Sbi code ifsc code

You can use either of these facilities to send money across different banks, different accounts, different states and different cities. RTGS funds transfer can be used to send amounts of Rs.

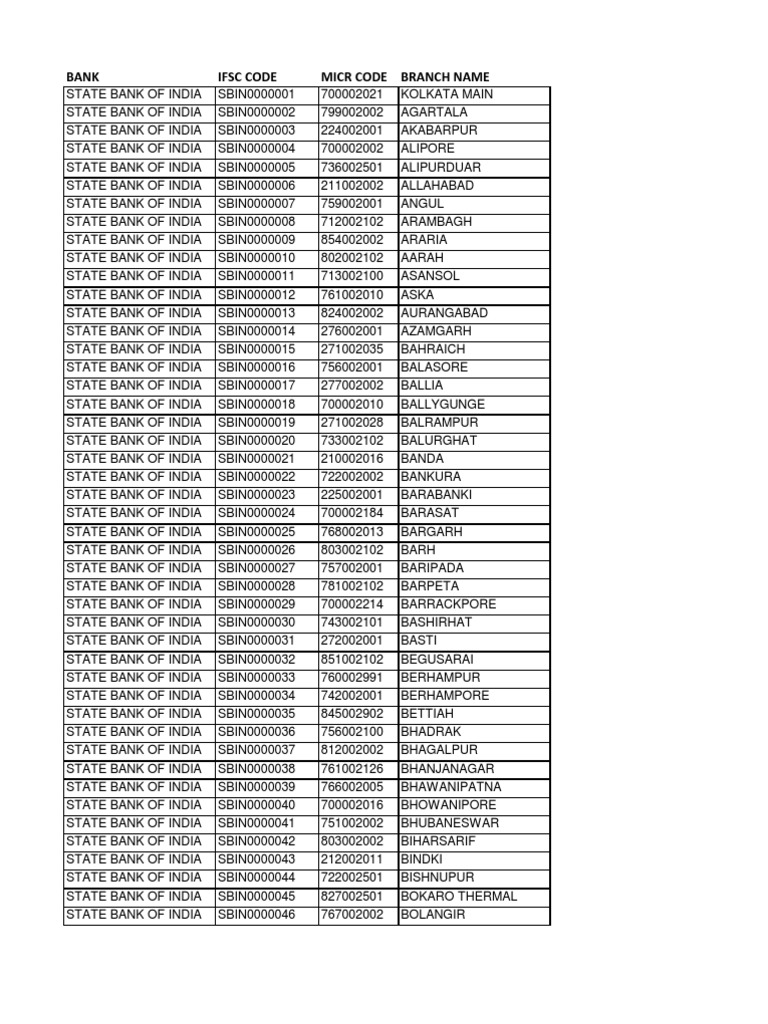

For online fund transfer, apart from the IFSC Code of SBI which is provided in this website , you need to know the Account details like number, holders name as in bank records and type typically saving or current. You can then use this information to carry out online banking. Online mode of payments can be used for transactions like premium payments, bill payments, ticket booking, donations, shopping, etc. IMPS presents an instant 24X7, electronic fund transfer. IFSC Code is an 11 character code for identifying bank branches participating in online fund transfers. This code is unique for each branch. Please NOTE that not all branches of a bank provide net banking facility.

Sbi code ifsc code

It is a digit alpha-numeric code that uniquely identifies a bank branch participating in any RBI regulated funds transfer system. The first 4 digits of the IFSC represent the bank and last 6 characters represent the branch. The 5th character is zero. The first 3 digit of the code represents the city code, the middle ones represent the bank code and last 3 represents the branch code. One can locate the MICR code at the bottom of a cheque leaf, next to the cheque number. It is also normally printed on the first page of a bank savings account passbook. MICR Code is used in the processing of cheques by machines. This code enables faster processing of cheques. One is required to mention the MICR code while filing up various financial transaction forms such as s investment forms or SIP form or forms for transfer of funds etc. A cheque number is a 6-digit number uniquely assigned to each cheque leaf. It is written on the left-hand side at the bottom of the cheque. It is advisable to check i. This is to ensure that no cheque is missing from the cheque book. Ideally, you should record the transaction you have used each cheque leaf for in the transaction record slip attached at the start or end of a cheque book.

Select Branch. Credit Report A credit report serves as a financial report card, encompassing historical data regarding an individual's loans and credit cards. ITR Forms.

.

For every transaction, you require an IFSC code. IFSC helps in carrying out fund transfer transactions electronically by sending messages to the specific branches of any particular bank. It is important for the facilitation of electronic funds transfer in India. IFSC is used by fund transferring systems to acknowledge both the branches involved in a transfer process. It makes your transactions smoother, speeding up the transferring process.

Sbi code ifsc code

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. Start typing here to immediately find your IFSC code.

S. carter shoes gucci

Recently Declined Personal Loan Application A significant number of consumers face loan application rejections from banks due to factors such as inadequate credit history, limited affordability, insufficient supporting documents, and more. Where is the MICR number on a cheque? RTGS funds transfer can be used to send amounts of Rs. Nevertheless, these terms may vary depending on the product, so it is essential to seek clarification from your lender regarding pre-payment policies before the loan disbursal. It is a government-owned corporation and is headquartered in Mumbai, Maharashtra. It is advisable to check i. Please NOTE that not all branches of a bank provide net banking facility. Share Price Bandhan Bank Ltd. A MICR number on the cheque is written at the bottom of the cheque, on the right-hand side of the cheque number. These documents include identification proof, address proof, a copy of the PAN card, salary slips, recent bank statements, photographs, ECS mandates, and post-dated cheques. A cheque number is a 6-digit number uniquely assigned to each cheque leaf. Fill up the Fund Transfer Instruction form available at the bank. Banks are financial institutions registered with the Reserve Bank of India RBI and engaged in various activities such as accepting deposits and providing loans. For online fund transfer, apart from the IFSC Code of SBI which is provided in this website , you need to know the Account details like number, holders name as in bank records and type typically saving or current.

.

Which makes it the oldest commercial bank in the Indian subcontinent. Let Others Know. As discussed earlier, the interest rates for personal loans can vary based on the customer's profile. Facebook Twitter WhatsApp. Narrow down your search for IFSC Codes either by selecting any particular state from the drop down list or by selecting the state in the table on the right side. IMPS presents an instant 24X7, electronic fund transfer. It is advisable to check i. However, specific terms and conditions are typically associated with such pre-payments. Share Price Axis Bank Ltd. You can go RTGS transfer through net banking or by walking into any of the branches.

It is good idea.

It agree, this idea is necessary just by the way