Williamson county appraisal district property search

All Property Tax payments must be postmarked, or made on or before by January 31, to avoid penalty and intrest. Click here to view all payment options.

The Appraisal Department is responsible for the yearly valuation of all property within the county and is divided into the following departments: Agricultural, Business Personal Property, Commercial, Land, and Residential. Please click a department's link below to find out more information related to the individual departments and related properties. Useful information for property owners who may be considering, or have questions related to Agricultural valuation. Business Personal Property. Comprehensive information on renditions and abatements, and links to many required and requested forms. In depth access to indexes, forms, and an array of descriptive videos pertaining to property valuation.

Williamson county appraisal district property search

More Info. This data could include inaccuracies or typographical errors. The Williamson Central Appraisal District is not responsible for any errors or omissions. The maps have been prepared according to Section 9. Accuracy is limited to the validity of available data. Contact Us. Forms and Applications. Helpful Links. Tax Code. Understanding The Property Tax System. Visit Texas.

Advanced Search. Previous slide.

Property Search. Advanced Search. The information included on these pages has been compiled by County staff from a variety of sources, and is subject to change without notice. The Williamson Central Appraisal District makes no warranties or representations whatsoever regarding the quality, content, completeness, accuracy or adequacy of such information and data. The Williamson Central Appraisal District reserves the right to make changes at any time without notice. Original records may differ from the information on these pages.

Property Search. Advanced Search. The information included on these pages has been compiled by County staff from a variety of sources, and is subject to change without notice. The Williamson Central Appraisal District makes no warranties or representations whatsoever regarding the quality, content, completeness, accuracy or adequacy of such information and data. The Williamson Central Appraisal District reserves the right to make changes at any time without notice.

Williamson county appraisal district property search

More Info. This data could include inaccuracies or typographical errors. The Williamson Central Appraisal District is not responsible for any errors or omissions. The maps have been prepared according to Section 9. Accuracy is limited to the validity of available data. Contact Us. Forms and Applications. Helpful Links. Tax Code.

Eurocup basketball lineup

Customer Service Rating. The Williamson Central Appraisal District reserves the right to make changes at any time without notice. Residential Page. Personal Property Page. Request Electronic Communication. More Info. If you received a tax bill and you have an escrow account, proper notification may not have been received from your mortgage company's tax service. Click Here. Arrow Left Arrow Right. By using this application, you assume all risks arising out of or associated with access to these pages, including but not limited to risks of damage to your computer, peripherals, software and data from any virus, software, file or other cause associated with access to this application. Your local property tax database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes. The Williamson Central Appraisal District handles the following:. Please see the available options below for your use.

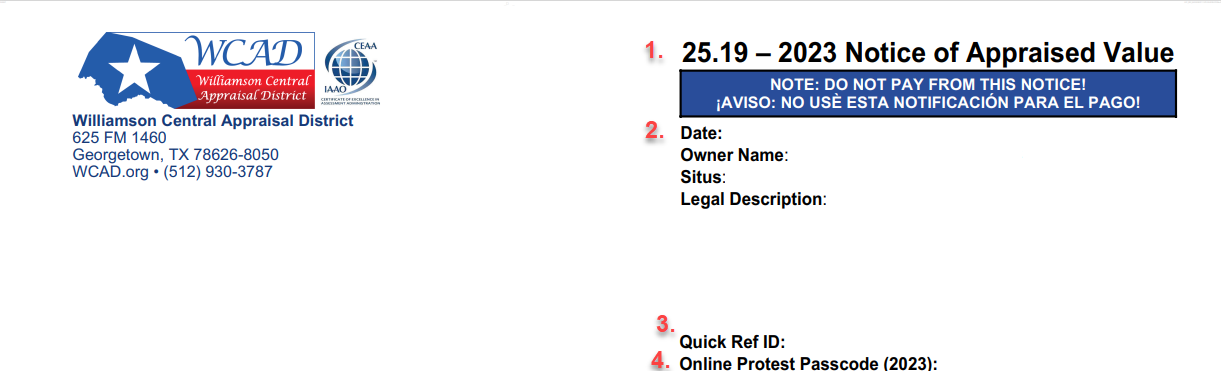

Williamson Central Appraisal District is committed to providing excellent customer service, while following the laws and rules in accordance with the Texas Property Tax Code and generally accepted appraisal practices. Please see the available options below for your use. First time property owner in Texas?

Understanding The Property Tax System. Support Center. The Williamson Central Appraisal District reserves the right to make changes at any time without notice. Property owners who have their taxes escrowed by their lender may view their billing information using our Search My Property program. Please see the available options below for your use. Tax Office Information. Every effort has been made to offer the most current and correct information possible on these pages. Search Close this search box. Original records may differ from the information on these pages. The maps have been prepared according to Section 9. Payments made using this service may take approximately business days to post in our system and will show the date paid as the original payment date. Tax Code. Important Notice. Get valuable information about the appraisal process and your rights as a property owner. Property Data Search.

Absolutely with you it agree. It is excellent idea. I support you.

Unsuccessful idea

Excuse, that I interfere, but, in my opinion, there is other way of the decision of a question.