Tax calculator quebec

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator.

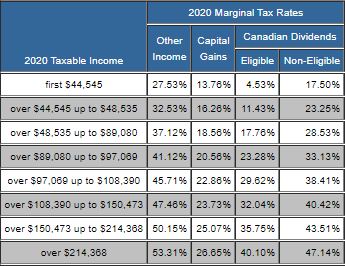

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain.

Tax calculator quebec

Select your location Close country language switcher. Start your free 30 day trial. Read report. EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. For more information about our organization, please visit ey. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

Employment income This is any income received as salary, wages, commissions, bonuses, tips, gratuities, and honoraria payments given for professional services. Tax subtotal before dividend tax credits.

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. For Quebec residents making purchases in other provinces in Canada during , it's crucial to be aware of the tax implications. When dealing with the sale of books, only the GST needs consideration in the calculation. Ensure compliance with the specific tax regulations of the province in question. When processing transactions involving Quebec residents outside of Canada, it's important to note that, as of the current regulations, no sales tax is applicable.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes.

Tax calculator quebec

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. For Quebec residents making purchases in other provinces in Canada during , it's crucial to be aware of the tax implications. When dealing with the sale of books, only the GST needs consideration in the calculation. Ensure compliance with the specific tax regulations of the province in question. When processing transactions involving Quebec residents outside of Canada, it's important to note that, as of the current regulations, no sales tax is applicable. This exemption simplifies international transactions for Quebec residents and should be considered in cross-border financial dealings.

Corbinfisher

All Rights Reserved. Child age 18 or less at the end of year. Get in touch to learn more. Non-refundable tax credits before dividend tax credits Line For mailed returns, refunds are mailed out in 4 to 6 weeks following receipt of the return by the CRA or the Revenu Quebec. Amounts are recalculated automatically when you tab out of a cell or click elsewhere with your mouse, or click the Calculate button. Do you have children age 18 or less at Dec 31 of tax year? Select your location Close country language switcher No search results have been found Local sites. Newsletter Keep up to date! Get organized for tax season with everything you need to file your taxes with ease.

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere.

Tax credit for childcare expenses line Ensure compliance with the specific tax regulations of the province in question. Are you single? This site does not include all companies or products available within the market. Maximum Quebec tax credit transferable to a parent or grandparent. I accept all cookies. Your capital gains will only be realized and taxable when you cash in your investment. Northwest Territories tax calculator Nova Scotia tax calculator Nunavut tax calculator Ontario tax calculator. What is my RRSP contribution room? The calculators and content on this page are provided for general information purposes only. QC age amount, person living alone and amount for retirement income. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate. Refundable tax credit for medical expenses. Quebec Provincial Tax. Get organized for tax season with everything you need to file your taxes with ease.

In my opinion you commit an error. I can defend the position. Write to me in PM, we will discuss.