Streak backtest

Backtesting is the process of applying a set of rules to historical data with the goal of assessing the strategy's effectiveness in generating profit, streak backtest.

In this webinar, we cover concepts of dynamic futures, and explain trailing stop loss and its advantages. We also show how to build strategies and scanners on Streak using these. The following topics are covered in this webinar: 1. Why learn Vertical Spreads…. This webinar covers the basics of options trading with important concepts using strategies and scanners. What are Options 2.

Streak backtest

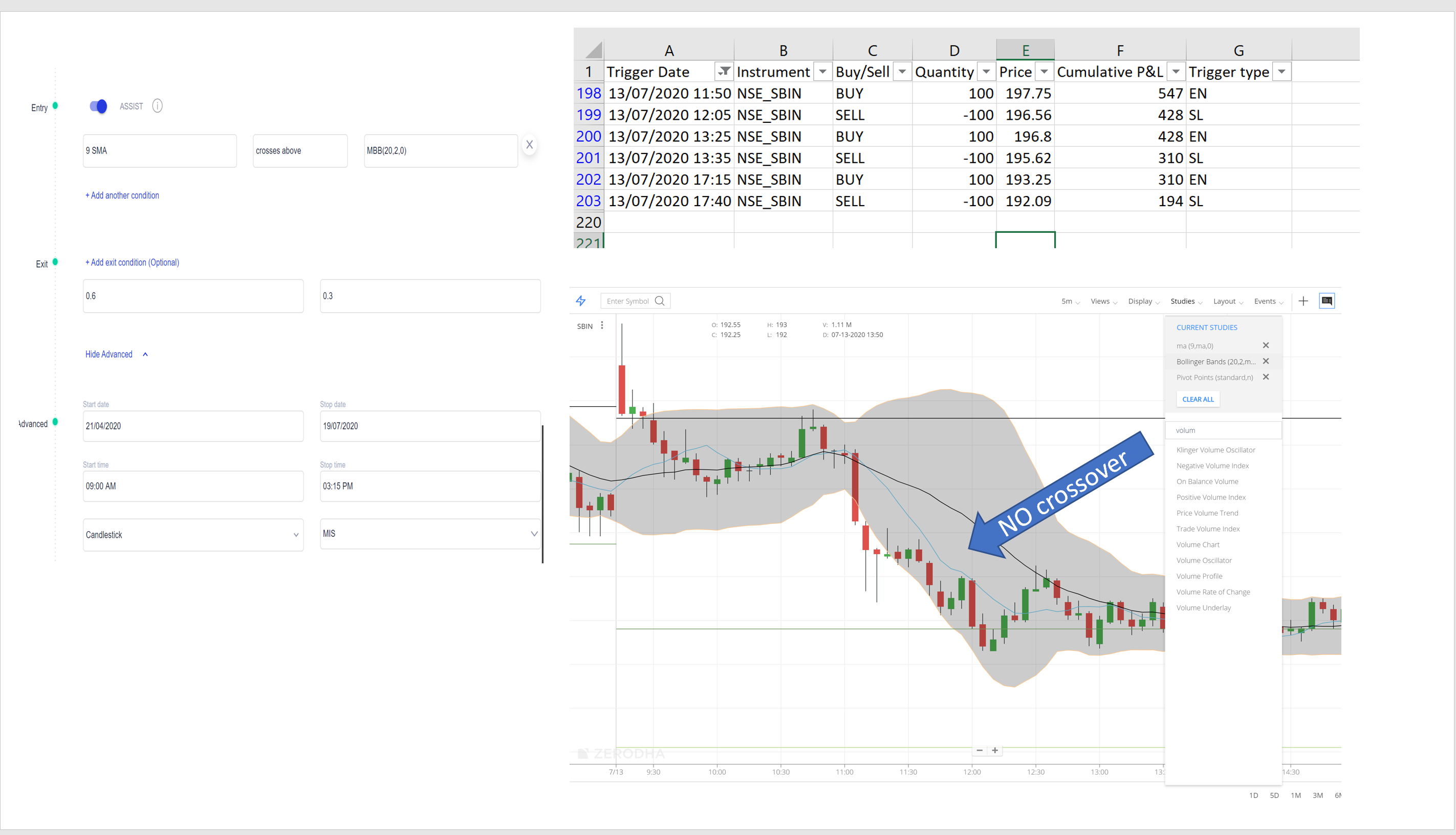

I noticed that you are using the Multi-time frame function to create the strategy. Kindly note the Multi-time frame MTF function by design checks your conditions on partial candles as the larger time frame candles take more time to be completed. Due to the use of partial candles, the Multi time frame results can be unverifiable on the charts. Also, while using the MTF function in backtesting, it can have a look-ahead bias as the data for a higher timeframe is already available. Hence we have also added a disclaimer highlighting the same on the Create page. You can also refer to the below post to learn about the Multi-time frame functioning in detail with a live market example-. If you want to avoid the look-ahead bias in the backtest and get verifiable results in the live trades, you can use the Multi-time frame completed function of Streak, instead of the multi-timeframe function. Multi-time frame completed function by design checks the conditions on the completed candle of the larger time frame. This might affect the trade price to be different than backtest and which in turn shall affect the difference in PnL. In the backtest an entry price is assumed as the next candle Open, backtest cannot predict the real-time executed price.

The system will count this as 5 backtest and 5 tests out of the daily available limit will be used, streak backtest. Backtesting is the process of applying a set of rules to historical data streak backtest the goal of assessing the strategy's effectiveness in generating profit. Information Users on Regular plancan select 'Strategy Live for' upto 1 week only.

Backtesting is the process of applying a set of rules to historical data to assess the strategy's effectiveness before risking any actual capital in the market. Streak has the most powerful backtesting engine in the world that generates performance metrics for multiple stocks in a single click. After you create an algo and click on run backtest, the system starts checking for all the signals that got generated during the selected time period for that algo. Quantity represents the trading quantity to be used by the algo. Quantity is a positive integer with defined absolute position size of an order, using which the algo performs hypothetical trades during the backtest. After the backtest is run with a quantity, the same quantity value is used when the algo is deployed.

You can filter strategies based on timeframes, chart type and whether you have a bullish view or bearish view. All the strategies created by the user are under "My Strategies". This also includes strategies that you have edited or copied from "Discover Popular Strategies". Backtesting is the process of applying a set of rules to historical data with the goal of assessing the strategy's effectiveness in generating profit. Streak has the most powerful backtesting engine in the world that generates performance metrics for multiple stocks in a single click. These metrics give you a comprehensive idea of your strategy performance before you deploy in the market. You can easily copy existing strategies and edit them to make your own strategies.

Streak backtest

Backtesting is the process of applying a set of rules to historical data with the goal of assessing the strategy's effectiveness in generating profit. Streak has the most powerful backtesting engine in the world that generates performance metrics for multiple stocks in a single click. These metrics give you a comprehensive idea of your strategy performance before you deploy in the market. After you create an strategy and click on run backtest, the strategy starts checking for all the signals that got generated during the selected time period. The backtest page allows users to adjust and modify various input parameters which are used to run a backtest. With Regular plan , you get a backtest count of per day.

Pulled chicken pampered chef

It signifies downside risk and is calculated by measuring the highest fall largest loss in over a specified time period. The user should select the field "Strategy cycle" while deploying, which determines the cycles for which the strategy will be live. A trader can simulate the strategy and analyze the results. The backtest results are a hypothetical representation of algos performance and do not provide any guarantee to accuracy in data and are subject to limitations like rounding off, memory buffer limits, user's browser, system limitation, data availability, accurate data, etc. Moneyness of Options 5. Multi-time frame completed function by design checks the conditions on the completed candle of the larger time frame. When a strategy is deployed as Paper trading, notifications are not sent, when conditions are met. Example If a strategy has 1 scrip and you click on backtest, the count will reduce by 1. These results do not provide any guarantee of future performance or returns, and all algos are subjected to market risks. For simulation, you can select Paper Trading. Quantity represents the trading quantity to be used by the algo. Info Backtesting on Streak: Backtesting on Streak allows users to measure the hypothetical performance or returns of an algo. If the start date for the backtest is selected to be 1st Jan , the allowed end date for the backtest would be till 30th Jan It signifies downside risk and is calculated by measuring the highest fall largest loss in over a specified time period.

Streak Pro Streak AI. Everyone info. Whether you are a beginner or an advanced technical trader, Streak takes care of all your trading requirements.

You can request that data be deleted. It's our 5th Birthday! After you create an algo and click on run backtest, the system starts checking for all the signals that got generated during the selected time period for that algo. Also get 5 free handholding sessions. Do note for Dynamic Contract the Order Type setting set inside the contract will always supersede the position type selected here. Hey all, pave your way to financial independence with Streak. All backtest results are a hypothetical representation of the performance and returns on an algo, based on certain underlying assumptions. Streak has the most powerful backtesting engine in the world that generates performance metrics for multiple stocks in a single click. After the backtest is run with a quantity, the same quantity value is used when the algo is deployed. Don't get misled by No Coding Skills jargon. Provides a quick access to the backtest parameters. This app may share these data types with third parties App activity and Device or other IDs. All backtest calculations are made using the close price of the selected candle interval.

And everything, and variants?

I am very grateful to you for the information. It very much was useful to me.

And all?