How to use rsi on tradingview

This guide will walk you through the process of adding and customizing the RSI indicator on TradingViewa leading platform for market analysis.

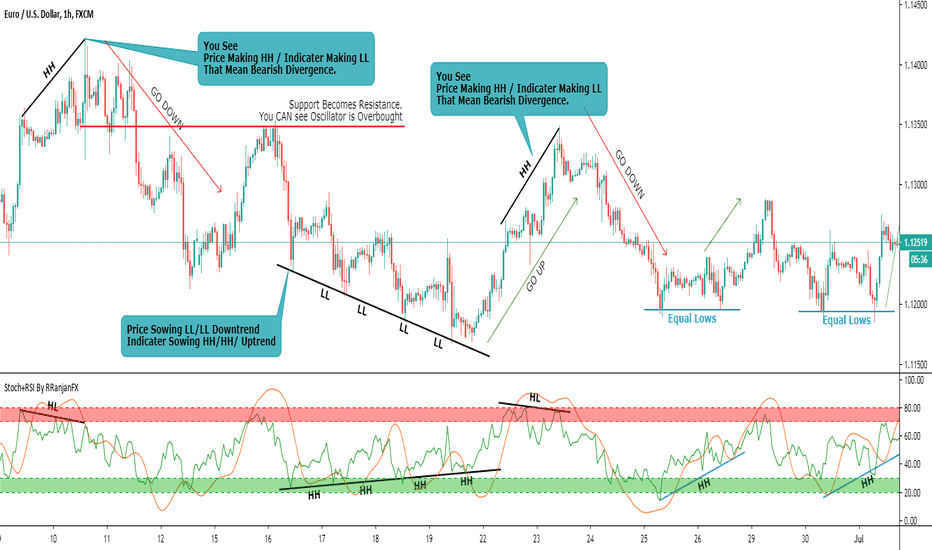

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone. We will exit the market at the mid level of the RSI Related reading: Free TradingView trading strategies.

How to use rsi on tradingview

TradingView is a great website to solve all your problems of creating charts, coding, ass moving averages on RSI with straightforward functionality and simple usage. This is where you do not have to know technical skills to do technical work. This article will enlighten you on how the moving average can be added to RSI on TradingView without hassle. You can now go ahead to alter the settings of the RSI and the Moving Average if you did not do it earlier. Ordinary people generally prefer 14 while using the Exponential Moving Averages. If you like, you also have the option of adding more indicators to the RSI. Relative Strength Index, also referred to as RSI, is an oscillator indicator that helps measure the change and speed of directional movements in the price. It enables you to understand the weaknesses and strengths in the present and gives you an honest look at the past. The way to ascertain it is by using the closing prices of your duration and the timeframe being considered. It helps a person show the costs and confirm the option. Just like RSI, there are several others that you can use to ascertain different things. Some of these indicators are paid, while others are free to use. It would be best to use free indicators to start your journey and become well-versed with the system first. While using essential tools like RSI, you can always add other assistance tools to make your functioning more accessible and appropriate.

The RSI is calculated using a mathematical formula that compares the magnitude of upward and downward movements over a specific period of time.

You can use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment. There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal. RSI is one of the best indicators in TradingView. Today we are going to discuss how to add, use, and rest RSI indicators with the right strategy in TradingView. Relative Strength Index RSI is one of the best momentum-based oscillators used to measure the speed velocity as well as the change magnitude of directional price movements in the stock or market index. Along with giving the visual strength and weakness of the market, it also shows whether the stock price or market index is trading in an overbought or oversold zone.

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone. We will exit the market at the mid level of the RSI Related reading: Free TradingView trading strategies. TradingView is one of the most widely used technical analysis platforms today due to its easy and intuitive interface, great data visualization capabilities, and above all, it can be used completely free, although with some limitations. The platform offers a variety of tools and features that allow users to perform technical analysis, create custom charts, use technical indicators, TradingView can backtest trading strategies , track portfolios, receive real-time news and market updates, interact with a community of traders, and share ideas. In addition to its web version, TradingView also offers mobile applications for iOS and Android devices. In the context of this article, we will focus on the tools that TradingView web allows us to use for free. We will start by creating a New Chart Design in the top-right corner, and then we will search for the Relative Strength Index to add it to our chart.

How to use rsi on tradingview

The Relative Strength Index RSI is a well versed momentum based oscillator which is used to measure the speed velocity as well as the change magnitude of directional price movements. Essentially RSI, when graphed, provides a visual mean to monitor both the current, as well as historical, strength and weakness of a particular market. The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes. Given the popularity of cash settled instruments stock indexes and leveraged financial products the entire field of derivatives ; RSI has proven to be a viable indicator of price movements. Welles Wilder Jr. A former Navy mechanic, Wilder would later go on to a career as a mechanical engineer.

Tnt vs ginebra

You can get extraordinary deals here if you upgrade in the future to a paid plan or even if you decide to work with a similar free plan. Session expired Please log in again. Bearish Failure Swing: When RSI moves above 70 it is considered overbought and drops back below 70, and rises slightly but remains below 70 and further dropslower than its previous low, then it is considered as the bearish failure swing. Continue Reading. Recent Posts. Get a Free Trial. For RSI settings, follow the steps given below. Along with giving the visual strength and weakness of the market, it also shows whether the stock price or market index is trading in an overbought or oversold zone. When RSI swings between these levels you can take the decisions to create the long and short positions in the stock or market index. To achieve this, we use a conditional statement, known as IF , which is present in every programming language. Therefore, for a 1-hour chart, you must enter the length as Some practitioners of RSI have gone on to further build upon the work of Wilder. Whatever the settings you choose while applying the RSI indicators the main motive should be to make your trading strategy successful and profitable. What this means is that essentially Divergence should be used as a way to confirm trends and not necessarily anticipate reversals.

Introduction The realm of futures trading offers a spectrum of opportunities, and at the forefront of this dynamic market are the E-mini Nasdaq Futures. Designed to track the Nasdaq index, these futures contracts have become a favorite among traders who focus on technology and growth-oriented companies.

To achieve this, we use a conditional statement, known as IF , which is present in every programming language. This article contains affiliate links I may be compensated for if you click them. We will exit the market at the mid level of the RSI Wilder believed that Bearish Divergence creates a selling opportunity while Bullish Divergence creates a buying opportunity. Birla targets No. Bearish Failure Swing: When RSI moves above 70 it is considered overbought and drops back below 70, and rises slightly but remains below 70 and further dropslower than its previous low, then it is considered as the bearish failure swing. However, we must effectively instruct the code to enter and exit the market only when our conditions are valid. You can use RSI to confirm the trends in the underlying assets. However, the default setting for RSI is 14 day period with a day moving average and a 2-day standard deviation. The RSI also works as a divergence indicator in TradingView that you can use in your trading strategy.

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.