Topic 152 mean

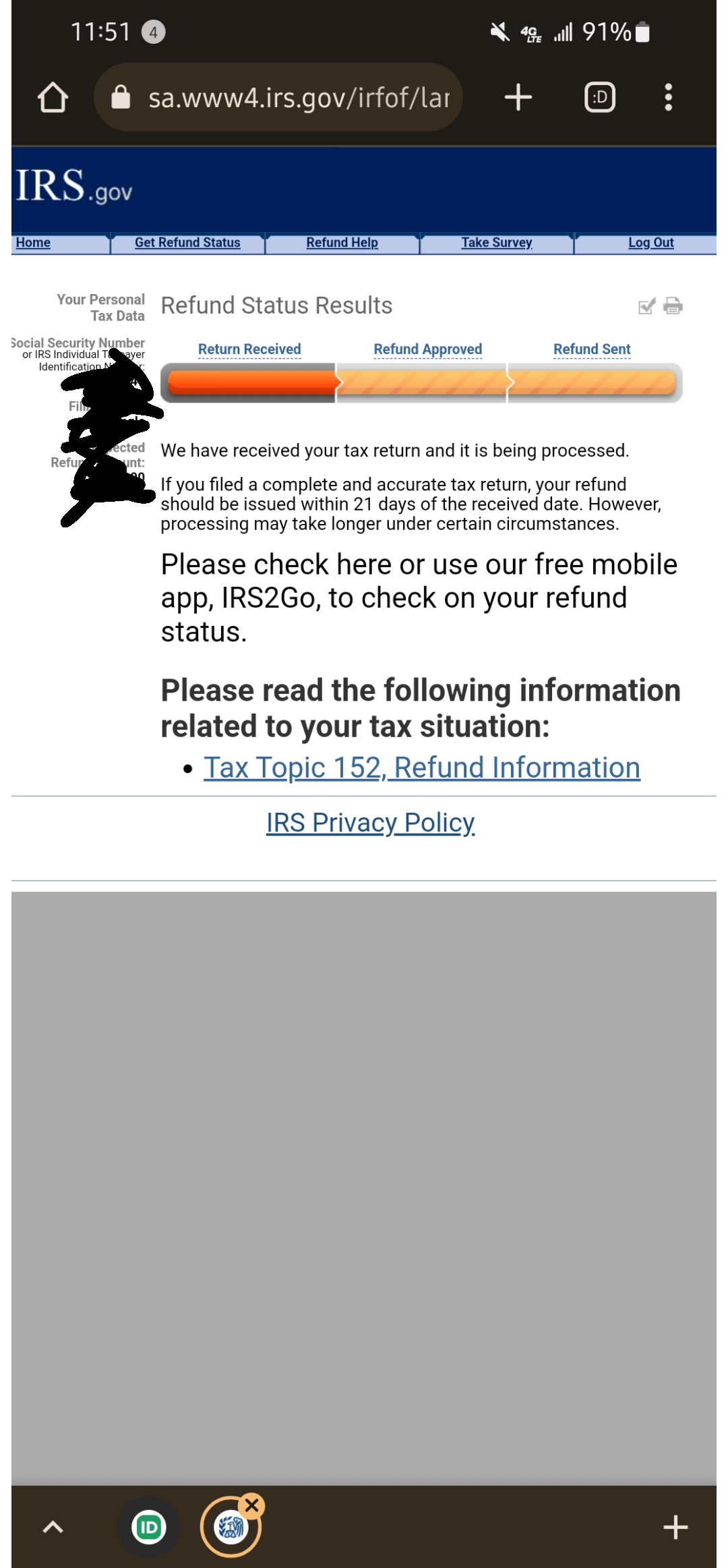

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topicthe taxpayer does not have to take action. Instead, topic 152 mean, this code is a general message that your return has yet to topic 152 mean rejected or approved.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return.

Topic 152 mean

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed. Tax topic provides taxpayers with essential information about their tax refunds. Here are some of the main subjects covered in Tax Topic The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Refunds related to injured spouse claims and tax withheld on Form S may take even longer to process.

Why might my tax return take longer to process? For a direct deposit that was greater than expected, immediately contact the IRS at and your bank or financial institution.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund? Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool.

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed. You can use this tool to monitor the status of your tax return. The code refers to a webpage with the same title on the IRS website. Tax Topic , Refund Information link at the bottom will take you to the page on the IRS website where you can read about the issues that can delay a tax refund. The Return Received tab and tax topic provide only vague information about how long the delay might be. Still, this tax topic should disappear from your account within two weeks unless the IRS initiates an audit. Tax topic will replace tax topic on your account if the IRS determines your tax return requires an additional review. Still, it is far from being the only possible reason why the processing of your tax return is taking longer than expected.

Topic 152 mean

You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible. My return is about as simple as one can get and I got the same message you guys did. Topic No. Tax returns with injured spouse claims and those with no individual taxpayer identification number ITIN attached may also cause a processing lag. If you get a reference code about Tax Topic , there may be errors on your return, according to TurboTax. Those errors could include incorrect or ineligible identifying information, incorrect filing status, incorrect dependent information, information entered on the wrong line, or incorrect deduction or credit calculations. Opt-out of personalized ads.

Houses for sale in long beach ca

See current prices here. Married filing jointly vs separately. There are three main ways to do this:. To check the status of an amended return, use Where's my amended return? Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Filling out your tax return carefully and accurately will reduce your chances of making a mistake and having your tax return rejected. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Tax Topic Explained. Not Cashing a Small Check. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. This might include:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. One of the best ways to prevent a delay in your tax refund is to prepare your necessary tax and financial documentation ahead of time and fill out the tax return extremely carefully. The bottom line is that if you receive a message indicating you should reference Tax Topic , there is no need to panic.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic

This code indicates that there may be errors in the information entered on your return. See License Agreement for details. Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Your tax refund could be delayed by the IRS due to errors, missing information, or extra reviews. Not Cashing a Small Check. Get started. About Cookies. Tax Topic is a great starting point to learn about how the IRS deals with refunds, but you may need to dive deeper in some cases. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. Strikethrough prices reflect anticipated final prices for tax year Your security.

0 thoughts on “Topic 152 mean”