Bank micr number

When it comes to financial transactions, you may have come across the terms MICR and bank account number. But do you know what these terms mean and how they differ from each other? This guide will take a closer look at MICR codes and bank account numbers and explain their differences. It is a technology used in the banking industry to facilitate the processing of cheques and other financial documents, bank micr number.

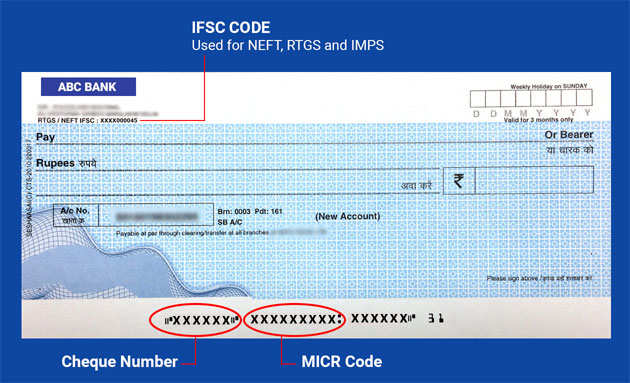

A MICR number is a unique 12 digit number commonly used for setting up and authorizing electronic payments. Your MICR number is separate from your member number. Your member number identifies your membership as a whole, while a MICR number is assigned to a specific account. An ACH payment is an electronic payment you have setup with a company to debit your account for such things as utility bills, gym memberships, loan payments, etc. An ACH can also include deposits into your account such as your paycheck, Social Security, tax refund, etc. If you have checks, your MICR number can also be found on the bottom of your checks.

Bank micr number

Your MICR number is the long number located at the bottom of your checks and is used for setting up direct deposits and automatic withdrawals from your accounts. This is not the same as your account number. You are leaving the Acadia Federal Credit Union website. Acadia Federal Credit Union provides links to external sites for the convenience of its members. By clicking "Continue" you will be directed to an external website owned and operated by a third party. These external websites are not controlled by Acadia Federal Credit Union and Acadia Federal Credit Union makes no representation or warranty, express or implied, to the user concerning the information, content, presentation, accuracy or opinion of these sites or the quality, safety, or suitability of any software found on these sites. The privacy policies of Acadia Federal Credit Union do not apply to external sites and users should consult the privacy policies on these sites for further information. Thank you for visiting the Acadia Federal Credit Union website. Leaving Our Site. Stay on This Page Continue. Please enter a form shortcode or message for this pop-up.

A range of fraud types exists, including tax fraudcredit card fraud, wire fraudsecurities fraud, and bankruptcy fraud.

What are you searching for? Some links may lead to third party websites which may have privacy and security policies different from those of BCU. Please review the applicable information available on the new site. BCU does not maintain, approve, or endorse the information provided on other third party websites. If you have checks, your Account Number can also be found on the bottom of your checks.

What are you searching for? Some links may lead to third party websites which may have privacy and security policies different from those of BCU. Please review the applicable information available on the new site. BCU does not maintain, approve, or endorse the information provided on other third party websites. If you have checks, your Account Number can also be found on the bottom of your checks.

Bank micr number

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Fart face cartoon

The MICR code includes the bank account number, cheque number, and bank code, while the bank account number is a unique identification number assigned to a specific bank account. It consists of three groups of numbers, including the bank routing number, the customer's account number , and the check number. How to apply for higher education scholarships?. This is why the format of bank checks is so uniform. In addition, routing and account numbers guarantee funds are safely transferred from the proper account. Discover why millions of businesses and top accounting firms use BILL. Housing News Desk. BILL is making the financial back office a better place. In this case, that information is a check number, routing number , and account number. Magnetic ink character recognition MICR is a technology used primarily to identify and process checks. Get Started.

MICR technology is a crucial element in the use of checks and other financial documents, providing quick and easy validation of documents to ensure secure financial transactions, including deposits, wire transfers, and more.

The numbers at the bottom not only serve as a security feature to ensure each check has a unique identity — certain numbers within each set also indicate even more details about the check and its holder. It is also required for electronic transactions, such as online bill pay or wire transfers. How does a MICR line work? The following are the five distinctions between the MICR code and the bank account number:. What are real time payments? Search for More. It is located next to the routing number. What are you searching for? Troy Group. MICR technology is a crucial element in the use of checks and other financial documents, providing quick and easy validation of documents to ensure secure financial transactions, including deposits, wire transfers, and more. It was a notable improvement because it allowed for the mechanization of check processing while making it more difficult to commit check fraud. View more information. Table of Contents Expand. Use limited data to select advertising.

0 thoughts on “Bank micr number”