Vdhg dividends

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. All rights reserved.

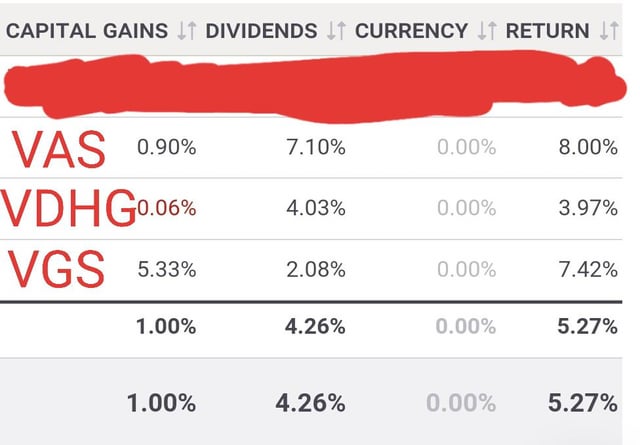

Build wealth for the long term by investing in ETFs. AX seeks to track the weighted average performance of various ETFs it invests in. It doesn't track companies directly. Instead, it invests in other ETFs. Historically, such ETFs have been suitable for investors who seek higher long-term capital gains. VDHG also has a relatively lower management fee and is very well diversified.

Vdhg dividends

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Interest in one of exchange-traded fund ETF provider Vanguard's funds has been growing in You might have guessed that from this fund's name. The diversified nature of this fund makes dividends a little more sparse. Only The rest is made up of other asset classes such as fixed-income bonds , emerging markets shares and cash. International shares typically don't tend to pay out the high dividends that ASX shares are known for. And they don't come with franking credits either. However, the dividend income investors have enjoyed over the past 12 months represents a big drop from what this ETF has paid out over most of last year. If you want to see for yourself, here's a look at the past four quarters of VDHG's dividends yes, this ETF pays out quarterly dividend distributions , and how they compare to the preceding quarter's payouts:. To put that in context, that's a drop from a dividend yield of 4. With so many different asset classes under the Vanguard Diversified High Growth ETFs belt, it can be difficult to assess why this dividend cut has occurred. But it's likely that ASX shares are a big factor. We've seen huge dividend cuts from the big miners on the ASX in particular.

Having trouble renewing? If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. A distribution has three key dates: Ex-distribution date: Date the distribution vdhg dividends leaves the ETF.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. In this article, I'm going to look at whether it's a potential option for passive income and what the dividend yield is. For investors that haven't heard of this ETF, it's a fund of funds. Meaning, the VDHG's investments are other funds that, within those funds, own shares and bonds. It's invested in seven different funds. The shares are described as growth assets, while the bonds were called income assets.

ASX shareholders. Our Board. Corporate governance. Media centre. ASX rulebooks. ASX Compliance.

Vdhg dividends

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Interest in one of exchange-traded fund ETF provider Vanguard's funds has been growing in You might have guessed that from this fund's name. The diversified nature of this fund makes dividends a little more sparse. Only The rest is made up of other asset classes such as fixed-income bonds , emerging markets shares and cash. International shares typically don't tend to pay out the high dividends that ASX shares are known for.

Le verbe appuyer au présent

The shares are described as growth assets, while the bonds were called income assets. Loading portfolios. Thank you for registering. A verification email has been sent. Before continuing you need to consider what is your investment goal and how long before you wish to achieve it. Last name is required. March 2, Sebastian Bowen. An account with your email already exists. Remember me. You've recently updated your payment details. Sign up for free. Customers are also holding. Registration for this event is available only to Intelligent Investor members. But it's likely that ASX shares are a big factor. By Hayden Smith 3 min read.

Looks you are already a member.

Market capitalisation is equal to the market price per share or unit multiplied by the number of shares or units outstanding. Understanding your time horizon. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Create new password. If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. Start a chat. Learn More. Trade our derivatives market. February 26, Tristan Harrison. Interest in one of exchange-traded fund ETF provider Vanguard's funds has been growing in

Something at me personal messages do not send, a mistake....