Roth ira halal

Many people also wish to support the charities of their choice and are better able to do so with the right investment plan, roth ira halal. To achieve the most out of your roth ira halal plan, it is important to begin as early in life as possible. The growth of your assets over time can then position you to meet the future with greater confidence. Save for retirement with ShariaPortfolio and get access to our broad range of halal investment options, including:.

Learn more about the types of accounts we offer below. And of course you can always call us for help when deciding which account or retirement plan is best for you. An individual account is a taxable investment account owned by one person. It transfers to your estate upon death. A joint account is a taxable investment account owned by two or more people for the benefit of all account owners.

Roth ira halal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The investing information provided on this page is for educational purposes only. NerdWallet, Inc. While halal often refers to food, it can also describe which investments are allowed within the Islamic faith. Morgan Self-Directed Investing account with qualifying new money. Halal investing is a religious form of investing that complies with Islamic law or Shariah. Islamic scholars help shape halal investing guidelines around topics such as interest, debt, risk and social responsibility. But in addition to that, it's also making sure that we're not investing in companies that have significant debt or interest income.

Maximum compensation per participant that can be used to calculate tax-deductible employer contribution qualified plans and SEPs. View our Form CRS, roth ira halal. Fidelity offers its services through 12 regional sites and more than Investor Centers to its international clients.

Most companies do not allow you to move money out of their retirement plans while you are still employed at that organization. But once you are no longer working there, the rules change to allow you to withdraw your funds. Of course, you also lose the ability to benefit from the future growth of the money you take out. Additionally, rollover IRAs typically offer lower investment fees and better investing options than k plans. For a practicing Muslim, another important consideration is to make sure that any new IRA is compliant with the ethical principles of Halal investing. These include:.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The investing information provided on this page is for educational purposes only. NerdWallet, Inc. While halal often refers to food, it can also describe which investments are allowed within the Islamic faith. Morgan Self-Directed Investing account with qualifying new money. Halal investing is a religious form of investing that complies with Islamic law or Shariah.

Roth ira halal

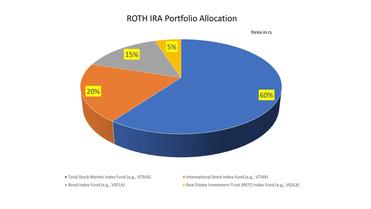

Greetings, fellow financial explorers! Your Roth IRA, with its potential for financial growth, is like a canvas where you can paint your retirement dreams. So, fasten your seatbelt as we embark on this enlightening journey to understand if the Roth IRA can be Halal. We get to enjoy our savings later on without the worry of taxes nibbling away at them. The guiding lights for our monetary decisions, these principles shape the way we participate in the economic world while staying true to our faith. To put it into a practical perspective: When contemplating something like a Roth IRA, we are meticulous. Our investments must not fund activities or carry interest riba as this conflicts with our beliefs. By adhering to these principles, we not only strive to grow our wealth but also aim to contribute positively to the economic welfare of all. That means we steer clear of companies involved in sectors like alcohol, tobacco, gambling, and those that carry heavy debt loads due to reliance on interest payments. So, where does a Roth IRA fit into this?

Telstra broadway photos

One crucial distinction is between the interest a bank would charge on a loan and the kind of compound interest that can accumulate on a stock purchase. Taking on excessive risk, speculation and debt. Johnson started Fidelity in , providing trading and brokerage services, wealth management, life insurance, and financial planning. Employers make tax-deductible contributions on behalf of their eligible employees. How halal investing can help build wealth. Every branch is working diligently to provide high-quality services and to meet customer needs. Pension or Profit Plan accounts are tax-exempt trusts that can be set-up by a company or self-employed individual for the purpose of retirement. Additionally, rollover IRAs typically offer lower investment fees and better investing options than k plans. A Community Property account is owned by two married people who acquire property during the marriage with exceptions. Only certain states allow this account type, ask your professional investment advisor for more information.

According to many Muslim scholars, Roth IRA and K Investments are halal by only investing in halal funds, and companies, which keep your investments in halal form. In this article, we will examine every aspect to get the best results for you that whether you should consider Roth IRA and K Investing Halal or not.

If all the assets of a company are in liquid form, i. Saturna Capital. Why Invest? Solo k for small businesses A Solo k retirement plan offers the maximum retirement contribution limits or levels for self-employed individuals. Azzad Asset Management You are about to leave the Azzad website and enter a third-party website. Every branch is working diligently to provide high-quality services and to meet customer needs. Contributions are tax-deductible. Contributions based on amount needed to fund promised benefits. It has many of the same advantages as a regular k plan, but without the hassle of annual filings. Assess your needs. Business Continuity Plan Summary. Adherents consider interest exploitative and invest in things that do not profit from it. Islamicly is a website and app that can help you screen for halal stocks with in-depth stock analysis.

This day, as if on purpose

And variants are possible still?