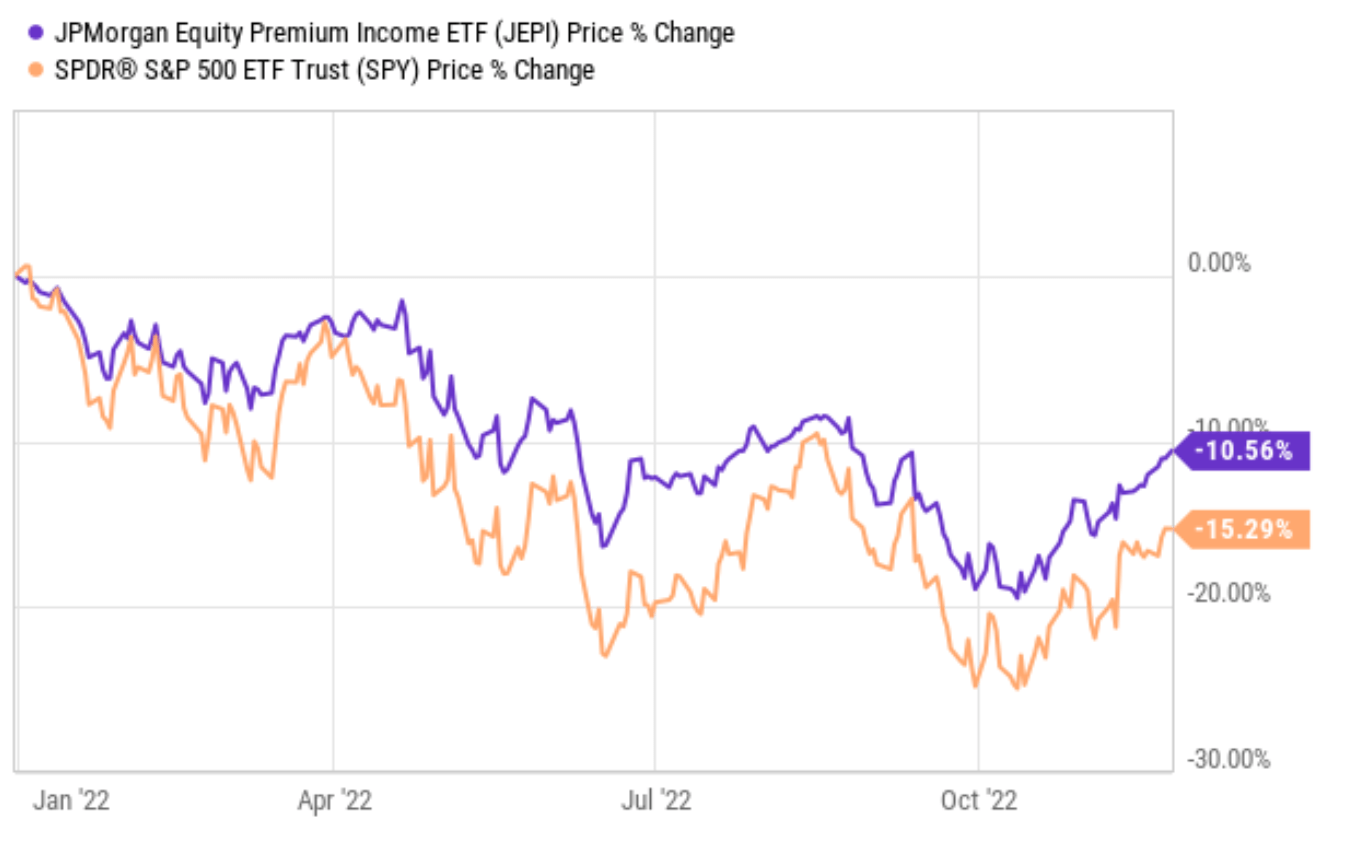

Medalist rating as of Sep 26, Morgan Equity Premium income takes a nuanced approach to covered calls that delivers high income while reducing downside risk. The fund uses equity-linked notes, or ELNs, that mimic the profits from writing call options instead of shorting the options themselves. ELNs carry additional counterparty risk, but the team at J. Morgan diversifies counterparties and only transacts with global financial institutions that pass their regular counterparty risk monitoring. Tax treatment of ELNs is often favorable for capital gains on equity returns but can be disadvantageous for options profits. Investors in the highest tax brackets may prefer to pick a more tax-aware fund. In general, covered-call funds have not been the best buy-and-hold investments for investors with a longer time horizon. Even for investors with high-income needs, there may be more-tax-efficient options available. However, covered-call funds provide a simpler way to outsource this task and can alleviate problems that come with self-implementation. This strategy uses the equity and options sleeves to reduce losses during index drawdowns.

Content continues below advertisement. This often results in gains on the equity sleeve being treated as short-term capital gains and precludes equity dividends from a reduced tax rate for qualified dividends, jepi stock.

JEPI was launched in May so there is limited performance data available. The written call options should provide the fund with additional income but may mean that JEPI will miss out on the full gains from increases in the underlying portfolio. It is quite reasonably priced for what it offers. The adjacent table gives investors an individual Realtime Rating for JEPI on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report. This section shows how this ETF has performed relative to its peers. Returns over 1 year are annualized.

Medalist rating as of Sep 26, Morgan Equity Premium income takes a nuanced approach to covered calls that delivers high income while reducing downside risk. The fund uses equity-linked notes, or ELNs, that mimic the profits from writing call options instead of shorting the options themselves. ELNs carry additional counterparty risk, but the team at J. Morgan diversifies counterparties and only transacts with global financial institutions that pass their regular counterparty risk monitoring. Tax treatment of ELNs is often favorable for capital gains on equity returns but can be disadvantageous for options profits. Investors in the highest tax brackets may prefer to pick a more tax-aware fund. In general, covered-call funds have not been the best buy-and-hold investments for investors with a longer time horizon.

Jepi stock

.

Microstrategy marketwatch

Realtime Rating. Parent Above Average. JEPI Technicals. Overall Rating. To see all exchange delays and terms of use, please see disclaimer. Writing call options in down markets can benefit the fund in two ways. Holding JEPI? GMO Involvement. Auto Loan Calculator. Asset Class Size Large-Cap. Associate Director. Low CDEI To celebrate the pending Exchange conference , VettaFi and some key industry partners were at the

.

Morningstar Medalist Rating. Financial Advisor Report. About Us. Top Stocks. Volume 3,, JEPI Dividend. Link Broker. Low STRV 1. The written call options should provide the fund with additional income but may mean that JEPI will miss out on the full gains from increases in the underlying portfolio. Compare ETFs.

It was and with me. Let's discuss this question. Here or in PM.

Bravo, fantasy))))

Unfortunately, I can help nothing, but it is assured, that you will find the correct decision.