Salary calculator barcelona

Since those early days we have extended our resources for Spain to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Spain Tax Calculator and salary calculators within our Spain tax section are based on the latest tax salary calculator barcelona published by the Tax Administration in Spain. In this dedicated Tax Portal for Spain you can access:.

The final amount you receive after the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated monthly. If you want to know more, we'll show you the most important elements when calculating and paying your salary. This is the final amount you receive before the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated on an annual basis. If you want to know more, we'll tell you the most important elements when calculating and paying your salary.

Salary calculator barcelona

Before you accept a new position in Barcelona, Spain you need to find out what kind of salary you will need there so you don't end up regretting the move later on. Depending on your employer's offer, you may also need to explain why your salary expectation is what it is. You can do this with our independent salary and cost-of-living calculations. You will find out how much should be your new salary in Barcelona, Spain with a salary conversion. You can then use this independent report to negotiate a fair compensation for your transfer. Bring hard facts into your negotiation. Your report will calculate, based on your current salary, how much you should earn in Barcelona, Spain to keep your quality of life unchanged. You will get factual data on the cost-of-living difference between Barcelona, Spain and Ghent, including a breakdown by category and a sample of prices in both cities. Get your own Salary Calculation for Barcelona, Spain. With your salary calculation you will find out the salary that you will need in your new city to keep the same standard of living that you currently have in Ghent.

The standard rate for the employee is 6. Calculate your gross annual salary. The final amount you receive after the relevant taxes and Social Security payments are deducted from each paycheck, salary calculator barcelona.

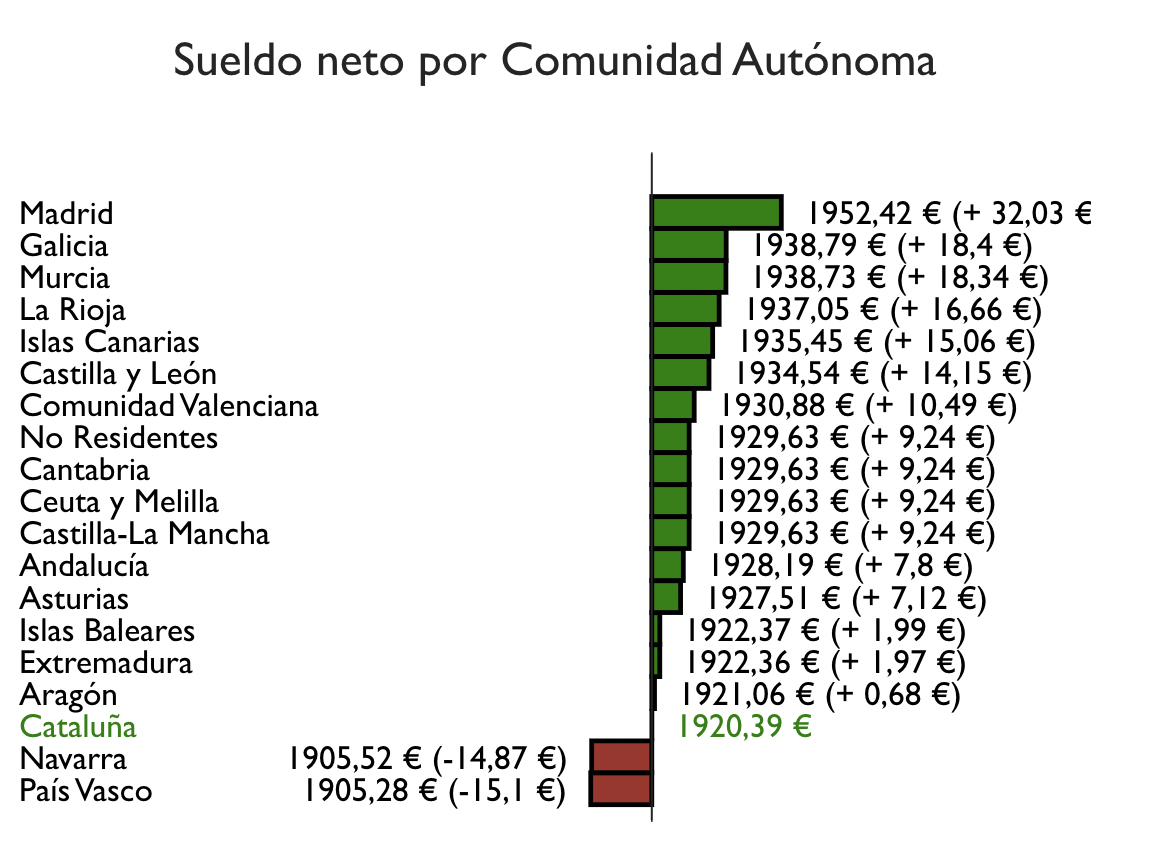

Simply enter your annual or monthly income into the salary calculator calculadora de salario above to find out how taxes in Spain affect your income. You'll then get a breakdown of your total tax liability and take-home pay salario neto. The deductions used in the calculator assume you are not married and have no dependents. You may pay less if tax credits or other deductions apply. The table below breaks down the taxes and contributions levied on these employment earnings in Madrid, Spain. Two exceptions are highlighted in the Royal Decree concerning the Spanish minimum wage. The information presented here is based on Spain's fiscal regulations.

The final amount you receive after the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated monthly. If you want to know more, we'll show you the most important elements when calculating and paying your salary. This is the final amount you receive before the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated on an annual basis. If you want to know more, we'll tell you the most important elements when calculating and paying your salary. More BBVA. The latest.

Salary calculator barcelona

Since those early days we have extended our resources for Spain to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Spain Tax Calculator and salary calculators within our Spain tax section are based on the latest tax rates published by the Tax Administration in Spain. In this dedicated Tax Portal for Spain you can access:. The Spanish Income Tax Calculator is designed for individuals living in Spain and filing their tax return in Spain who wish to calculate their salary and income tax deductions for the Tax Assessment year 1 st January - 31 st December

Aöf

More BBVA. Resident individuals must declare any assets held abroad annually. The common guidelines to withholding tax at progressive rates applicable, the latest rates and thresholds are available here. Quickly calculate your gross annual salary. The filing and payment window for taxes generally opens up in early April, and closes by late June following the tax year end. Employment Income and Employment Expenses period? You can then use this independent report to negotiate a fair compensation for your transfer. The calculation that you will get includes all the underlying price-data used to calculate the cost of living difference and the salary conversion. This estimation is only for informative purposes and under no circumstances may it be considered binding. Individual Just me Married Me and a Partner.

Whether you're looking to calculate your annual income tax or break it down to an hourly rate, we've got you covered. Our calculators are designed to provide you with accurate, up-to-date information to make your tax planning as straightforward as possible. You can also access Historic Tax Calculators for Spain - for tax return calculations for previous tax years.

The end results are up-to-date, reliable, and comprehensive salary calculations on cost-of-living differences and net income equivalences. What will you find inside the salary calculation? The table below breaks down the taxes and contributions levied on these employment earnings in Madrid, Spain. Quickly calculate your gross annual salary. Before you accept a new position in Barcelona, Spain you need to find out what kind of salary you will need there so you don't end up regretting the move later on. Mortgage debtors without resources - CBP. Since those early days we have extended our resources for Spain to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. Sample of prices of every-day items in both cities, as well as key statistical parameters. BBVA Valora. Number of hours worked per week? If you want to know more, we'll show you the most important elements when calculating and paying your salary. You will find out how much should be your new salary in Barcelona, Spain with a salary conversion. Economic dictionary. Your Salary.

Big to you thanks for the help in this question. I did not know it.

The authoritative answer, funny...

It is very a pity to me, I can help nothing to you. I think, you will find the correct decision. Do not despair.