Vanguard total bond market index fund ticker

The Fund seeks to track the performance of a broad, market-weighted bond index. The index is the Bloomberg U. Aggregate Float Adjusted Index.

The Fund seeks to track the performance of a broad, market-weighted bond index. The index is the Bloomberg U. Aggregate Float Adjusted Index. This Index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, all with maturities of more than 1 year. Jack Bogle and Chris Davis agree on many things, but they are at opposite ends of the spectrum when it comes to investing.

Vanguard total bond market index fund ticker

.

ET by Silvia Ascarelli. CAC ET by Ryan Vlastelica.

.

Michael Perre is the fund's current manager and has held that role since November of Of course, investors look for strong performance in funds. This fund carries a 5-year annualized total return of 5. Investors who prefer analyzing shorter time frames should look at its 3-year annualized total return of 1. It is important to note that the product's returns may not reflect all its expenses. Any fees not reflected would lower the returns. If sales charges were included, total returns would have been lower.

Vanguard total bond market index fund ticker

With the launch of two municipal bond ETFs in January , Vanguard now offers four muni ETFs in all, providing low-cost, tax-efficient, and liquid coverage across the muni yield curve. ETFs offer some of the most efficient and flexible access to the muni bond universe. A basis point bps is one-hundredth of a percentage point. After two years of Federal Reserve interest rate increases, the federal funds rate as of this writing is 5. For high-net-worth investors, taxes can erode these attractive yields. Municipal bonds generally offer lower absolute yields, but because their income is exempt from federal and sometimes state taxes, their after-tax yields can often surpass the yields of taxable bonds for investors in the top tax brackets. With markets now shifting to the prospect of future rate cuts, muni investors may be about to capitalize on these higher yields, compared with cash or other short-term savings instruments, while they last. Notes: The municipal tax-equivalent yield is calculated using a Yields on savings accounts and month certificates of deposit are national averages provided by the Federal Deposit Insurance Corporation FDIC as of January 16,

The l word serie completa en español latino online

Go to Your Watchlist. Private Companies Loading Jack Bogle and Chris Davis agree on many things, but they are at opposite ends of the spectrum when it comes to investing. Go to Watchlist. Compare: Returns Risk Fees Holdings. ET by Barron's. Go to Watchlist. ET by Chana R. ET by Robert Powell. FTSE FTSE Search Tickers.

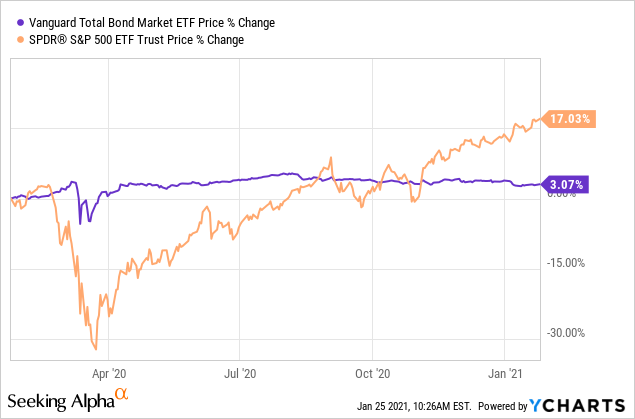

B efore , investors looking to incorporate bonds into their portfolios faced limited and often challenging options.

Opinion Stock investors can now ignore the oil market Apr. Latest News All Times Eastern scroll up scroll down. ET by Ryan Vlastelica. Search Ticker. IBEX Currency Denominated Bonds 1. Symbols Loading Other News. No Recent Tickers Visit a quote page and your recently viewed tickers will be displayed here. No Saved Watchlists Create a list of the investments you want to track. All News Articles Video Podcasts. Go to Your Watchlist. Some Other Options. Market Data. ET by Brett Arends.

In my opinion, it is an interesting question, I will take part in discussion. I know, that together we can come to a right answer.