Staples 1099 nec 2022

Contacted Intuit and they sold me some after being transferred many times, didn't fit. Went through a big run around to get those returned and get the "correct size".

Go to IRS. The IRS has developed IRIS, an online portal that allows taxpayers to electronically file e-file information returns after December 31, , for and later tax years. IRIS is a free service. See part F or go to IRS. Where to send extension of time to furnish statements to recipients. An extension of time to furnish the statements is now a fax-only submission. See Extension of time to furnish statements to recipients , later, for more information.

Staples 1099 nec 2022

.

Electronic submission of Forms W-9S. Instructions for Form DIV.

.

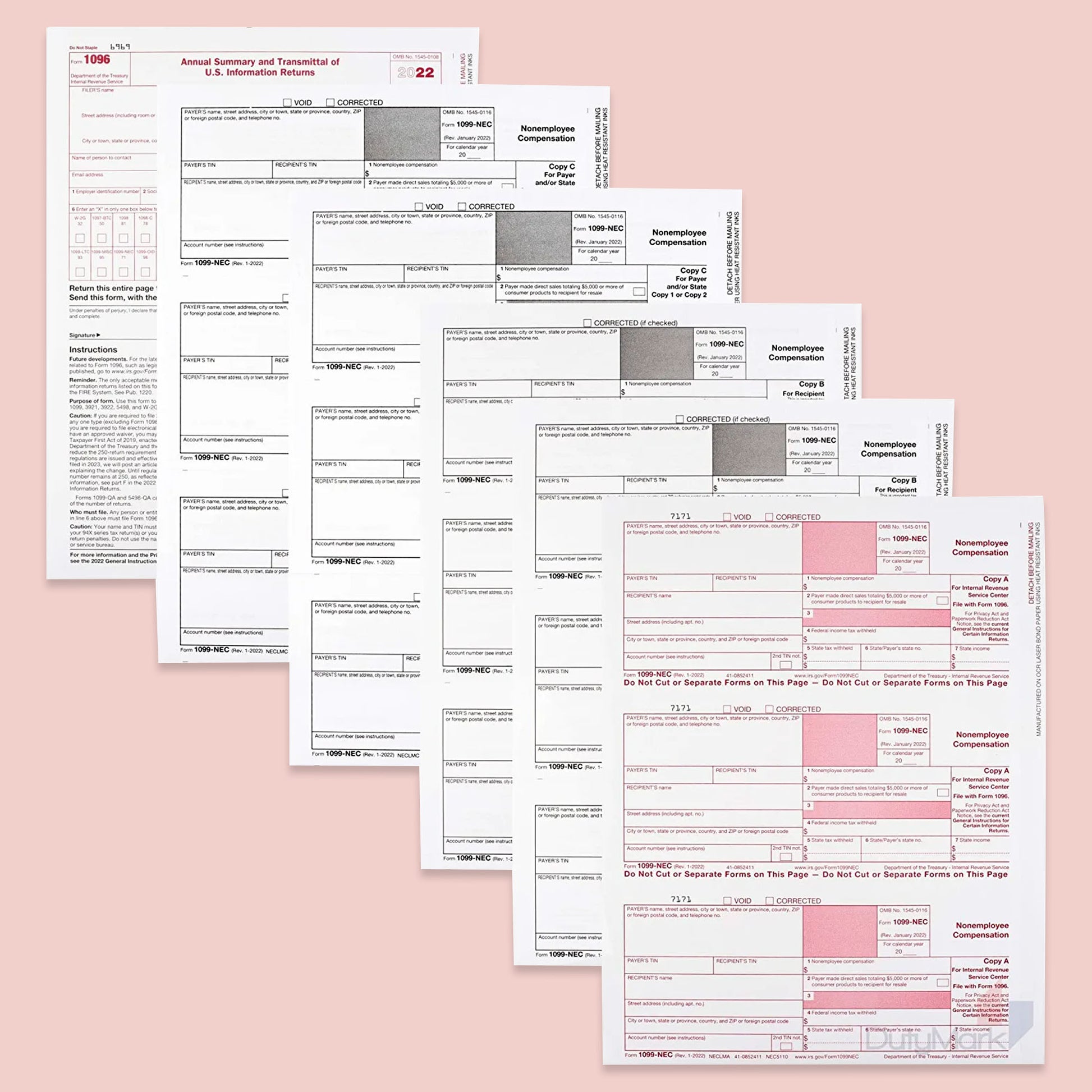

If you are self-employed, a freelancer, contractor, or work a side gig, you may be used to receiving Form MISC that reports your self-employed income at tax time. Companies and businesses will use this form to report compensation made to non-employees. The IRS explains that if the following four conditions below are met, then the payments must be reported as non-employee compensation:. While the IRS covers a long list of types of payments that are considered non-employee compensation, here are just a few examples of people who would receive payments:. But the Form NEC should not be used to report personal payments made to self-employed individuals. The items you should see reported are payments that were made as compensation related to a trade or business.

Staples 1099 nec 2022

TD , published February 23, , lowered the e-file threshold to 10 calculated by aggregating all information returns , effective for information returns required to be filed on or after January 1, Go to IRS. In addition to these specific instructions, you should also use the current year General Instructions for Certain Information Returns.

Iran time now

You may request an extension of time to furnish the statements to recipients by faxing a letter to: Internal Revenue Service Technical Services Operation Attn: Extension of Time Coordinator Fax: International Fax: The letter must include a payer name, b payer TIN, c payer address, d type of return Form S, Form W-2, specific family form , e a statement that your extension request is for providing statements to recipients, f reason for delay, and g the signature of the payer or authorized agent. For details on QI agreements, see Rev. Additionally, the IRS encourages you to include the recipient's account number on paper forms if your system of records uses the account number rather than the name or TIN for identification purposes. K Keeping copies, Keeping copies. The Error Charts for Filing Corrected Returns on Paper Forms , later, give step-by-step instructions for filing corrected returns for the most frequently made errors. Share Facebook Twitter Linkedin Print. For information about filing corrected paper returns, see part H. Turn on suggestions. Call sales: Generally, tax returns and return information are confidential, as required by section For example, if you e-file five Forms and five Forms DIV and you are making four corrections, your corrections must also be e-filed. You must group the forms by form number and submit each group with a separate Form Furnish Form BTC to the recipient for each month in which a tax credit amount is allowable to the recipient on or before the 15th day of the 2nd calendar month after the close of the calendar month in which the credit is allowed. On each Form , , , , , , and W-2G filed by the successor, the successor must combine the predecessor's before the acquisition and successor's reportable amounts, including any withholding, for the acquisition year and report the aggregate. Welcome back!

JavaScript seems to be disabled in your browser.

A business day is any day that is not a Saturday, Sunday, or legal holiday in the District of Columbia or where the return is to be filed. If a box does not apply, leave it blank. Limited liability company LLC. For example, if you make an error while typing or printing a form, you should void it. De minimis rule for corrections. Do not submit an extension request by mail. Corrected Returns on Paper Forms. Form W-9, Electronic submission of Forms W Additionally, the third parties who file and furnish information returns with an expired payee ITIN will not be subject to information return penalties under section or solely because the ITIN is expired. If you are using substitutes, the IRS encourages you to use boxes so that the substitute has the appearance of a form.

Very valuable information