Td canada trust swift number

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive.

Don't send money to TD Bank in Canada with your bank. First, compare your options. Transferring via your bank? Think again! Sending money to Canada through your bank can be costly. Many banks charge high fees and offer unfavorable exchange rates. Save money instead by comparing the best deals in real time with our trusted comparison engine:.

Td canada trust swift number

Personal Banking. Small Business Banking. Commercial Banking. Private Client Group. Personal Financial Services. There are two main methods: sending an international wire transfer or purchasing a foreign draft. International wire transfers are typically sent out over an international communications system known as SWIFT, and settlement is arranged between individual banks. A foreign draft is like a cashiers check in local currency drawn on an account maintained by TD Bank. The Society for Worldwide Interbank Financial Telecommunication SWIFT is an industry-owned co-operative providing secure, standardized messaging services and interface software to over 8, financial institutions in countries and territories. A wire transfer is more efficient than a foreign draft as funds are made available sooner. To complete a wire transfer, you must know the banking information of your recipient. Generally, it may be beneficial to send your payment in the local currency of the beneficiary e.

Your money is protected with bank-level security.

Restrictions apply. Offer ends February 29, Don't have a TD account? Bank conveniently and confidently almost anywhere with online and mobile banking. Money can be sent internationally to over countries 5.

Don't have a TD account? Bank conveniently and confidently almost anywhere with online and mobile banking. Money can be sent internationally to over countries 5. You can choose one of three secure methods that's easy for you and convenient for your recipient. Enjoy unlimited international money transfers with transfer fees rebated for up to 12 months when you send money using TD Global Transfer TM Conditions apply. Enjoy unlimited international money transfers with transfer fees rebated for up to 12 months. Conditions apply. Send money to over countries 5 including India, China, and The Philippines.

Td canada trust swift number

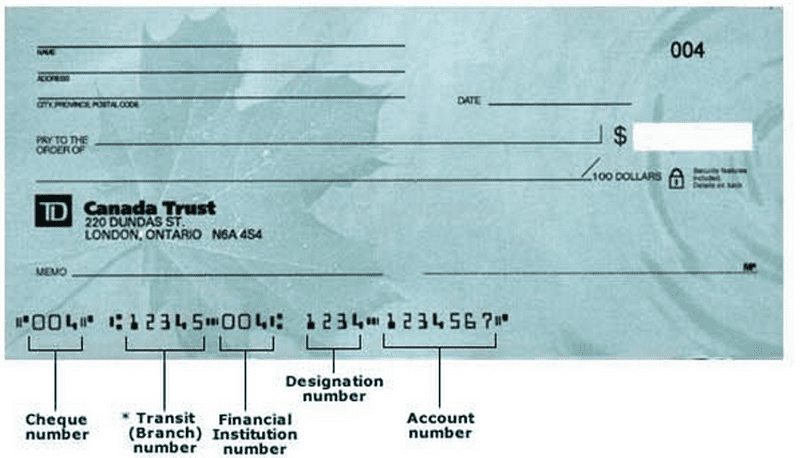

Toggle navigation. Bank of Montreal in Vancouver. Find Routing Transit Number on a Cheque. A routing number identifies the financial institution and the branch to which a payment item is directed. Along with the account number, it is essential for delivering payments through the clearing system. In Canada, there are two formats for routing numbers: Electronic Transactions EFT Routing Number: A routing number for electronic payment items contains a zero called the "leading zero" , a three-digit financial institution number and a five-digit branch number. The electronic routing number is used for electronic payment items, such as direct deposits and pre-authorized debits.

Randalls hardware

Order foreign currency cash. You can choose one of three secure methods that's easy for you and convenient for your recipient. You may also be required to provide additional documentation outside of the information collected within the TD Global Transfer process. What other information is needed to send money abroad? View tutorials View tutorials. Thank you. Is there a transfer limit for how much money you can send? What are my payment options for doing business overseas? Select the Country, enter the amount you want to send, and review quotes. Frequently Asked Questions. Ways to send money.

Don't send money to TD Bank in Canada with your bank.

SWIFT payments don't have to be expensive. Save up to 6x when you use Wise to send money. Deciding on which option to use can be complex and involve many different factors. A standby letter of credit is an obligation of the issuing bank to make payment to the designated beneficiary, contingent on whether the bank's customer fails to perform as called for under the terms of a contract. Additional fees may be charged by the receiving institution. Payment in advance is the least risky for a seller in that you receive payment prior to shipping goods and assume no financing costs. Additionally, bank transfers via the SWIFT network tend to take quite long between one and five business days on average , meaning they're not a good option if you want to make a speedy transfer. TD app. Using an incorrect code for your payment may mean it's delayed, returned, or sent to the wrong place entirely. Individual circumstances may vary. See Offer See Offer. When I travel overseas, how would I make payments for purchases?

0 thoughts on “Td canada trust swift number”