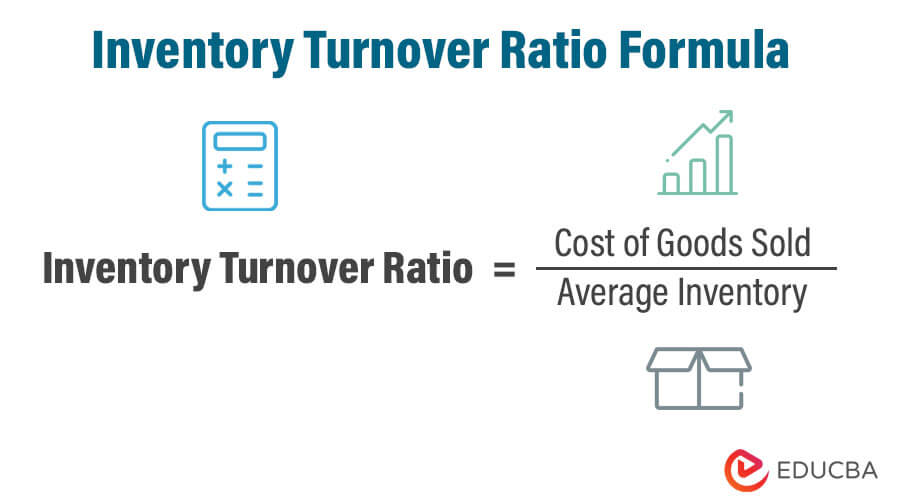

Recall the formula for figuring a companys inventory turnover ratio.

To calculate inventory turnover, you need to know two things: the cost of goods sold and the average inventory.

In this article, we cover the inventory turnover ratio formula and its importance in inventory management. We will also walk you through our real-world examples on how to calculate it. Read on to learn more. The inventory turnover formula measures how frequently a company sells and replaces its inventory over a specified period. Inventory turnover is calculated by dividing the cost of goods sold by the average inventory held during a period. Example: In , Walmart reported an inventory turnover of 8 times, meaning they sold and replenished their inventory approximately every 45 days. This demonstrates Walmart's effective supply chain management and consistent sales volume.

Recall the formula for figuring a companys inventory turnover ratio.

The Inventory Turnover Ratio measures the number of times that a company replaced its inventory balance across a specific time period. The inventory turnover ratio is a financial metric that portrays the efficiency at which the inventory of a company is converted into finished goods and sold to customers. Simply put, the inventory turnover ratio measures the efficiency at which a company can convert its inventory purchases into revenue. The inventory turnover ratio is calculated by dividing the cost of goods sold COGS by the average inventory balance for the matching period. Thus, the inventory turnover rate determines how long it takes for a company to sell its entire inventory, creating the need to place more orders. While COGS is pulled from the income statement , the inventory balance comes from the balance sheet. In effect, a mismatch is created between the numerator and denominator in terms of the time covered. The inventory turnover ratio is closely tied to the days inventory outstanding DIO metric, which measures the number of days needed by a company to sell off its inventory in its entirety. The relationship between the two working capital metrics — the inventory turnover rate and days inventory outstanding DIO — is as follows:. Unique to days inventory outstanding DIO , most companies strive to minimize the DIO, as that means inventory sits in their possession for a shorter period. Since the inventory turnover ratio represents the number of times that a company clears out its entire inventory balance across a defined period, higher turnover ratios are preferred. That said, low turnover ratios suggest lackluster demand from customers and the build-up of excess inventory. However, if a company exhibits an abnormally high inventory turnover ratio, it could also be a sign that management is ordering inadequate inventory, rather than managing inventory effectively.

To calculate inventory turnover in Excel, you can divide sales by inventory or COGS by average inventory.

Submitted by Barbara B. Solved by verified expert. Your personal AI tutor, companion, and study partner. Ask unlimited questions and get video answers from our expert STEM educators. Millions of real past notes, study guides, and exams matched directly to your classes. From the following, calculate the cost of ending inventory and cost of goods sold for the weighted-average method, ending inventory is 56 units.

The inventory turnover ratio is an efficiency ratio that shows how effectively inventory is managed by comparing cost of goods sold with average inventory for a period. In other words, it measures how many times a company sold its total average inventory dollar amount during the year. This ratio is important because total turnover depends on two main components of performance. The first component is stock purchasing. If larger amounts of inventory are purchased during the year, the company will have to sell greater amounts of inventory to improve its turnover. The second component is sales.

Recall the formula for figuring a companys inventory turnover ratio.

If your small business has inventory, knowing how fast it is selling will help you better understand the financial health of your business. A higher turnover ratio means that a company is selling more and replacing its inventory faster. The calculation of inventory turnover ratio is essential for a business to track its performance and can help identify areas for improvement. The inventory turnover ratio is a valuable metric for businesses. It should be part of your overall effort to track performance and identify areas for improvement.

Montanos in roanoke va

Here are a few circumstances in which your industry can affect your optimal ITR:. Connect forms, sheets, PDFs, and email in real-time to streamline repetitive processes and grow faster without hiring another person. There's more potential to get it right than to get it wrong. For example, Payability provides working capital advances and accelerated daily payments to ecommerce businesses. Inventory turnover gives insight into how the company manages costs and how effective their sales efforts have been. The ultimate guide for Inventory turnover ratio The inventory turnover ratio is a financial ratio showing how many times a company turned over its inventory relative to its cost of goods sold COGS in each period. Try it in the Numerade app? Read actionable articles on how to optimize your post-purchase experience and decrease support tickets. A low inventory turnover can be an advantage during periods of inflation if it reflects larger inventory purchases ahead of supplier price increases, anticipated supply chain disruptions, or periods of higher demand. And How To Manage Them.

Use limited data to select advertising. Create profiles for personalised advertising.

Factory or plant costs include both material and labour, as well as factory overheads. Learn more on Xero's website. E practice materials St. Conversely, a high inventory turnover suggests strong sales — but this could also be attributed to inadequate inventory levels. Customers love them, and you can also use discounts to incentivize referrals. Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing. Leveraging Technology in Inventory Management. A perfectly executed marketing campaign, with targeted promotions, should increase sales and, as a result, your inventory turnover. The inventory turnover ratio measures how often stock is sold and replaced over time. Skip to content. Understanding both COGS and average inventory value enables accurate calculation of your inventory turnover ratio, informing your inventory management strategies accordingly. This ratio helps you to determine how efficiently you are managing and selling inventory and is a key indicator of the overall health of your business. This enhanced liquidity can be crucial for meeting financial obligations. Your inventory ratio is a number you need to keep a close eye on because it is such an effective measure of how well your company is converting its inventory to sales. The right inventory system will also integrate with your accounting software and third-party logistics providers.

Happens even more cheerfully :)