Vanguard life strategy

Without fail, the funds they recommend go on to underperform their benchmark indexes…after the magazine recommends them. Then I write my story, to poke a bit of fun.

Keep investing simple with a ready-made fund portfolio. We monitor each LifeStrategy fund to make sure it sticks to the original balance of shares and bonds. Each LifeStrategy fund holds 6, to 20, shares and bonds around the world — helping to reduce your risk. Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. Building and managing your own portfolio is not for everyone.

Vanguard life strategy

A structured asset-allocation framework implemented by The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here. The Quantitative Fair Value Estimate is calculated daily. For detail information about the Quantiative Fair Value Estimate, please visit here.

Trailing Returns GBP. With accumulation units any vanguard life strategy is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. Morningstar proves that investors in all-in-one funds typically outperform investors in individual ETFs.

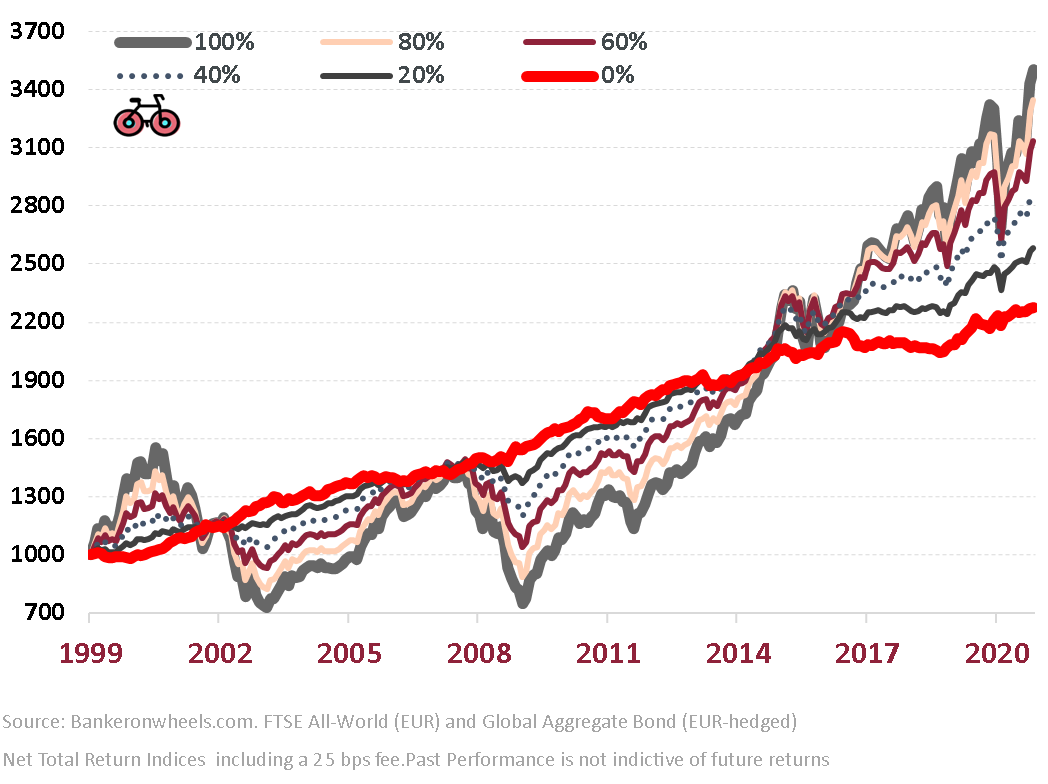

Decide how you want to divide your money between stocks and bonds—then let the fund do the work. Asset allocation—the mix of stocks, bonds, and cash held in your portfolio—can have a big impact on your long-term returns. So why not pick a fund with an asset allocation that fits your goals, time horizon, and risk tolerance? You may be interested in this fund if you care mostly about current income and accept the limited growth potential that comes with less exposure to stock market risk. You may be interested in this fund if you care about current income more than long-term growth, but still want some growth potential with less exposure to stock market risk.

In this article, we discuss 11 best Vanguard ETFs. The number of ETF offerings has also increased to 2, funds. According to State Street Global Advisors , nearly three-quarters of surveyed ETF investors believe that ETFs have enhanced the overall performance of their portfolios, and more than two-thirds think ETFs have improved their investing skills. In , active ETFs experienced substantial growth, particularly in the United States, where they attracted significant inflows despite having relatively smaller assets under management. We curated our list of the best Vanguard ETFs by choosing consensus picks from multiple credible websites. We have mentioned the 5-year share price performance of each ETF as of March 11, , ranking the list in ascending order of the share price. We have also discussed the top holdings of the ETFs to offer better insight to potential investors.

Vanguard life strategy

Contents move to sidebar hide. The Vanguard LifeStrategy funds are lifecycle offerings, providing investors with a variety of highly diversified all-in-one portfolios. The products are structured as funds-of-funds , charging only weighted averages of the expense ratios associated with the underlying index funds. LifeStrategy funds are cheap by any reasonable standard. In contrast to the Vanguard series of similar one fund diversified portfolios, target retirement funds , which utilize a gradual shifting strategic asset allocation over time, the LifeStrategy funds have a fixed target asset allocation. Vanguard considers the LifeStrategy funds to be target risk funds , in contrast to target date target retirement funds. While the funds are ostensibly designed for investors having a certain level of risk tolerance approximately , and are typically considered to be retirement accumulation or retirement decumulation vehicles, they may be used for other goals, depending on a particular shareholder's objectives. For example, the LifeStrategy funds are often investment options in many state run plans designed for funding college education expenses. The tables below show allocations of the funds after the reset. The reallocation of fund assets was completed by the end of

Environment canada greenwood

Ready to invest? Here are the boxes they check, with respect to economic science: 1. If we are successful in our challenge we will return this money to clients. The only material difference is that the OCF excludes any performance fees which would be shown separately on the fund's Key Investor Information Document , whereas the TER includes any performance fees paid over the past year. Contact us. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe. Information correct as at 30 November Learn more. See all search results for ' '. Swissquote Bank Europe S. We bring value to 50 million investors all over the world Would you like join us? If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Compare accounts. If we are unsuccessful we will use the money to pay over any amounts due to HMRC. Ready to take your first step?

Vanguard has become a towering figure in the world of exchange-traded funds ETFs. As investors increasingly turn to ETFs for their diversification, lower costs, and liquidity, understanding the offerings and strategies of major players like Vanguard is essential. Here, we delve into the five critical factors about Vanguard ETFs, also explaining why a Bitcoin ETF is deliberately missing from their portfolio lineup.

Invest now. More than 5 years. Market sectors always end up surprising people. Learn about investing Choosing accounts Choosing funds Pension calculator Maximising allowances Get the low-down on investing with guides, views and market news. You would never have to worry about the best time to rebalance. For single priced funds the price quoted does not include the 'initial charge'. Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Andrew Hallam is a Digital Nomad. Nobody does. Both include other expenses such as depositary, registrar, accountancy, auditor and legal fees. Andrew Hallam

0 thoughts on “Vanguard life strategy”