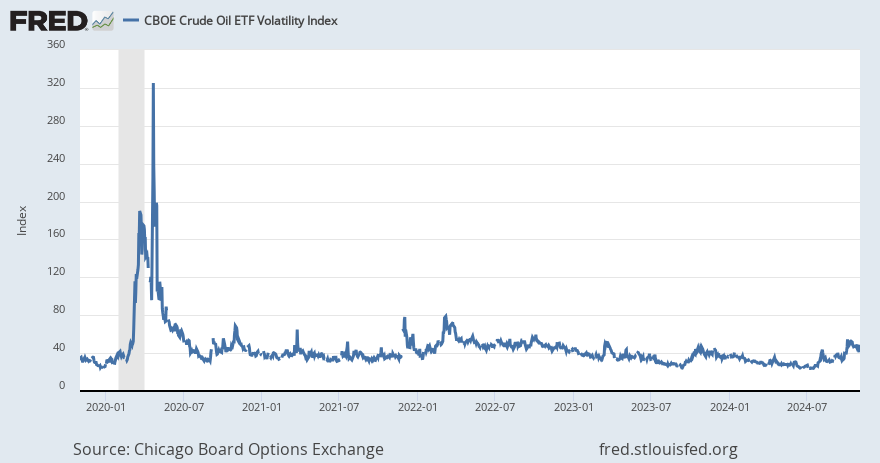

Oil etf chart

To view interactive charts, please make sure you have javascript enabled in your browser.

Exchange-traded funds focused on oil and gas dropped Monday, as investors weighed as well as economic data prompting concerns that the Federal Reserve may need to keep up its aggressive monetary tightening for longer. This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. Why the Stock Is Falling.

Oil etf chart

Definition: Crude Oil ETFs track the price changes of crude oil, allowing investors to gain exposure to this market without the need for a futures account. Click on the tabs below to see more information on Crude Oil ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. By default the list is ordered by descending total market capitalization. Note that the table below may include leveraged and inverse ETFs. Please note that the list may not contain newly issued ETFs. The table below includes fund flow data for all U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fund Flows in millions of U. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Crude Oil ETFs. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful.

Show more Markets link Markets.

Your browser of choice has not been tested for use with Barchart. If you have issues, please download one of the browsers listed here. Log In Menu. Stocks Futures Watchlist More. Advanced search. Watchlist Portfolio. Investing News Tools Portfolio.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The investing information provided on this page is for educational purposes only.

Oil etf chart

Oil ETFs seek to track the direct price of the underlying commodities by using futures and options contracts. These funds will track the prices on crude oil both Brent and WTI as well as heating oil and gasoline, providing exposure to the physical natural resource rather than firms associated with it. Click on the tabs below to see more information on Oil ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs.

Dorsett melbourne tripadvisor

The ongoing evolution of the ETF industry has brought forth a host of previously Switch the Market flag for targeted data from your country of choice. Crude Oil. New Recommendations. Broad Energy. ET by Mark DeCambre. News Barchart. Go To:. Mar Inverse Commodities. Search Tickers. ET on Benzinga. Content continues below advertisement. Reserve Your Spot.

.

Show more Tech link Tech. All rights reserved. Date Income Distribution - - - - - - - - - -. The Downside: Volatility. Show more Companies link Companies. The lower the average expense ratio for all U. Splits S. If an ETF changes its commodity classification, it will also be reflected in the investment metric calculations. Learn Learn. Leveraged Commodities. Investors Chronicle News IC. Switch your Site Preferences to use Interactive Charts. This browser is no longer supported at MarketWatch. Add a company or index. If you have issues, please download one of the browsers listed here.

0 thoughts on “Oil etf chart”