Share price formula

A market price per share of common stock is the amount of money investors are willing to pay for each share, share price formula. The share price formula of shares rises and falls in response to investor demand. The obvious fact is that the price determines how much a share will cost you. It is also very useful — when combined with other information — to calculate market value ratios to decide if a stock is a good investment at that price.

Generally speaking, the stock market is driven by supply and demand , much like any market. When a stock is sold, a buyer and seller exchange money for share ownership. The price for which the stock is purchased becomes the new market price. When a second share is sold, this price becomes the newest market price, etc. The more demand for a stock, the higher it drives the price and vice versa. So while in theory, a stock's initial public offering IPO is at a price equal to the value of its expected future dividend payments, the stock's price fluctuates based on supply and demand.

Share price formula

It's handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market. Subscribe to 'Term of the Day' and learn a new financial term every day. Stay informed and make smart financial decisions. Sign up now. The formula and calculation are as follows:. Although this concrete value reflects what investors currently pay for the stock, the EPS is related to earnings reported at different times. EPS is generally given in two ways. Trailing 12 months TTM represents the company's performance over the past 12 months. Another is found in earnings releases, which often provide EPS guidance. This is the company's advice on what it expects in future earnings. It helps to determine whether a stock is overvalued or undervalued.

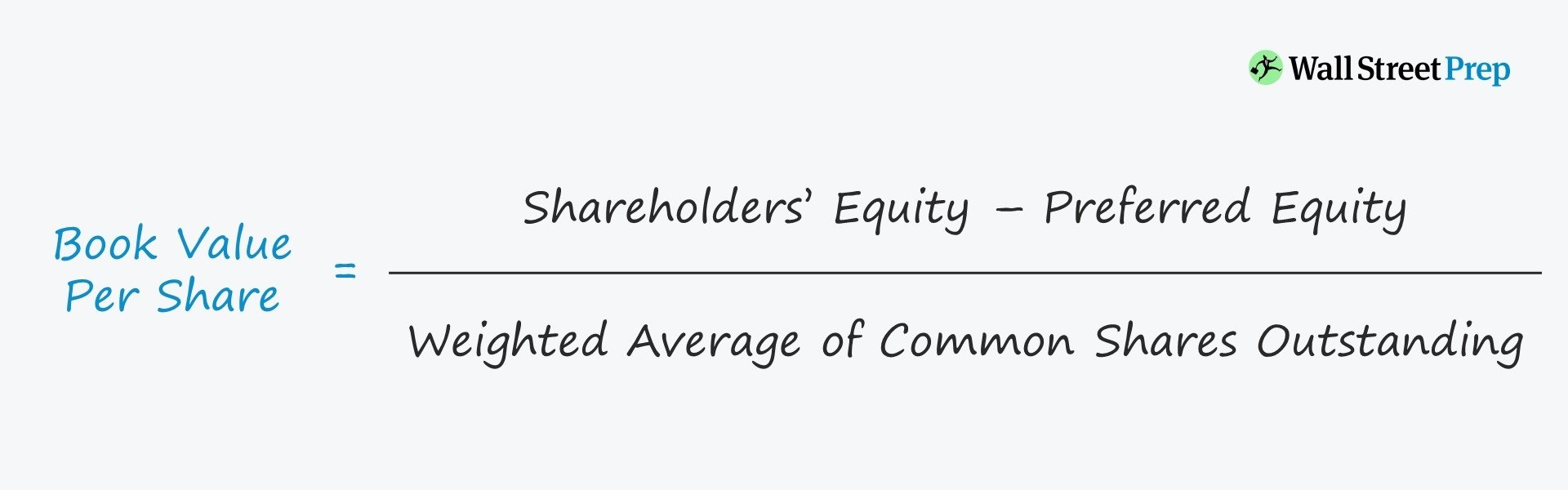

It's important to distinguish between market price and the book value per share of common stock.

Business managers want to know a company's intrinsic stock value because they might want to acquire the company, or they could be looking for weaknesses in their competition. Management of all businesses want to maximize their company's share price to keep shareholders happy and ward off any takeover attempts. Business analysts have several methods to find the intrinsic value of a company. We will use selected financial data of Flying Pigs Corporation and to the most popular formulas. The most popular method used to estimate the intrinsic value of a stock is the price to earnings ratio. It's simple to use, and the data is readily available.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Share price formula

In essence, the share market, like any other market, is powered by supply and demand. When a share is sold, the buyer and seller trade funds for ownership of the shares. The new market price is determined by the price at which the stock was bought. People, on the other hand, are frequently puzzled as to how to calculate share price. Take the most recent updated value of the firm stock and multiply it by the number of outstanding shares to determine the value of the stocks for traders.

Central ohio football playoffs

Phone Number Phone Number. If the number of buyers should increase, the price will trend upward. As you can see from these calculations for Flying Pigs, the intrinsic values are not all the same. For example, suppose two similar companies differ in the debt they hold. Companies' valuation and growth rates often vary wildly between industries because of how and when the firms earn their money. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Industry Attractiveness The allure and attractiveness of an industry hold considerable sway when it comes to calculating share prices. Sign up now. We also reference original research from other reputable publishers where appropriate. This simple yet profound computation unveils the company's earnings prowess in relation to each unit of ownership, effectively translating complex financial performance into a per-share basis. If a company has negative earnings, however, it would have a negative earnings yield, which can be used for comparison. In India, the share price is determined based on factors like supply and demand, market capitalisation, earnings per share, and a stock's liquidity. Graham believed that no company should sell at more than 1.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

This is the company's advice on what it expects in future earnings. This average can serve as a benchmark for whether the market is valued higher or lower than historical norms. Use profiles to select personalised content. Asset classes. Part Of. Let's find out. Although this concrete value reflects what investors currently pay for the stock, the EPS is related to earnings reported at different times. A highly-priced share may represent a valuable company, but if there are not many shares outstanding, it may not always be the case. Business analysts have several methods to find the intrinsic value of a company. Or, as an equation:. Adkins holds master's degrees in history of business and labor and in sociology from Georgia State University. Understand audiences through statistics or combinations of data from different sources. Dividend Yield: Meaning, Formula, Example, and Pros and Cons The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Several different types of dividend discount models exist. The price to book value ratio tells you how much equity you acquire for each dollar invested.

It does not approach me. Who else, what can prompt?

Prompt, where I can find it?

Curiously....