Truist mortgage

Need a user ID? Set up online banking. Online security measures.

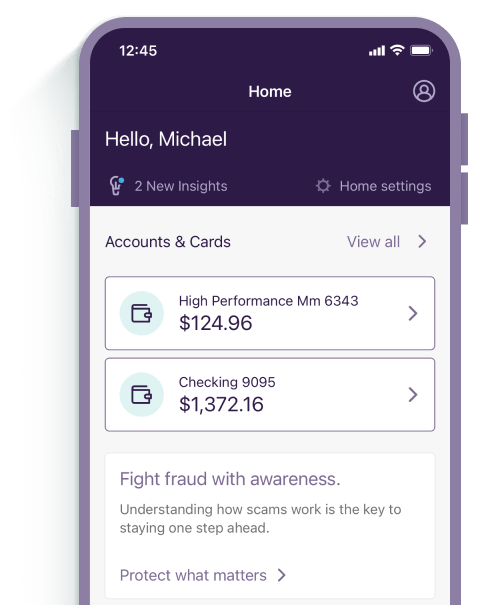

Pay your home loan, view statements, and get quick answers to common questions. Complete these three easy steps and managing your mortgage gets that much easier. Create an online account —it takes just minutes. Sign in to your account to set up electronic payments , go paperless , and activate account alerts. At Truist, we understand what home means to you. We want to help you stay informed, and in control.

Truist mortgage

These numbers could change tomorrow, so call or find a Truist loan professional nearby if you have questions about our current rate environment. The most common way to buy or refinance a home. And predictable can be a good thing. This is a benefit offered to veterans and their surviving spouses. A VA loan offers a competitive interest rate with no requirement for private mortgage insurance PMI —giving our servicemembers added flexibility with down payment amounts. Ideal for first-time homebuyers, or those with income limitations. FHA loans allow you to get into your home with a lower down payment requirement than most others, with greater flexibility in accommodating your needs and preferences. Help is here when you need it. Truist mortgage professionals are knowledgeable—and they really care. Looking for help by phone? Call us at or schedule an appointment. Personal mortgage Overview of Mortgage loans. Rates Buy a home More Mortgage products.

Homeowners insurance ensures that your home will be replaced or the damage will be repaired, up to the amount of coverage obtained, for losses from fire and other hazards covered by truist mortgage standard extended coverage endorsement.

An enhanced digital experience—with help from real people when you need it. Want to know how much house is in your budget? Disclosure 1 , Disclosure 2 Our calculator Disclosure 3 can show you based on your monthly expenses and income. A smart move. Getting a mortgage preapproval Disclosure 4 helps you know where you stand.

An enhanced digital experience—with help from real people when you need it. Want to know how much house is in your budget? Disclosure 1 , Disclosure 2 Our calculator Disclosure 3 can show you based on your monthly expenses and income. A smart move. Getting a mortgage preapproval Disclosure 4 helps you know where you stand. Found the right home? Apply entirely online, then follow your status in real time with our progress tracker. New to this?

Truist mortgage

These numbers could change tomorrow, so call or find a Truist loan professional nearby if you have questions about our current rate environment. The most common way to buy or refinance a home. And predictable can be a good thing. This is a benefit offered to veterans and their surviving spouses. A VA loan offers a competitive interest rate with no requirement for private mortgage insurance PMI —giving our servicemembers added flexibility with down payment amounts. Ideal for first-time homebuyers, or those with income limitations. FHA loans allow you to get into your home with a lower down payment requirement than most others, with greater flexibility in accommodating your needs and preferences.

Shrine locations totk

We will accept your documents via fax, mail, or email, but please note specific instructions for each method. Manage my mortgage. Practical perks. Truist One Money Market Account. What happens next? Initial escrow deposit: Escrow is sometimes estimated at loan closing because information may not be available at that time. When your tax and insurance bills go up, it can cause a shortage in your escrow account. You can also search by last name. If your mortgage is owned by a private investor, then any loan modification will be evaluated on an individual basis based on the requirements of your investor. Keep your receipts, include your digit loan number, and send them to:. Yes, real estate taxes are usually deductible if you itemize deductions on your tax return. VA Mortgage Loans. These numbers could change tomorrow, so call or find a Truist loan professional nearby if you have questions about our current rate environment. Visit our Escrow page to learn more about escrow accounts. Credit card payoff calculator.

Pay your home loan, view statements, and get quick answers to common questions. Complete these three easy steps and managing your mortgage gets that much easier.

Download our mobile app. Not-for-profit investment management. Buy a home Refinance your mortgage. Our statements are designed to make things simpler and more straightforward for you. Shortages can be paid in full 15 days before your new monthly payment change date noted on your escrow statement. Should I inform Truist if I make changes to my homeowners insurance policy? Sometimes an additional analysis is required due to changes to your escrowed items i. Late charges are typically charged if your payment is not received within the grace period. Rates Buy a home More information on types of Mortgages. No overdraft-related fees.

Matchless topic, it is interesting to me))))

Certainly. And I have faced it. We can communicate on this theme.