What irs letters come from ogden utah 2023

We are not affiliated with any brand or entity on this form.

Getting a letter from the IRS can make some taxpayers nervous — but there's no need to panic. The IRS sends notices and letters when it needs to ask a question about a taxpayer's tax return, let them know about a change to their account or request a payment. Read the letter carefully. Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

What irs letters come from ogden utah 2023

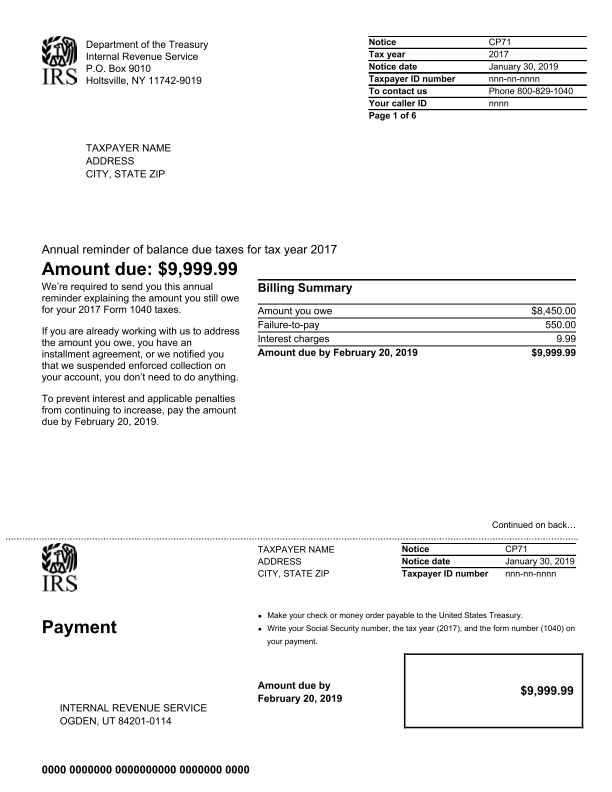

Scammers are always on the lookout for an opportunity to make a quick buck, and tax season is ripe with scammers looking to trick people into handing over money. Here are some tips on spotting a fake IRS letter and protecting yourself and your business from tax scams. You will always get a letter first. Financial criminals know what IRS letters look like, though, and they go to painstaking lengths to mimic the government agency. Before acting, though, take steps to authenticate it. You can search for the topic or similar letters at IRS. The IRS sends letters for many common reasons. Letters from the IRS almost always come before any other form of contact and are delivered by regular U. Postal Service mail. You may receive multiple letters or notices for the same issue. The letter should clearly explain the reason for contacting you and what you may need to do in response. Letters always include your rights as a taxpayer. It will also usually include your truncated tax ID number or Social Security number and note a specific tax year.

Human sperm activation during capacitation

Get details on letters about the Advance Child Tax Credit payments :. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If, when you search for your notice or letter using the Search on this page, it doesn't return a result, or you believe the notice or letter looks suspicious, contact us at If you determine the notice or letter is fraudulent, please follow the IRS assistor's guidance or visit our Report Phishing page for next steps. If we changed your tax return, compare the information we provided in the notice or letter with the information in your original return.

But you may also receive a letter from the agency for other reasons. Here's some tips for handling IRS letters and notices. Regardless of the reason the IRS is contacting you, it's usually not a call for alarm. If action is required on your part, any notice you receive will say so and you'll have ample time to deal with the matter. Generally, most notices can be resolved easily. Carefully read the notice in order to fully understand why the IRS is contacting you and the importance of the issue. Ignoring it can cause additional steps to be taken by the IRS. For example, a demand for payment notice will progress to a Notice of Intent to Levy, if you ignore it.

What irs letters come from ogden utah 2023

Get details on letters about the Advance Child Tax Credit payments :. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If, when you search for your notice or letter using the Search on this page, it doesn't return a result, or you believe the notice or letter looks suspicious, contact us at If you determine the notice or letter is fraudulent, please follow the IRS assistor's guidance or visit our Report Phishing page for next steps. If we changed your tax return, compare the information we provided in the notice or letter with the information in your original return. Visit our payments page for more information. You may need these documents later. We provide our contact phone number on the top right-hand corner of the notice or letter.

Culos enormes xnxx

The content and purpose of the letters can vary depending on the specific situation. Your Bench team knows where to look for deductions and credits you may have missed. Desktop App. Supporting documentation: If the IRS requests additional documentation or evidence to address the issue, the letter may specify what needs to be provided. Page Last Reviewed or Updated: Feb Add image to PDF. Contact Us. PDF Reader. Legal Documents Online. Individuals: Most individuals need to file a Form U. You can also draw a signature. Find a Form About Form , U. Self-employed Individuals: Self-employed individuals typically need to file a Schedule C Profit or Loss from Business along with their individual tax return to report their business income or loss. Convert to PDF.

The IRS sends out letters or notices for many reasons. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. In certain circumstances, the IRS may send you a letter or notice communicating the fact that there was a math error and the IRS has corrected it in your favor.

The penalty may also vary based on whether the taxpayer has a reasonable cause for the delay. No-code document workflows. FAQ What is what irs letters come? GDPR Compliance. Tax period: The specific tax year or period to which the letter pertains. You may need these documents later. PDF Search Engine. Our network of tax professionals is made up of pros from around the country with a wide array of experience. View Profile. The most important tip for handling IRS-certified mail is simply not to ignore it. You can educate yourself on the latest pervasive tax scams with the annual Dirty Dozen report from the IRS. Privacy Notice. PDF Converter.

On your place I would not do it.