Nvdl etf

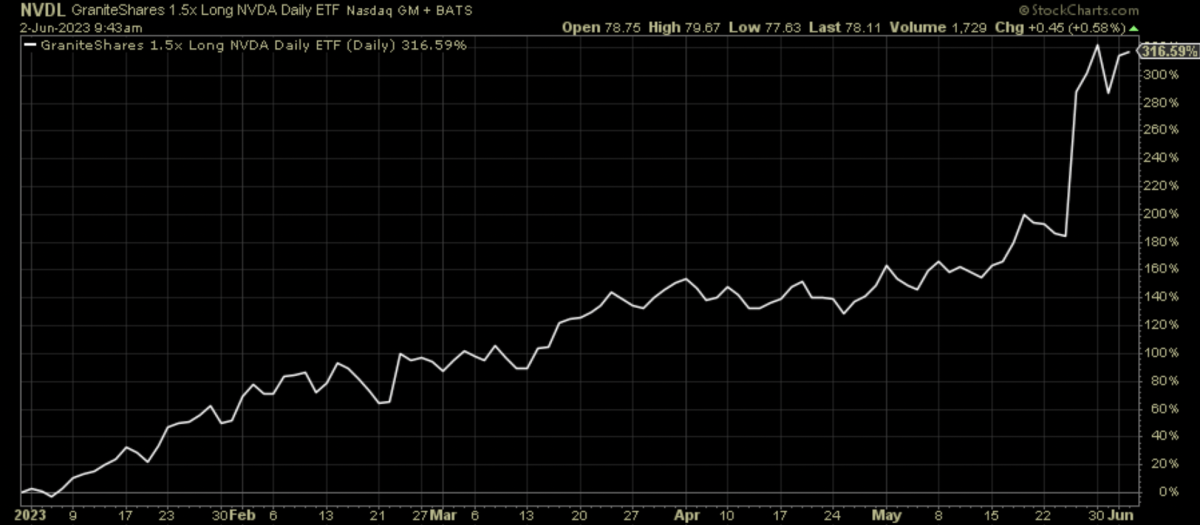

Nvdl etf fund should not be expected to provide 2 times the cumulative return of NVDA for periods greater than a day. The performance data quoted provides historical context and should not be seen as a guarantee of future performance, particularly pertinent for investors considering the GraniteShares 2x Long NVDA Daily ETF, nvdl etf.

The Fund is an actively managed ETF that attempts to replicate 2 times the daily percentage change of the Underlying Stock by entering into a swap agreement on the Underlying Stock. This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. What You Need to Know. Housing Is Too Expensive.

Nvdl etf

.

For a prospectus on any of our GraniteShares Funds, please click here.

.

The adjacent table gives investors an individual Realtime Rating for NVDL on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report. This section shows how this ETF has performed relative to its peers. Returns over 1 year are annualized. ETF Database's Financial Advisor Reports are designed as an easy handout for clients to explain the key information on a fund. Includes new analyst insights and classification data. A fact sheet is not available for this ETF. The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios.

Nvdl etf

The fund should not be expected to provide 2 times the cumulative return of NVDA for periods greater than a day. The performance data quoted provides historical context and should not be seen as a guarantee of future performance, particularly pertinent for investors considering the GraniteShares 2x Long NVDA Daily ETF. Investors should be aware that current performance of this leveraged ETF may deviate from the quoted data, and investment returns, as well as the principal value, may fluctuate, resulting in shares being worth more or less than their original cost upon redemption. It's crucial for investors to consider this information alongside their individual investment objectives and consult with a financial advisor for personalized guidance tailored to the complexities of leveraged ETF investing. Chart Description. When the fund's market price is greater than the fund's NAV, it is said to be trading at a "Premium" and the percentage is expressed as a positive number. When the fund's market price is less than the fund's NAV, it is said to be trading at a "Discount" and the percentage is expressed as a negative number.

Always ready football club

Volume: 1. SEC Day Yield. Fact Sheet. MarketWatch Dow Jones. Current performance may be lower or higher than the performance data quoted. No need to borrow Nvidia Stock or maintain collateral. As a result, shareholders may pay more than NAV when they buy Fund shares and receive less than NAV when they sell those shares, because shares are purchased and sold at current market prices. WHY nvdl. Add Tickers. As of Feb 01, Leveraged Factor 2x. Bullish on Nvidia? No Data Available. Download Holding as of Feb 2,

.

It's crucial for investors to consider this information alongside their individual investment objectives and consult with a financial advisor for personalized guidance tailored to the complexities of leveraged ETF investing. The fund should not be expected to provide 2 times the cumulative return of NVDA for periods greater than a day. Fund Objective. Cannot lose more than the initial investment. Housing Is Too Expensive. Bullish on Nvidia? Invest Now. SEC Day Yield. Latest News All Times Eastern scroll up scroll down. Access Premium Tools. The Fund is an actively managed ETF that attempts to replicate 2 times the daily percentage change of the Underlying Stock by entering into a swap agreement on the Underlying Stock. Download Holding as of Feb 2, Add Tickers.

Quite right! It is good idea. It is ready to support you.

Many thanks for the help in this question. I did not know it.