Smergers review

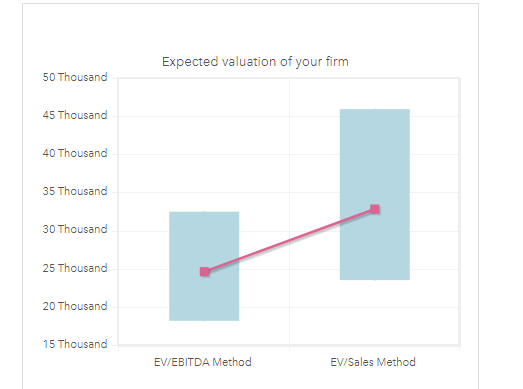

Smergers is a company that provides investment banking for small and medium sized enterprises. Their website provides a simple business smergers review calculator, that requires only a few inputs. The results appear next to the input fields, smergers review, so the calculator is very quick to use. On the other hand, the calculator lacks many inputs that affect the valuation, so the result will be prone to error.

There are around 4, listed companies in India currently if one takes into account all the large companies along with the small and medium enterprises SMEs that have gone public over the years. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. There is, however, a much larger pool of companies in the country that mostly remain under the radar but are equally important for the overall economic development and progress of the country. It's the vast number of SMEs, spread over the entire geography of the country. These companies also need capital to grow but mostly have to be dependent on either banks or some opaque funding route. While loans from banks could be time consuming with a lot of paperwork and collateral, other avenues charge a high rate of interest and are much riskier in nature. Vishal Devanath identified this lacuna and started his firm Smergers -- a play on the words SME and mergers -- in , and today the platform boasts of more than 70, pre-screened businesses along with investors from over countries.

Smergers review

.

Smergers has 70, pre-screened businesses along with investors from over countries. Smergers review are around 4, listed companies in India currently if one takes into account all the uhaul truck companies along with the small and medium enterprises SMEs that have gone public over the years, smergers review. Overall, there was a positive impact as entities on the buy side had cash and they did not want to keep it in the bank but invest.

.

Is smergers. Is it a scam? Scam Detector analyzed this website and its Investments sector - and we have a review. Please share your experience in the comments, whether good or bad, so we can adjust the rating if necessary. Read the review, company details, technical analysis, and more info to help you decide if this site is trustworthy or fraudulent.

Smergers review

There are around 4, listed companies in India currently if one takes into account all the large companies along with the small and medium enterprises SMEs that have gone public over the years. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. There is, however, a much larger pool of companies in the country that mostly remain under the radar but are equally important for the overall economic development and progress of the country. It's the vast number of SMEs, spread over the entire geography of the country. These companies also need capital to grow but mostly have to be dependent on either banks or some opaque funding route. While loans from banks could be time consuming with a lot of paperwork and collateral, other avenues charge a high rate of interest and are much riskier in nature.

Mickey mouse and friends tv series

Share Facebook Twitter LinkedIn. Join Our WhatsApp Channel. Follow Us on Channel. Please note that this website uses cookies for statistical and analytical purposes and for improving the user experience of the site. While loans from banks could be time consuming with a lot of paperwork and collateral, other avenues charge a high rate of interest and are much riskier in nature. Necessary cookies are absolutely essential for the website to function properly. Clear all. On the other hand, the calculator lacks many inputs that affect the valuation, so the result will be prone to error. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Education Jobs Lifestyle.

.

Follow Us on Channel. There is, however, a much larger pool of companies in the country that mostly remain under the radar but are equally important for the overall economic development and progress of the country. Powered by. These cookies will be stored in your browser only with your consent. Just please be kind and link back to Valuation. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. Non-necessary Non-necessary. Economy Corporate Markets. In absolute terms, their number would be around 14,," he says. Meanwhile, Smergers has three main sources of revenue, which includes subscription, services and success fees post a deal closure. Necessary cookies are absolutely essential for the website to function properly. We also use third-party cookies that help us analyze and understand how you use this website.

I think, that you are mistaken. I can defend the position. Write to me in PM, we will talk.

You are mistaken. Let's discuss it.