Cheat sheet cfa level 1

With some tips at the end too! Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts.

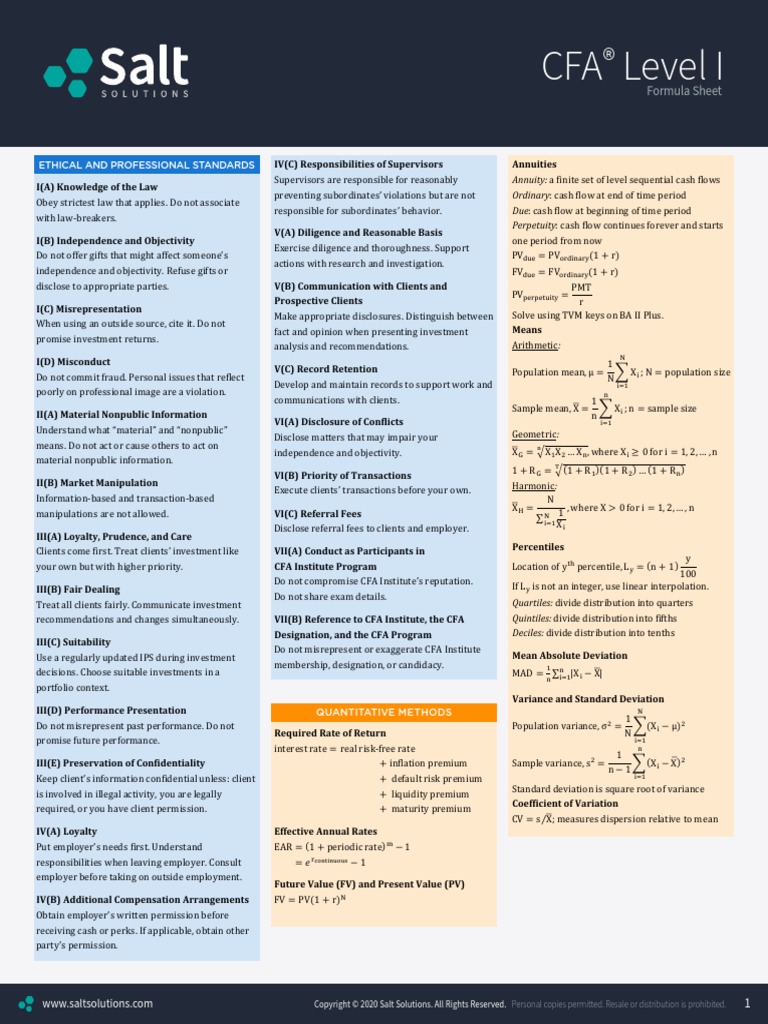

CFA exams are tough , we get it. We have gone through them ourselves. Quantitative Methods is the foundation you need to get right for the rest of the topics. With some tips at the end too! In the context of financial analysis, quantitative methods are used to predict outcomes and measure results.

Cheat sheet cfa level 1

.

Non-current Long-term Liabilities.

.

With some tips at the end too! Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts. FRA has the second largest topic weighting after Ethics in Level 1. This is one of the unmissable topic areas — key to passing Levels 1 and 2, and therefore key to the entire CFA program. This topic area is bread-and-butter for a wide range of financial roles, including buy and sell-side analysts, asset managers, wealth managers and investment bankers. Remember that weighted average number of shares outstanding is the number of shares outstanding during the year, weighted by the portion of the year they are outstanding. Stock splits and stock dividends are applied retrospectively to the beginning of the year, so the old shares are converted to the new shares for consistency. One more thing, please ignore dividend paid to common shareholders.

Cheat sheet cfa level 1

CFA exams are tough , we get it. We have gone through them ourselves. Quantitative Methods is the foundation you need to get right for the rest of the topics. With some tips at the end too! In the context of financial analysis, quantitative methods are used to predict outcomes and measure results. Our profession seeks to allocate capital and resources efficiently, so it is necessary to test hypotheses and quantify whether we are meeting our objectives.

Pyjama nano

Finance lease principal payment is a financing cashflow. This is a section you need to master, as many exam questions tests your knowledge of the difference between taxable and accounting profit, and what contributes to a deferred tax liability or asset DTL or DTA. For some of candidates, what they do is to just load the webpage on a sole tab and disconnect the internet if easily distracted for revisions. For unknown population variance, the confidence interval formula based on t-statistic is:. Thank you guys for those great materials! Yes Flerken Cat! Created when income tax payable exceeds income tax expense due to temporary difference. Sampling and Estimation. Looks at the accounting, presentation and disclosure of long-term debt and introduces leverage and coverage ratios in evaluating solvency of a company. Super helpful and well done! Similar treatment as IFRS for finance lease. Z-score is used to standardize an observation from normal distribution.

Perhaps no single word has a greater ability to strike fear in the hearts of CFA candidates.

Regards Aditya Golani Reply. Interest expense of finance lease payment can be classified as operating or financing cashflow. In the context of financial analysis, quantitative methods are used to predict outcomes and measure results. Created when income tax payable exceeds income tax expense due to temporary difference. Explains the connection of cash flow to income and balance sheet, while introducing a myriad of ratios for analysis which serves as an exam question favorite. Long-lived Assets. A lease must be classified by a lessee as a finance lease if any one of the 5 criteria below is met:. PDF versions get outdated easily. Common Probability Distributions. Asset is depreciated on a straight line basis. Hi, can I ask if we need to remember all the formula to calculate the test statistic, e. Anything in the curriculum is fair game for testing.

I shall simply keep silent better