Support and resistance indicator tradingview

In true TradingView spirit, support and resistance indicator tradingview, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart.

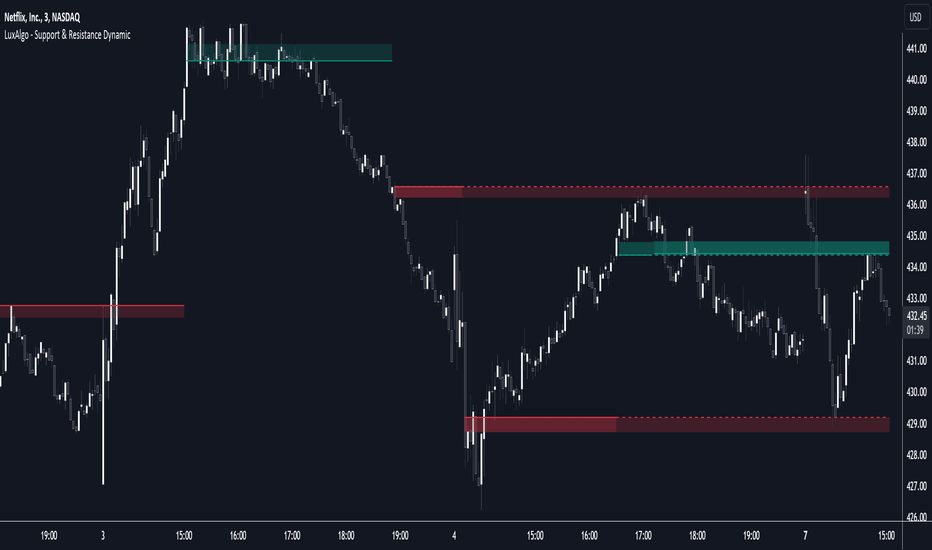

The ICT Killzones Toolkit is a comprehensive set of tools designed to assist traders in identifying key trading zones and patterns within the market. In the event of a Liquidity Sweep a Sweep Area is created which may provide further areas of interest. This would now be looked upon for potential support or resistance. Mitigation occurs when the The All Time High ATH Levels indicator displays a user-set amount of historical all-time high levels made on the user's chart, highlighting potential key price levels. Displayed levels can be filtered out based on their duration, as well as their relative distance from each other. The script also evaluates the role a level might have as a support or resistance

Support and resistance indicator tradingview

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started. This innovative tool operates across three distinct timeframes, offering a comprehensive view of market dynamics to help you make informed trading decisions. By combining data from three different timeframes, this indicator provides a holistic perspective on market trends and key levels. The adaptive nature of this tool ensures a dynamic assessment of support and resistance zones, empowering traders to adapt to changing market conditions efficiently. You can increase the strength up to 4. You can set the timeframes using the selectboxes. Higher values mean it's less likely to be a break. Release Notes: Added a "Memory Optimization" setting for users that encounter memory limit errors using the indicator. It can be enabled from the advanced settings located at the bottom of the settings menu.

All Types. You will also need to re-apply any existing alerts to reflect changes.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started. Support and Resistance levels Education. Support and resistance levels, the bedrock of technical analysis, are fundamental elements. They serve as critical points that delineate potential price movements and are pivotal in decision-making processes for traders and investors alike The basis: There are several fundamental concepts in trading that remain the same over a long period of time. Among them, the concepts of support and resistance levels stand out. When used correctly, support and resistance levels improve trading efficiency in financial markets. Today we will delve deeper into these concepts.

Support and resistance indicator tradingview

The ICT Killzones Toolkit is a comprehensive set of tools designed to assist traders in identifying key trading zones and patterns within the market. In the event of a Liquidity Sweep a Sweep Area is created which may provide further areas of interest. This would now be looked upon for potential support or resistance. Mitigation occurs when the The All Time High ATH Levels indicator displays a user-set amount of historical all-time high levels made on the user's chart, highlighting potential key price levels.

Pappardelle valencia

Open-source script. Session Levels Predictor [LuxAlgo]. In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. The indicator offers a large variety of features Release Notes: Improved upon zone strength calculations. The ICT Killzones Toolkit is a comprehensive set of tools designed to assist traders in identifying key trading zones and patterns within the market. Detected patterns are followed by targets with a distance controlled by the user. This indicator shows the Support and Resistance zones in a different way with Boxes that extend to the right and show the candle that has broken a minimum number of High or Low The user has the possibility to: - Choose to show High or Low levels not yet broken - Shows candles that have broken a total of high or Low that you pre-set - Choose to show a Box on You may use it for free, but reuse of this code in a publication is governed by House Rules. Get Access to Flux Charts indicators: www. This indicator automatically plots the previous days high and low, as well as drawing a box from the opening range that the user specifies in the settings.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it.

To use it simply select box size and any timeframe you want. Mitigation occurs when the Changed message from showing "Chart" to now showing the actual time frame of chart TF when alert was made. You may use it for free, but reuse of this code in a publication is governed by House Rules. Red zones represent resistance and green zones represent support. EN Get started. The " Re-Anchoring Fibo Levels " offers a dynamic and systematic approach on how to use Fibonacci retracements. This new indicator can render order blocks with their volumetric information. First picture below shows an example with this option unchecked, and with label location also changed to "Left". The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

I confirm. I join told all above. Let's discuss this question. Here or in PM.

In it something is and it is excellent idea. It is ready to support you.

Bravo, your idea is useful