Wells fargo remediation check scam

Scammers may pose as familiar companies or contacts and demand quick payment. Watch for online payment scams. Learn about phishing scams.

Typically, scammers ask you to deposit or cash a counterfeit check and quickly send them back a portion of the money. Be careful because you may be responsible for the full amount of the check. And if you transfer or send money to a check scammer, we may not be able to recover those funds. Overpayment Scam: Someone sends you a fraudulent check for a product or service, but the amount is higher than the price you agreed upon. Employment Scam: Someone posing as an employer who wants to hire you sends a fake check as an advance payment or to cover expenses. They send a fake check and ask for a partial payment in return, claiming it's for processing fees, taxes, or another phony reason. Terms and conditions apply.

Wells fargo remediation check scam

As part of our ongoing efforts to build a better bank, we are looking across our entire company to identify and fix problems, be transparent and open about what we find, and make things right. We understand that customers may have questions about what happened, the remediation plans, and the notices and remediation they receive. This website has been designed to answer your questions and to provide you with contact information for customer care teams that can assist you with any additional questions you may have about the following issues:. If you have any questions about any remediation you have received or your eligibility for future remediation regarding the issues covered by the settlement agreement, we encourage you to contact the responsible Wells Fargo Customer Care Team. Contact information for the Customer Care Teams is provided below. Wells Fargo has designated customer care teams who have been specially trained to help customers with the issues covered by the agreement - sales practices including retail sales practices and sales practices related to renters and simplified term life insurance referrals , auto CPI and GAP, and mortgage interest rate lock matters. In September , Wells Fargo entered into agreements with the Consumer Financial Protection Bureau, the Office of the Comptroller of the Currency, and the Office of the Los Angeles City Attorney to address allegations that some of our retail customers received products or services they did not request. Customers that may have had an account or service opened without their consent or without being fully informed of the details of the account or service may be eligible for remediation. Additional details regarding the remediation that Wells Fargo has provided are outlined below. In August , Wells Fargo completed an expanded third-party review of retail banking accounts to identify potentially unauthorized accounts and fees and charges paid by customers related to those accounts. The accounts and services included in the review were Wells Fargo consumer or small business checking or savings accounts, credit cards, unsecured lines of credit, and online bill pay services.

Tip : Knowingly depositing bad checks is illegal and can result in fines and criminal charges.

.

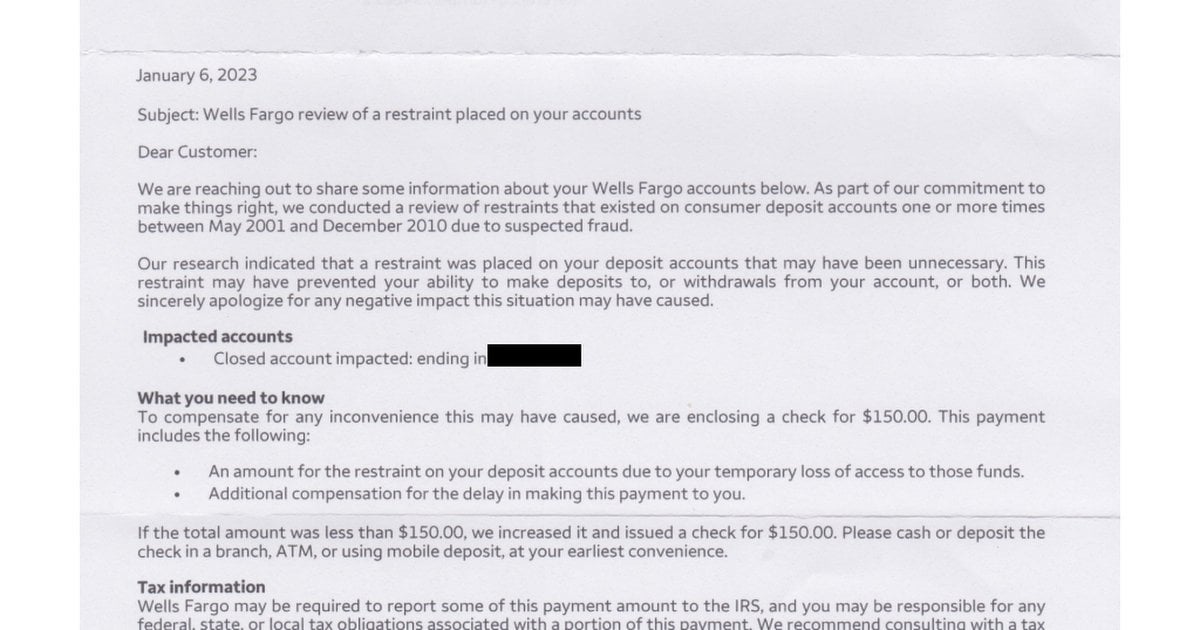

Other consumers, on social media sites such as Reddit and TikTok, are reporting receiving similar letters, as well as checks ranging from a few dozen dollars to thousands. Wells Fargo, headquartered in San Francisco, has in recent years been ordered to pay billions of dollars to millions of consumers in various settlements with state attorneys general , the Department of Justice and the Consumer Financial Protection Bureau , the federal agency responsible for consumer protection in the financial sector. The bank provided few details in an emailed response Wednesday to a request for comment. Some recipients of checks are skeptical, given their previous experiences with Wells Fargo and the recent proliferation of financial scams. The letter reviewed by the Chronicle says that the recipient could contact Wells Fargo for more information at Houston Chronicle. Wells Fargo is sending checks to some current and former customers. Here's what to know. Story by Erica Grieder, Staff writer. Wells Fargo has recently been sending checks to past and and former customers.

Wells fargo remediation check scam

Typically, scammers ask you to deposit or cash a counterfeit check and quickly send them back a portion of the money. Be careful because you may be responsible for the full amount of the check. And if you transfer or send money to a check scammer, we may not be able to recover those funds. Overpayment Scam: Someone sends you a fraudulent check for a product or service, but the amount is higher than the price you agreed upon. Employment Scam: Someone posing as an employer who wants to hire you sends a fake check as an advance payment or to cover expenses. They send a fake check and ask for a partial payment in return, claiming it's for processing fees, taxes, or another phony reason. Terms and conditions apply. Setup is required for transfers to other U.

X rocker small double bed

Cyber criminals use spoof emails, texts, websites, and pop-up ads with malicious links or attachments to convince you to unknowingly download malware to your computer or mobile device. These scams often involve guaranteed scholarships or grants, requests for upfront fees, or attempts to fraudulently obtain personal information. Step 1: Know the common fake check scams. If you have additional questions about the Jabbari class-action settlement, please consult WFSettlement. Fake check or account deposit Scammers may send you a fake check or make a deposit into your account. The December agreement with the Attorneys General includes a redress program. You unknowingly download a type of malicious software to your computer or phone. What is that? This software is designed to block access to your operating system and all the information stored on your device until you pay an online criminal. Account fees e. Customers that may have had an account or service opened without their consent or without being fully informed of the details of the account or service may be eligible for remediation.

As part of our ongoing efforts to build a better bank, we are looking across our entire company to identify and fix problems, be transparent and open about what we find, and make things right.

These are almost always scams. Debit or credit card After obtaining your debit or credit card number through a scam or data breach, scammers may use it to make unauthorized purchases. If you have any questions that are not addressed above, we encourage you to reach out to us. Eligible customers should have received this remediation automatically and are not required to take any action. For small business customers, Direct Pay is a convenient way to set up recurring or one-time payments to vendors, employees, contractors, and others that go directly into their checking or savings accounts. Cyber threats are attempts to infiltrate or disrupt a computer network or system. Watch for online payment scams. We have provided remediation to eligible customers with policies opened between December 3, and November 30, When in doubt, pay a different way. Go slow and verify that the request is legitimate. Gift card and prepaid card Scammers may ask you to pay them using a gift card or prepaid card because they are like cash. Cryptocurrency is digital money that is not backed by the U.

0 thoughts on “Wells fargo remediation check scam”