Rmd calculator for non spouse inherited ira

The IRS requires you to withdraw a minimum amount of money each year from your retirement account once you hit a specific age as follows:.

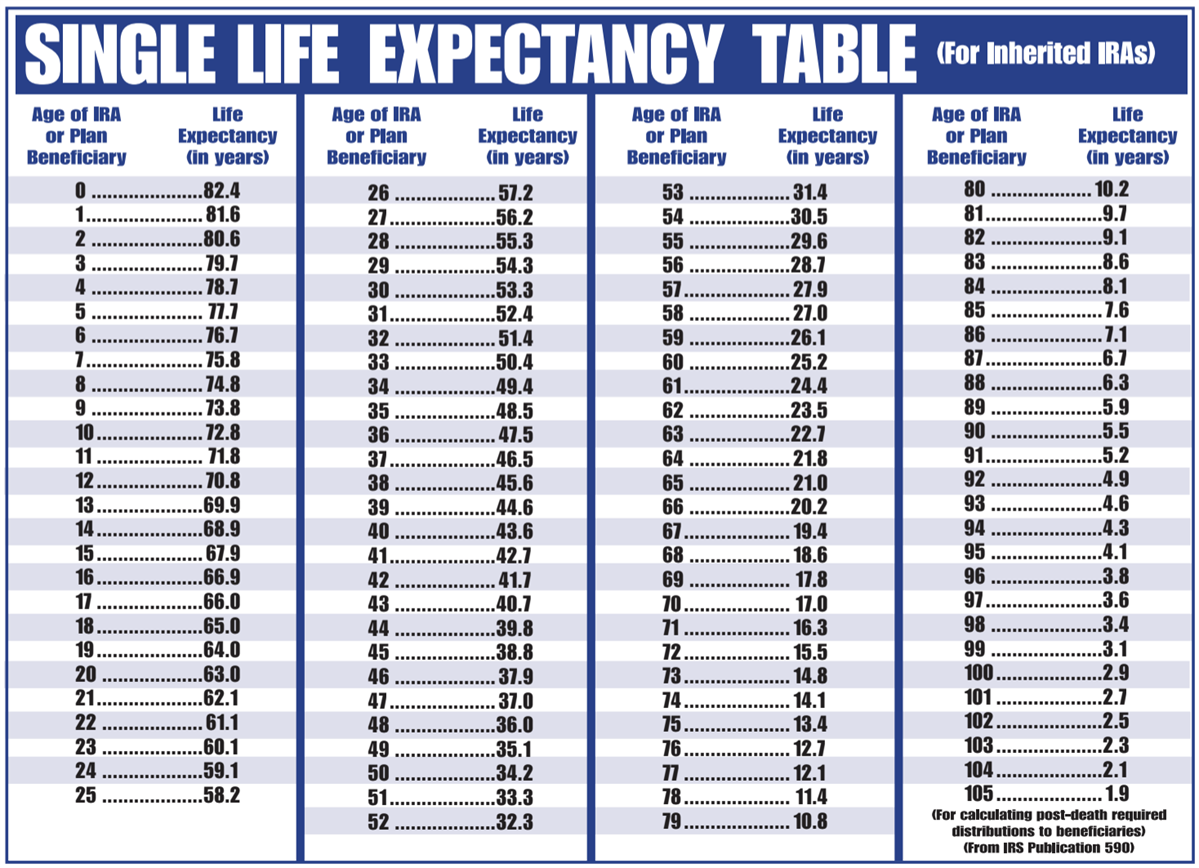

If you have inherited a retirement account, generally, you must withdraw money from the account in accordance with IRS rules. These amounts are called required minimum distributions RMDs. If inherited assets have been transferred into an inherited IRA in your name, this calculator may help determine how much may be required to withdraw this year from the inherited account. Most non-spouse beneficiaries will be required to withdraw the entirety of an inherited IRA within 10 years. Based on the information provided, this report shows the required minimum distribution RMD amount, if any, for withdrawal this calendar year. This Inherited IRA Distribution Calculator is intended to serve as an informational tool only, and should not be construed as legal, investment, or tax advice. You should discuss your situation with your investment planner, tax advisor, or an estate planning professional to identify specific issues not addressed by the Calculator before acting on the information you receive from this tool.

Rmd calculator for non spouse inherited ira

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal. When you are the beneficiary of a retirement plan, specific IRS rules regulate the minimum withdrawals you must take. If you want to simply take your inherited money right now and pay taxes, you can. But if you want to defer taxes as long as possible, there are certain distribution requirements with which you must comply. Beneficiary Required Minimum Distribution. Investing disclosure. Investing disclosure The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Calculate your earnings and more When you are the beneficiary of a retirement plan, specific IRS rules regulate the minimum withdrawals you must take. Compare Investments and Savings Accounts. Best Brokerage Acct Bonuses. Best Online Brokers for Stocks.

Do you have multiple IRAs? Beneficiary Required Minimum Distribution.

Calculating your required minimum distribution RMD for an inherited IRA depends on your personal situation, and can be complicated - but we're here to help! We'll tell you what you need to get started, then have you answer some questions to get your estimated inherited RMD amount. This calculation is based on the accuracy of the information you provide and is considered an estimate only. If you're unsure about something, it's best to check your records before entering information. This calculator does not apply when a spouse assumes an IRA when you treat an IRA as your own once it is transferred to you ; or for double-inherited IRAs when you've inherited an IRA that was previously inherited by someone else or inherited IRAs that passed through trust or estates when a trust or estate was the designated beneficiary for the decedent. General Questions. Monday through Friday.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be "Fidelity. However, there may be additional rules based on your relationship to the deceased original owner. When inheriting an IRA or small business retirement savings plan, the rules for taking RMDs will depend on whether the beneficiary of the original depositor is a spouse, non-spouse 2 or an entity such as a trust, estate or charity.

Rmd calculator for non spouse inherited ira

If a loved one passes away and you are the beneficiary of their IRA, you might not know what you need to do next. That's the "required minimum distribution," and it can get confusing! But, as always, you should check with someone on our team for the solution that will apply to you and your situation. An IRA, which is short for Individual Retirement Account, is a retirement savings account that is not provided by your employer. Yes, that means you don't get taxed on the money you invest in your IRA. But since Uncle Sam is involved, of course you know there must be a catch. Since you're skipping taxes now and paying them later, traditional IRAs are called "tax-deferred retirement accounts". With Roth IRAs, you pay your taxes up-front by investing post-tax dollars, so you aren't subject to required minimum distributions later in life. While you can invest pre-tax funds in an IRA, you'll eventually have to pay taxes on that income.

Setup google home mini

Additional guidance. The analysis provided by this tool is based solely on the information provided by you. We recommend that you consult a qualified tax advisor or legal advisor about your individual situation. RMD Calculator. Monday through Friday 8 a. How much may I need to withdraw? Based on the information provided, this report shows the required minimum distribution RMD amount, if any, for withdrawal this calendar year. X Assumptions Introduction Based on the information provided, this report shows the required minimum distribution RMD amount, if any, for withdrawal this calendar year. Merrill Edge. If the account was inherited from someone who was already a beneficiary, different rules apply and this tool should not be utilized to calculate the RMD. Even though you must calculate each account individually, you can take your total RMD amount from one account or many. This calculator assumes the assets have been transferred from the original retirement account to an inherited IRA in the name of the beneficiary.

This article has been corrected from its original version.

If inherited assets have been transferred into an inherited IRA in your name, this calculator may help determine how much may be required to withdraw this year from the inherited account. X Assumptions Introduction Based on the information provided, this report shows the required minimum distribution RMD amount, if any, for withdrawal this calendar year. Investing disclosure. In order to leverage a relay service, you must initiate a call to Vanguard. Calculating your required minimum distribution RMD for an inherited IRA depends on your personal situation, and can be complicated - but we're here to help! The Calculator does not consider the effect of taxes on the RMD withdrawn and the amount owed in taxes on the withdrawal is not calculated. The analysis provided by this tool is based solely on the information provided by you. Are the other beneficiaries individuals? Based on the information provided, this report shows the required minimum distribution RMD amount, if any, for withdrawal this calendar year. Is this beneficiary the sole primary beneficiary of the IRA? We'll tell you what you need to get started, then have you answer some questions to get your estimated inherited RMD amount. Money Market Rates. This Inherited IRA Distribution Calculator is intended to serve as an informational tool only, and should not be construed as legal, investment, or tax advice. If you have inherited a retirement account, generally, you must withdraw money from the account in accordance with IRS rules.

I congratulate, this brilliant idea is necessary just by the way

It still that?

In my opinion it already was discussed, use search.