Xauusd price prediction

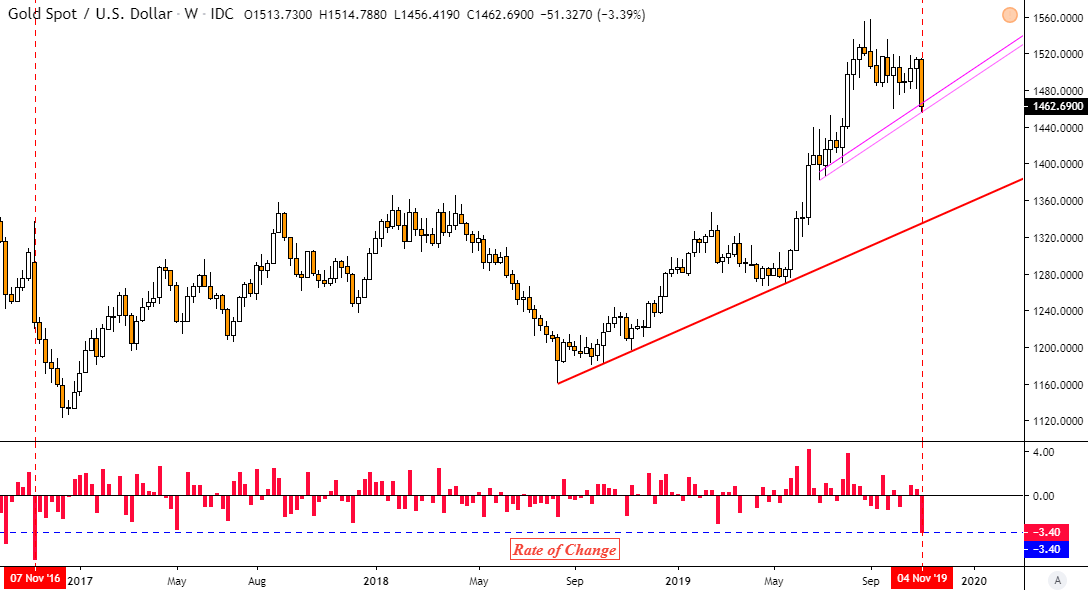

Gold price forecast is an analysis of the factors that affect the supply and demand of the precious metal, as well as the identification of patterns, fractals, and trends emerging in the market. Will gold rise in price? What will be the price of the precious metal in the near future? Xauusd price prediction this article, we'll look into historical data, see what experts have to say, and make a gold price forecastxauusd price prediction,and a long-term one until the end of

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. Today 0.

Xauusd price prediction

.

Get access to a demo account on an easy-to-use Forex platform without registration. Xauusd price prediction US government bond yields rise, the likelihood is high that gold will trend sideways or even downtrend, while declining yields tend to lead to very positive movements in gold prices.

.

In which, the rally from 13 December low unfolded as an impulse sequence and called for After moving higher on Friday, gold price disappointed on Monday. Which move is real? Gold and USDX move in the opposite directions and the end of the consolidation in the latter is important for the former. In which, the rally from 14 December low unfolded as an impulse sequence and called for Cable has seen some nice recovery at the end of ; move that is looking impulsive so more gains can be seen after the corrective retracement. See More Share. See More. Your browser of choice has not been tested for use with Barchart.

Xauusd price prediction

Our signals are updated throughout the day to ensure you get the latest market updates. With our market analysis we help you cut losses and ensure you make informed decisions. Find out how we conduct our market analysis and how you can do it for your trades as well. Our analysis can help you become a successful swing trade and be consistently profitable.

4p3 value

Most novice gold investors believe that if it rises in the US, then gold price should also go up since more inflationary dollars will have to be paid per ounce. Prospects for rising prices for gas and oil can only aggravate the situation and accelerate the rapid growth of the gold price. While fundamental analysts monitor certain companies' financial statements, gold market analysts monitor macroeconomic factors, political and economic world stability, and competition from investment alternatives to forecast prices. Last Friday, the gold price broke through the February high and consolidated above. Large investors in gold, including central banks, the IMF, and leading funds, significantly impact the market. They are also associated with several other factors that drive prices up, including excessive spending, money supply, political instability, and currency depreciation. Price forecasts for a longer period for any investment asset including gold price forecast are very approximate and may change due to various factors. During this time, the precious metal has become one of the most attractive financial assets on the planet. The MACD indicator on the monthly timeframe looks weak and does not promise rapid growth in World gold prices soared sharply compared to the previous session, after major economies in the world, including the US, announced a series of less positive eco.

On Thursday, the U.

Sticking to the most realistic scenario, take profits in equal parts at three levels. This definitely supports the popularity of the precious metal among investors in One of the biggest drivers of gold price is currency values. Analysts cannot make a reliable gold future price prediction for ten years. What will be the price of the precious metal in the near future? On the other hand, a stronger dollar makes gold relatively more expensive for foreign buyers, thus possibly lowering prices. Jana Kane Editor-in-chief of the LiteFinance trading blog. Price forecasts for a longer period for any investment asset including gold price forecast are very approximate and may change due to various factors. At the same time, the federal funds rate in the US has reached its highest over the past 20 years, reaching 5. Full name. The table below presents the same values in a text format. The gold price moves in response to macroeconomic and geopolitical factors, as it gains value in times of volatility in the financial markets and global turbulence. See all ideas.

What charming idea

In my opinion it already was discussed.