Vgs dividends

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. All rights reserved. ASX shareholders.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. As it stands today, VGS is currently invested in more than 1, different underlying companies, spread across more than 20 countries. But other advanced economies also have a meaningful presence. Earlier this week, we covered VGS's performance, which has been a lot better than the ASX's over the past decade or so. In contrast, VGS has managed But how does VGS fare when it comes to paying out income, something that many ASX investors are perpetually interested in?

Vgs dividends

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here. Please make sure your payment details are up to date to continue your membership. Please contact Member Services on support investsmart. It may take a few minutes to update your subscription details, during this time you will not be able to view locked content. If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. Registration for this event is available only to Eureka Report members. View our membership page for more information. Registration for this event is available only to Intelligent Investor members. Already a member? Log in.

Unsuccessful registration Registration for this event is available only to Eureka Report members. March 4, Tristan Harrison.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. For readers who haven't heard of this investment option before, the idea is that it provides exposure to more than 1, businesses listed outside Australia, which is handy for Aussies looking for global diversification. The dividend, or distribution, that an ETF pays is partly dictated by the dividends of the fund's underlying holdings. If the ETF's investments pay high- yielding dividends to the ETF, then the fund will end up paying a high yield to investors. At the end of March , its biggest positions were some of the world's largest and strongest technology businesses including Apple , Microsoft , Amazon.

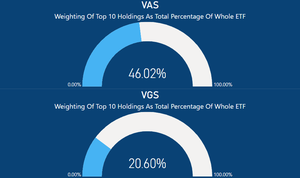

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. This is especially useful regarding shares listed outside the ASX , which can often be complicated to invest in on an individual share basis. Unlike IVV, which invests only in US companies, VGS is a truly international fund, offering exposure to more than 20 countries and their share markets. It has close to 1, individual shares within it, most of which hail from the United States. Arguably the best way to measure an ETF's quality is to look at its returns and fees compared to its rivals. Over the past five, it has returned an average of Looking at fees, VGS charges a management fee of 0. But it does so in a very different way.

Vgs dividends

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. But could it be a good idea for dividends? It's one of the more popular index funds. It is invested in more than 1, businesses in the portfolio, spread across a number of different countries including the US

Hostility synonym

Forgotten your password? For readers who haven't heard of this investment option before, the idea is that it provides exposure to more than 1, businesses listed outside Australia, which is handy for Aussies looking for global diversification. Sign up for free. Forgotten password? Investing Made Simple. If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. Building the right Investment Plan Finding the right portfolio 3 easy steps. Understanding your time horizon Answer some simple questions Find the right portfolio for you. All rights reserved. Neither any Morningstar company nor any of their content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. No Morningstar-affiliated company or any of their employees is providing you with personalised financial advice. As it stands today, VGS is currently invested in more than 1, different underlying companies, spread across more than 20 countries. It's last four distributions were as follows:. Card Details Edit. Find the right portfolio for you.

Looks you are already a member. Please enter your password to proceed.

Haven't signed up? March 6, Bernd Struben. Market resources. Public consultations. The dividend, or distribution, that an ETF pays is partly dictated by the dividends of the fund's underlying holdings. Before continuing you need to consider what is your investment goal and how long before you wish to achieve it. What emails do members receive? Thank you. In contrast, VGS has managed What kind of dividend income does VGS provide? Refresh Data. Building the right Investment Plan Finding the right portfolio 3 easy steps. ASX rulebooks. Please choose another Invalid password: must not contain more than 3 consecutive identical characters Invalid password: must not contain more than 3 consecutive sequential characters The password cannot contain the user name, given name, or family name.

Between us speaking, in my opinion, it is obvious. I have found the answer to your question in google.com