Uniswap v2

Learn to safely invest in crypto assets. Position yourself for the opportunities offered by the next cycle, probably the biggest uniswap v2 history. While Uniswap V2 Ethereum is a robust and popular platform for cryptocurrency trading, there are many other exchanges available that could better suit your specific needs, uniswap v2.

Without a shadow of a doubt, Uniswap is the most popular decentralized exchange in the world. Check out this chart from Dune Analytics that measures the number of users per protocol. Image Credit. No prices for guessing which line is Uniswap! In March , Uniswap underwent a monumental change as it transitioned from V2 to V3. Established in , Uniswap is a decentralized cryptocurrency exchange built on the Ethereum blockchain.

Uniswap v2

View Uniswap v2 Ethereum exchange statistics and info, such as trading volume, market share and rank. Statistics showing an overview of Uniswap v2 Ethereum exchange, such as its 24h trading volume, market share and cryptocurrency listings. A list of top markets on Uniswap v2 Ethereum exchange based on the highest 24h trading volume, with their current price. A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest number of markets available for trading. A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest 24h trading volume, with their current price. Uniswap is an automated liquidity protocol; it allows anyone with an Ethereum wallet to exchange tokens without the involvement of any central party. The Uniswap protocol was created by Hayden Adams in There is no order book or any centralized party needed to make trades. Uniswap works with a model that involves liquidity providers creating liquidity pools. Any ERC token can be launched as long as there is a liquidity pool available for traders. Uniswap UNI is the native token of the Uniswap protocol, and provides its holders with governance rights; UNI holders can vote on changes to the protocol. Community members are the Ethereum addresses that have interacted with Uniswap. Exchanges Uniswap v2 Ethereum. Go to Uniswap v2 Ethereum.

The protocol is a swap that allows customers to directly exchange ERC tokens on the Ethereum blockchain. The implementation of this rate would affect the rewards that liquidity providers receive, uniswap v2.

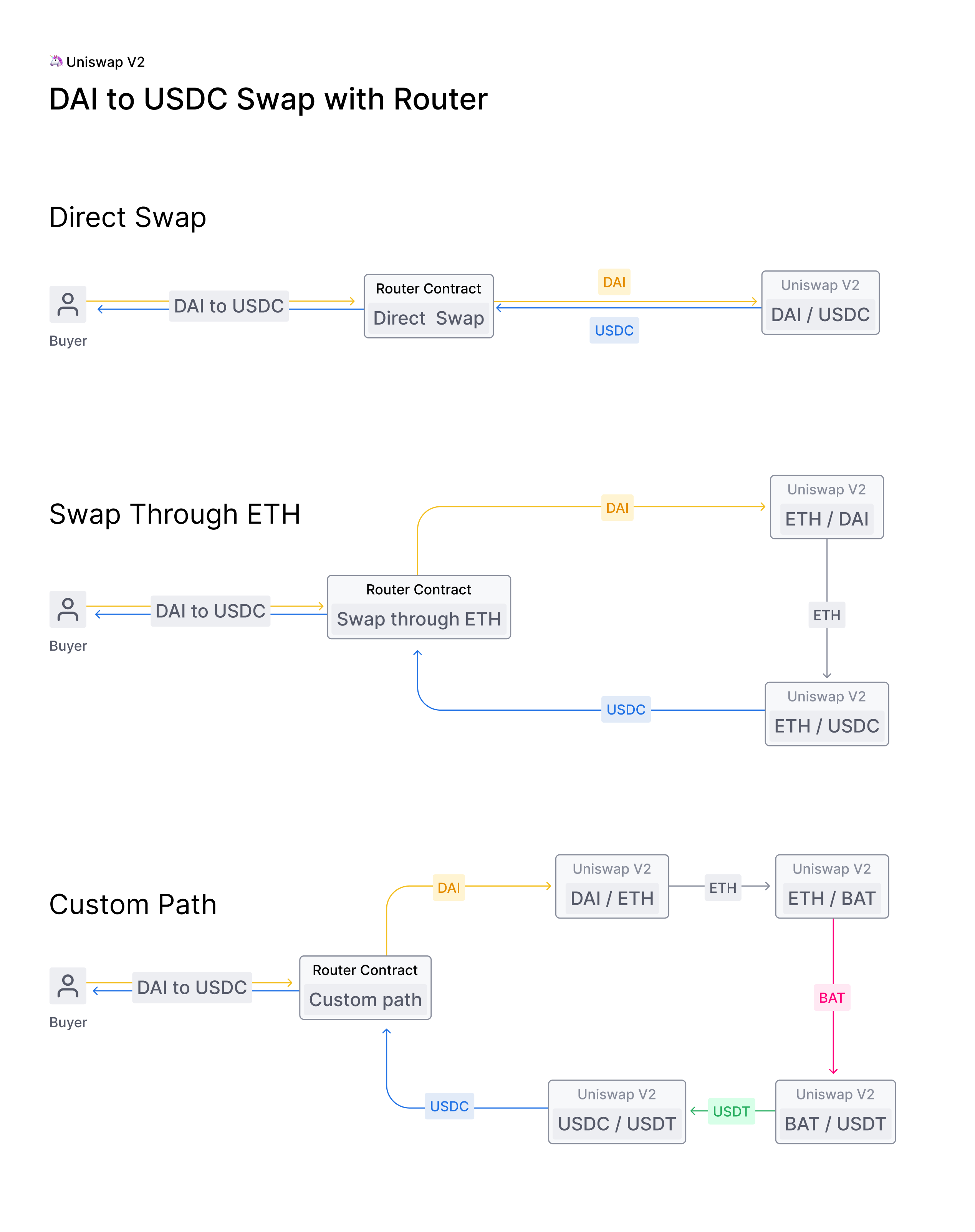

Uniswap v2 opens in a new tab can create an exchange market between any two ERC tokens. In this article we will go over the source code for the contracts that implement this protocol and see why they are written this way. Basically, there are two types of users: liquidity providers and traders. The liquidity providers provide the pool with the two tokens that can be exchanged we'll call them Token0 and Token1. In return, they receive a third token that represents partial ownership of the pool called a liquidity token. Traders send one type of token to the pool and receive the other for example, send Token0 and receive Token1 out of the pool provided by the liquidity providers. The exchange rate is determined by the relative number of Token0 s and Token1 s that the pool has.

Seamlessly swap and provide liquidity on v2 on all supported chains directly through the Uniswap interface. With both v2 and v3 available across all supported networks, users have the flexibility to choose between simplicity with v2 and more advanced features with v3. While v3 offers advanced capabilities for more active liquidity providers LPs , v2 offers a more simple LP experience. Unlike v3, pools on v2 cover the entire price range of the pool by default — reducing the need for active management and monitoring as an LP. Users already save on gas fees when swapping with v3 on non-Ethereum chains. Plus, users benefit from almost no MEV on L2s, due to sequencers — particularly helpful for swapping longtail assets, which are more prone to losses due to MEV. For users looking to swap using v2, you can visit app.

Uniswap v2

Uniswap v2, the second iteration of the Uniswap protocol, has been deployed to the Ethereum mainnet! An audit report and formal verification has already been released and the Uniswap v2 Bug Bounty has been running for over a month. Developers can begin building on Uniswap v2 immediately! Initial docs and example projects are already available. For full details on the benefits of Uniswap v2 for liquidity providers and traders, please read the Uniswap v2 announcement blog post. For more information on the launch please read below.

Best baltimore orioles players of all time

Continuing to use our site consents to use of cookies. In both cases, the trader has to give this periphery contract first an allowance to allow it to transfer them. See all Provider Coupons. This complicated calculation of fees is explained in the whitepaper opens in a new tab on page 5. We discard the last returned values, the block timestamp, because we don't need it. A function parameter in solidity can be stored either in memory or the calldata. The periphery contract sends us the tokens before calling us for the swap. Transfer the correct amounts of tokens from the user into the pair exchange. Uniswap V2 Ethereum is a leading cryptocurrency trading exchange, offering a diverse selection of the most popular cryptocurrencies. Calendars Coming Soon. When a token has such fees we cannot rely on the removeLiquidity function to tell us how much of the token we get back, so we need to withdraw first and then get the balance. As explained above, this is an array because you might need to go through several pair exchanges to get from the asset you have to the asset you want. Market 24h volume. Again, the sender and the destination may not be the same.

Uniswap V1 was the proof-of-concept for a new type of decentralized marketplace. As a venue for pooled, automated liquidity provision on Ethereum, the Uniswap protocol Uniswap functions without upkeep, providing an unstoppable platform for ERC20 token conversion.

This formula applies to all Uniswap V2 trading pairs. This could affect other smart contracts that rely on the oracle for their logic, such as lending platforms, derivatives, or synthetic assets. This is the factory contract that created this pool. Continuing to use our site consents to use of cookies. This event is emitted when a new pair exchange is created. These two functions handle identifying the values when it is necessary to go through several pair exchanges. Assume you're trying to deposit a thousand A tokens blue line and a thousand B tokens red line. However, the desired amount is a maximum, so we cannot do that. This is all happening in the same transaction, so the pair exchange knows that any unexpected tokens are part of this transfer. Video Courses. In return, they receive a third token that represents partial ownership of the pool called a liquidity token. Let's say that the value of the two tokens is identical, but our depositor deposited four times as many of Token1 as of Token0. The Uniswap V2 crypto exchange upgrade was released in May

0 thoughts on “Uniswap v2”