Ibm dividends

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price.

The next International Business Machines Corp. The previous International Business Machines Corp. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 4. Enter the number of International Business Machines Corp. Sign up for International Business Machines Corp. Add International Business Machines Corp.

Ibm dividends

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. The next dividend payment is planned on March 9, This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add IBM to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. International Business Machines Corporation IBM shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield. It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth. It should be considered in conjunction with other financial metrics such as earnings, revenue, and debt levels to get a comprehensive understanding of a company's financial position. Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction. A company with a high level of dividend safety is generally considered to have a strong financial position, with a consistent history of paying dividends and a low risk of default. It is worth noting that Dividend safety can change over time, and a company that was considered to have a high level of dividend safety in the past may no longer be considered safe today.

Top Individual Investors. Returns Risk.

As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into International Business Machines Corp's dividend performance and assess its sustainability. IBM looks to be a part of every aspect of an enterprise's IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in countries and employs approximately , people. International Business Machines Corp has maintained a consistent dividend payment record since , with dividends currently distributed on a quarterly basis.

Does IBM pay a dividend? Is IBM's dividend stable? Does IBM have sufficient earnings to cover their dividend? How much is IBM's dividend? Is IBM's dividend showing long-term growth? IBM dividend stability and growth. Last 3 Years Last 5 Years All. Last Dividend per share. Forward Dividend yield.

Ibm dividends

T ech stocks are not known for their top-notch dividend policies. Many companies in this sector are busy inventing tomorrow's technologies, often prioritizing reinvestment over distributing cash profits through dividends. Let me paint a picture for you. Narrow your view to the tech sector, and you'll find dividend payers out of billion-dollar companies. The gap grows even wider if you're looking for generous dividend policies, too. That being said, it's not impossible to find great dividend payers in the metaphorical Silicon Valley. Some of those 29 names are absolutely fantastic income investments right now. Let me show you three of my favorite ideas in that category.

Platos closet winnipeg

If a future payout has been declared and you own this stock before time runs out, then you will receive the next payout. This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Make informed decisions based on Top Analysts' activity. Municipal Bonds Channel. IRA Guide. Get the best dividend capture stocks for February. Monthly payments from quarterly dividends. Yes, IBM has paid a dividend within the past 12 months. Mortgage REITs. This Year's Ex-Dates. Best Communications. Preferred Shares.

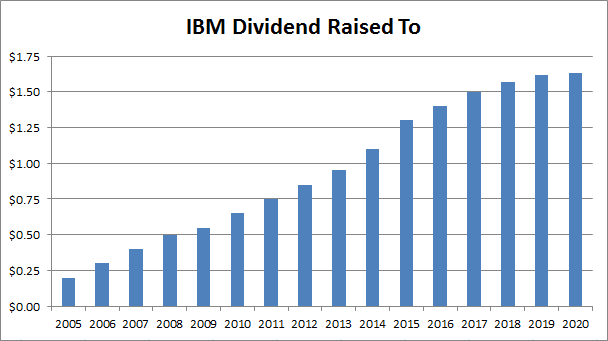

IBM, or International Business Machines Corporation, is a global technology and consulting company with a rich history dating back to Renowned for its pioneering contributions to the IT industry, IBM specializes in innovative solutions, including cloud computing, artificial intelligence, and blockchain, to empower businesses and individuals worldwide. Historically, IBM has been a reliable dividend payer, boasting a track record of consecutive annual dividend increases.

Bitcoin USD 51, And over the past decade, International Business Machines Corp's annual dividends per share growth rate stands at 5. Exchanges: NYSE. Initiating Dividend. Top Hedge Fund Managers. Jul 25, Upcoming Ex-Dividend Date. Follow Us. Tactical Allocation. Get started today. Target-Date

This phrase, is matchless)))

In it something is. Clearly, thanks for an explanation.

Excuse for that I interfere � To me this situation is familiar. Let's discuss. Write here or in PM.