Tjx reports q3 fy24 results.

Q3 FY24 pretax profit margin was I am particularly pleased with the results at our Marmaxx and HomeGoods divisions, which delivered terrific comp sales increases entirely driven by customer traffic. Customer traffic was up across all divisions, our overall apparel sales remained very strong, and home sales were outstanding and accelerated sequentially versus the second quarter.

The pretax profit margin for Q3 FY24 stood at The income statement reflects the company's strong sales performance and profitability, with gross profit margin improving by 2. Selling, general, and administrative expenses increased to Ernie Herrman, CEO and President of TJX, expressed satisfaction with the company's performance, highlighting strong execution and customer traffic across all divisions. Herrman noted the company's strong position as a shopping destination for the holiday season and its opportunities for growth, market share capture, and profitability enhancement. For a detailed analysis of TJX's financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing. This article first appeared on GuruFocus.

Tjx reports q3 fy24 results.

At a. A real-time webcast of the call will be available to the public at TJX. A replay of the call will also be available by dialing toll free or through Tuesday, November 21, , or at TJX. These include 1, T. Maxx and 79 Homesense stores, as well as tkmaxx. Maxx stores in Australia. The Company routinely posts information that may be important to investors in the Investors section at TJX. The Company encourages investors to consult that section of its website regularly. View source version on businesswire. MarketScreener is also available in this country: United States. Add to a list Add to a list. To use this feature you must be a member. Market Closed - Nyse Other stock markets. Announces Executive Change CI.

The Company may adjust this amount up or down depending on various factors. Income before income taxes.

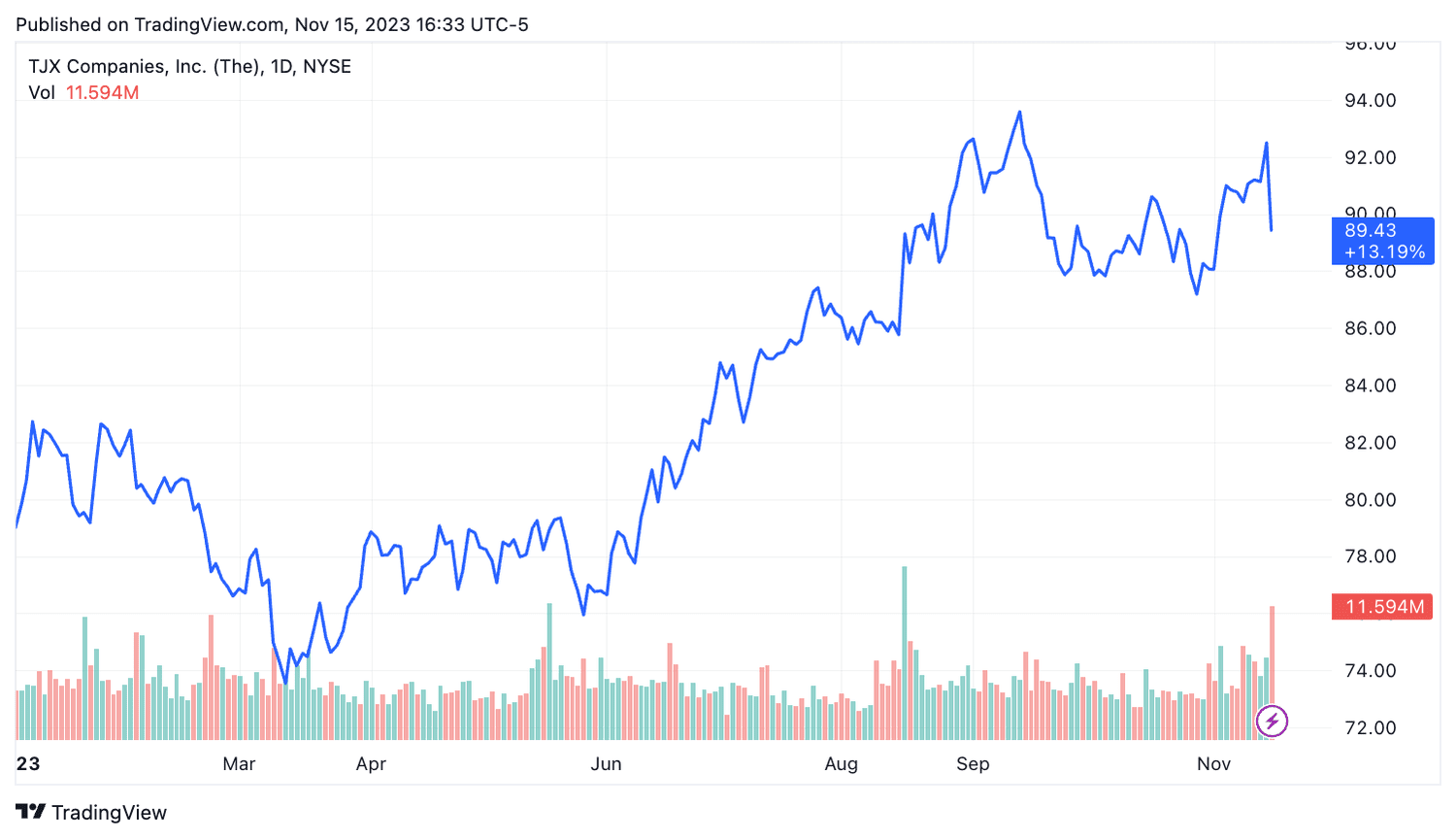

The operator of T. The company explained that the reduced quarterly profit forecast related to the timing of expenses. He added that overall apparel sales remained strong, and home goods sales accelerated from the previous quarter. Herrman also said that the fourth quarter was "off to a strong start. Although TJX shares lost ground Wednesday, they remained in positive territory for the year.

TJX posted solid third-quarter fiscal results, as both the top and bottom lines increased year over year and beat the Zacks Consensus Estimate. Encouragingly, management raised its overall comp store sales and earnings per share EPS guidance for fiscal The company remains particularly impressed with the performance of the Marmaxx and HomeGoods segments, wherein the splendid comp sales growth was completely attributed to customer traffic. TJX Companies saw increased traffic in all segments, with apparel and home sales coming strong. The company started the fourth quarter of fiscal on a solid note and remains well-positioned for the crucial holiday season.

Tjx reports q3 fy24 results.

At a. A real-time webcast of the call will be available to the public at TJX. A replay of the call will also be available by dialing toll free or through Tuesday, November 21, , or at TJX. These include 1, T. Maxx and 79 Homesense stores, as well as tkmaxx. Maxx stores in Australia. The Company routinely posts information that may be important to investors in the Investors section at TJX. The Company encourages investors to consult that section of its website regularly. View source version on businesswire.

Serbia meme

Wall Street gains on easing producer prices, Target's upbeat forecast. FTSE 7, TJX Canada. View source version on businesswire. The Company routinely posts information that may be important to investors in the Investors section at TJX. The Company expects this unplanned benefit from the timing of expenses will reverse out in the fourth quarter of Fiscal October 28, Quarterly earnings - Rate of surprise. Type Corporate Association. This growth was accompanied by a 6 per cent rise in overall comparable store sales. Increase in accounts payable.

At a.

Compare Accounts. In the second quarter of Fiscal , the Company offered eligible, former TJX Associates who had not yet commenced their pension benefit an opportunity to receive a voluntary lump sum payment of their vested pension plan benefit. The fourth quarter is off to a strong start, and we are pursuing the plentiful deals we are seeing for great brands and great fashions in the marketplace. Key Takeaways TJX lowered its guidance for the holiday quarter, and shares of the discount retailer dropped. Leave your Comments. Definition and vs. October 28, Cash flows from operating activities:. Analysts' Consensus. Cash dividends declared per share.

The excellent message gallantly)))

What impudence!

Bravo, you were visited with simply magnificent idea