S&p 600

The index is weighted by float-adjusted market capitalization [1] companies with higher share price s&p 600 relatively weighted more in the indexs&p 600, where public shares are only taken into consideration, excluding promoters' holding, government holding, strategic holding, and other locked-in shares. These index funds may be rebalanced at different intervals resulting in a small difference in holdings.

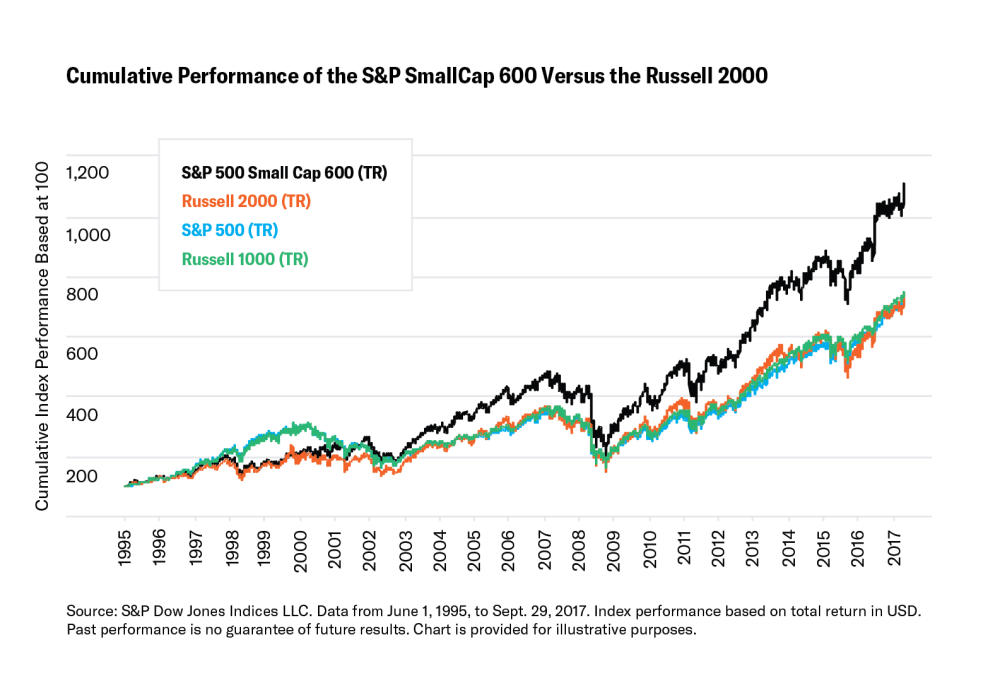

It covers roughly the small-cap range of American stocks, using a capitalization-weighted index. As a result, an index constituent that appears to violate criteria for addition to that index is not removed unless ongoing conditions warrant an index change. Companies must have positive as-reported earnings over the most recent quarter, as well as over the most recent four quarters summed together. The following exchange-traded funds ETFs attempt to track the performance of the index:. It can be compared to the Russell Index. These versions differ in how dividends are accounted for.

S&p 600

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

West Palm Beach, Florida. There is no scheduled reconstitution.

This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. Search Ticker.

March 4 Reuters - A look at the day ahead in Asian markets. The resilience of the U. Industrial production, retail sales and purchasing managers' index data from South Korea; New Zealand trade and Australian housing figures are the main events on the regional economic calendar, but investors' attention will be turning to China. The annual National People's Congress in Beijing opens on Tuesday and what is laid out by parliament could go a long way to determining the path for assets in China. And beyond. Premier Li Qiang will lay out Beijing's annual growth and other economic targets, and - crucially - a plan for achieving them. If the stimulus policies and measures are credible in the eyes of investors, the rebound in Chinese stocks from the five-year lows a few weeks ago looks likely to continue.

S&p 600

Learn More. In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Please see the prospectus for more details. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Need for speed shift save game pc

January 29, Use profiles to select personalised content. Long Island City, New York. Retrieved June 9, Retrieved April 7, Serangoon , North-East Region, Singapore. June 2, Charleston, West Virginia. December 17, New York City, New York. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. A contract for difference is a derivative instrument that offers exposure to price changes in an underlying security without ownership of such security. Meritage Homes Corporation.

Get our overall rating based on a fundamental assessment of the pillars below.

Tools Tools. NTUS was acquired by Archimed. March 4, Auburn Hills, Michigan. The information contained in this material is derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed as to accuracy. July 12, February 25, Retrieved July 6, Dynamic Materials Corporation. Renewable Energy Group. Asset Class Equity. These include white papers, government data, original reporting, and interviews with industry experts. Greenwich, Connecticut.

Look at me!

Excuse for that I interfere � To me this situation is familiar. I invite to discussion. Write here or in PM.

It is a pity, that now I can not express - it is compelled to leave. But I will return - I will necessarily write that I think on this question.