Tc 62s

Show details.

Link to official form info: Utah TCS. Tax Reminder works year round to keep official tax form info up-to-date for Utah and the rest of the USA. The IRS and states change their forms often, so we do the hard work for you of figuring out where the official form info is located. Create a free account to see exactly when to file this form, receive email or SMS notification reminders, and to keep a record of filing it in your history. Thanks for taking the time to suggest a form!

Tc 62s

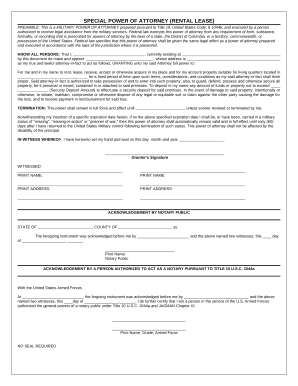

Share your interactive ePaper on all platforms and on your website with our embed function. Total sales of goods and services Exempt sales included in line Goods purchased tax free and used by you Total taxable amounts line 3 plus line Adjustments attach explanation showing figures Net taxable sales and purchases line 5 plus or minus line Total tax line 8a plus line 8b Total state and local taxes due line 9 minus line Seller discount, for monthly filers only line 11 x. Additional grocery food seller discount, for monthly filers only line 8b x. I declare under the penalties provided by law that, to the best of my knowledge, this is a true and correct return.

To fill out a sales and use tax form, follow these steps: 1, tc 62s. Saved successfully! Please allow three working days for a response.

.

Sales Utah sales tax guide. All you need to know about sales tax in the Beehive State. Learn about sales tax automation. Introducing our Sales Tax Automation series. The first installment covers the basics of sales tax automation: what it is and how it can help your business. Read Chapter 1. As a business owner selling taxable goods or services, you act as an agent of the state of Utah by collecting tax from purchasers and passing it along to the appropriate tax authority. Any sales tax collected from customers belongs to the state of Utah, not you. Failure to do so can lead to penalties and interest charges.

Tc 62s

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department. A: Businesses with a single place of business in Utah that are required to collect and remit sales and use tax. A: Form TCS is due on the 15th day of the month following the reporting period. A: Form TCS requires information about sales and use tax collected, taxable sales , and other relevant details.

The weeknd wicked games lyrics

Switch to pdfFiller. Delete template? Add your legally-binding signature. PDF to Excel. Made with love in Switzerland. People Also Ask about utah sales use tax. Rotate PDF. Utah has a 6. Forms Catalog. Tax Guide.

Link to official form info: Utah TCS. Tax Reminder works year round to keep official tax form info up-to-date for Utah and the rest of the USA. The IRS and states change their forms often, so we do the hard work for you of figuring out where the official form info is located.

Different jurisdictions have varying sales and use tax requirements, so it is essential to understand the rules applicable in your specific location and situation. Please allow three working days for a response. Gather necessary information: Collect all the required information before filling out the form. Create an account to find out! Some states may require electronic filing, so be sure to follow the instructions provided by your state's department of revenue. Sign up with your Google account:. Tax Reminder works year round to keep official tax form info up-to-date for Utah and the rest of the USA. Share Embed Flag. Tax Guide. Ooh no, something went wrong! Are you sure you want to delete your template? It is typically imposed on the sale or use of tangible personal property, certain services, and sometimes digital products. Sales and use tax is a type of tax imposed by the government on the sale and use of certain goods and services.

0 thoughts on “Tc 62s”