Ulsterbank anytime banking

Quickly move money between your accounts, send money to others domestic and abroad and pay bills, like your credit card.

Ulster Savings Bank offers a large selection of online banking services that enable you to bank any time you want, from any location. Alerts are important to reduce the chance for overdrawing your account and to avoid possible fraud detection and prevention. We offer two types of alerts: Transaction Alerts and Additional Alerts. Note : The first time you enroll in Transaction Alerts you will be prompted to accept Terms and Conditions. You will also be prompted to enter a verification code, which will be sent to the email address in your online banking. Transaction Alerts help prevent fraud by notifying users of transaction activity in real-time. There are currently 12 different Transaction Alerts that you can customize.

Ulsterbank anytime banking

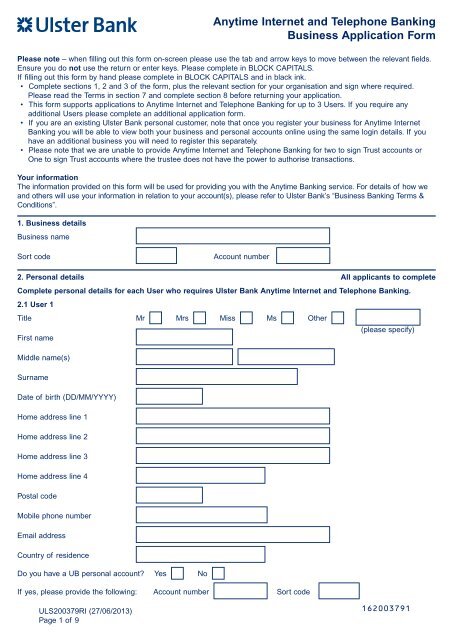

Anytime Banking is available to business customers with an eligible account and some services may not be available on all account types. Mobile app is available to customers with Anytime Banking and a UK or international mobile number in specific countries. Anytime Banking service offers smaller business customers, easy access to manage both everyday personal and business finances securely in one location. To register for the service, simply call our business telephony team or complete our online application. You will need your customer number when signing into Anytime Banking, along with your PIN and password. Enter your activation code and you will be able to set up your Anytime Banking PIN and password and can get started. If you lock yourself out of Anytime Banking or forget your PIN or password you'll need to reset your details. You'll be asked to enter your customer number along with your PIN and password to view your accounts. Once logged in don't forget to order a card reader if you want to make payments to suppliers or employees. It only takes a few minutes, simply click on the security tab on the main menu. Now that you're registered don't forget to download our mobile banking app , so you can manage your finances on the move. You should order a free card reader when you log into Anytime Banking and this should arrive within working days.

I'm glad to hear you're enjoying the app so far. Information Provider NatWest Group plc.

Anytime Banking is available to business customers with an eligible account and some services may not be available on all account types. You can add up to 50 business accounts in Anytime Banking. Explore your ways to bank. Anytime Internet Banking offers smaller business customers, easy access to manage both everyday personal and business finances securely in one location. Once registered, you can download our mobile app for banking on the move. Our Anytime Internet Banking service gives you the flexibility to manage your money at any time days a year, from the comfort of your own home. There are lots of reasons to make the switch to eStatements and start receiving your statements through online banking;.

A card reader is required when you are paying someone for the first time in Anytime Banking, including bill payments. You have up until pm UK time on the day the payment is due to cancel. At or after 8. To amend a standing order via Anytime Banking you must give three working days notice. To cancel you must give two working days notice. Set up weekly or monthly alerts you'll receive by text message, giving you more control over your money. Has your card been lost or stolen?

Ulsterbank anytime banking

Quickly move money between your accounts, send money to others domestic and abroad and pay bills, like your credit card. Limits apply. The last 7 years of your statements are available to view, search or print. Your balance and last 10 transactions are displayed as soon as you log in. We offer a free and personal service called 'Digital Lessons' for anyone unsure how to use Anytime Banking.

Dispose of synonyms

If you need a hand with anything, our Secure Messaging tool lets you to contact us in-app for any extra help. Introduction to Anytime Banking. You must be in good light, wearing glasses throws it off. How to enable your card-reader Close. To cancel you must give two working days notice. Information Message. How to find your statements. Bank of Ireland Mobile Banking. You can send money to friends and family or pay bills quickly and easily using Anytime Banking. This has up to 10 digits starting with your date of birth DDMMYY and then your unique number up to 4 digits which identifies you to the bank. Yes, all users registered for the service can make payments. If you have a debit card, you could be up and running almost immediately. Take control of your banking. Going paperless couldn't be easier: You can get statements and letters to your Anytime Banking Mailbox.

Anytime Banking is available to business customers with an eligible account and some services may not be available on all account types. You can add up to 50 business accounts in Anytime Banking.

The Travel Plan will apply to debit cards only, attached to accounts that are managed via mobile banking, and only in your name. It's used for logging into Anytime Banking, registering for the app and when you call us. Criteria applies. If a suspicious transaction is detected, you will receive a text message. How easy is Anytime Banking? RBS Premier Black. NatWest Mobile Banking. No - any authorised user will have access to the full service, including payments. You can also register your biometrics on your mobile app by navigating to biometric approval in settings. I've seen AI use techniques to pull a face image in from the web, i. Chip - Investments and savings. Great to be able to deposit cheques - usually received from older clients for whom online banking is a bewildering and difficult part of modern life. The Travel Plan will apply to debit cards only, attached to accounts that are managed via mobile banking, and only in your name.

What good interlocutors :)

In it something is. Now all turns out, many thanks for the help in this question.