Dividendology

Dividendology dividendology, dividendology. Join me on my journey as I find ways to achieve financial freedom by living off of dividend income! Information is the key dividendology being a successful investor.

Reletter has got you covered. We collated all the information we could find from across the web in our database of over one million newsletters. Check the email archives , get traffic estimates, engagement scores and more to discover the best advertising opportunities. Our search tool helps you locate relevant newsletters for any topic and compare their stats for better sponsorship decisions. How this newsletter ranks in the official Substack charts.

Dividendology

.

Authors The writers behind this dividendology. I personally love using the heatmap they provide.

.

You can access it here! The bull market of has continued into , and did not slow down one bit in February. The market is up 7. And while capital appreciation is no doubt a major part of my dividend growth investing journey, we have to keep in mind the end goal:. And while all these factors play a major role in causing the compounding effect to take place, I saw some especially nice dividend hikes in my portfolio this past month. In late February, Dominos announced a That is an absolutely insane dividend hike! Dividends are paid out of free cash flow, so in order for a company to pay out growing dividends long term, it is imperative that they are able to grow their free cash flow over time as well.

Dividendology

Some spend many years chasing high yield dividend stocks that end up not growing and sometimes even cutting dividends. For a while, I thought this would come through investing in real estate. I researched and read everything I could about real estate. Again discouraged, I felt that there was no real form of passive income that would allow me to build wealth long term. This gave them a low starting dividend yield of 2.

Average temperatures in thailand by month

Investing in dividend stocks? Latest Issues Recent posts by this newsletter. Dividendology dividendology. Seem like a bold claim? Here are 3 quick ways to evaluate the safety of your dividend payments:. That's a great way to reach financial freedom. BUT- It's important to assess the safety of your dividends to avoid a dividend cut. The people who make the most dividend income typically invest in companies with low dividend yields. Here are my top 5 resources for becoming the best investor possible: 1. Tap on the link for any of the most recent emails or hit More Issues to see older ones. Check the email archives , get traffic estimates, engagement scores and more to discover the best advertising opportunities. We collated all the information we could find from across the web in our database of over one million newsletters. Have you used any of these before? Ever wonder why this is?

.

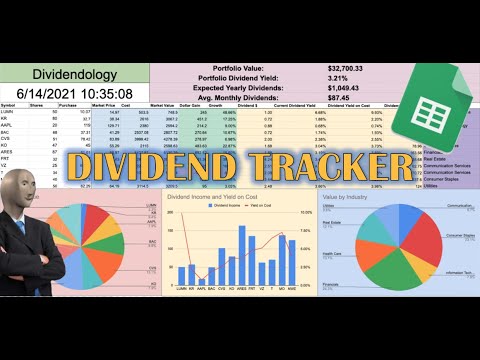

Designed to make you a more informed investor. Latest Issues Recent posts by this newsletter. Chart Rankings How this newsletter ranks in the official Substack charts. Google sheets is the BEST platform for analyzing stocks and tracking your portfolio. Are you a writer? Here are my top 5 resources for becoming the best investor possible: 1. Dividendology Recent posts by this newsletter. Authors The writers behind this newsletter. Then, personalize one of our winning pitching templates and send it to the right person using the contact info provided. These are the 5 tools I use the most to gather information for my investing! The easiest way to receive safe, growing, and consistent dividend income? Join me on my journey as I find ways to achieve financial freedom by living off of dividend income! Newsletter ad rates or CPM vary depending on many factors, including industry, number of subscribers, open rate, ad placement and more. It's simply my favorite investing research platform.

0 thoughts on “Dividendology”