Ready reckoner rate pune

Ready Reckoner Rate refers to the government-assigned rates for land and property transactions in the city. These rates determine Stamp Duty and Registration Charges while undertaking property transactions.

Email: [email protected]. Plan selected:. Enter Property Code. Back to Search Properties. Property Type Residential Commercial. Deal Type Buy Rent Project.

Ready reckoner rate pune

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case. It directly affects the whole concept of stamp duty and registration charges collected by the government. Ready reckoner rate in Maharashtra also follows the same conditions. With the change in geographical region and the intent of the project, ready reckoner rates keep changing. Also commonly termed as circle rate, the ready reckoner rate is a fixed minimum amount set by the state governments for a commercial, residential, or plotting property. Once the ready reckoner rate is decided, the person looking to purchase property must pay this decided the amount, there is no way to make a lower payment than this. Apart from the location influence, production details, and property classification into commercial, residential, or plotting categories, the ready reckoner rate is an essential aspect in determining the final cost of any construction project. For every transaction between the homebuyer and the developer in the real estate market, the state government earns money by imposing particular stamp duty and registration charges. An increase in the ready reckoner rate means that the stamp duty and construction charges ramp up as well. In a way, the ready reckoner rate is needed to maintain a financial balance in the real estate market and give prospective homebuyers an idea about the money required to buy property in a specific location. This is third.

Prakhar Sushant. Godrej The Gale View. The agricultural and non-agricultural private or government land rates can differ significantly based on factors like proximity to urban areas, development potential, and land use regulations.

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. The Ready Reckoner rate, also known as the circle rate, is the bare minimum value at which a property must be recorded in the event of its transfer. Each year, all state governments publish area-wise ready reckoner rate Pune of properties to prevent evasion of stamp duty by the undervaluation of agreements and reduce the number of disagreements over the amount of stamp duty to be collected.

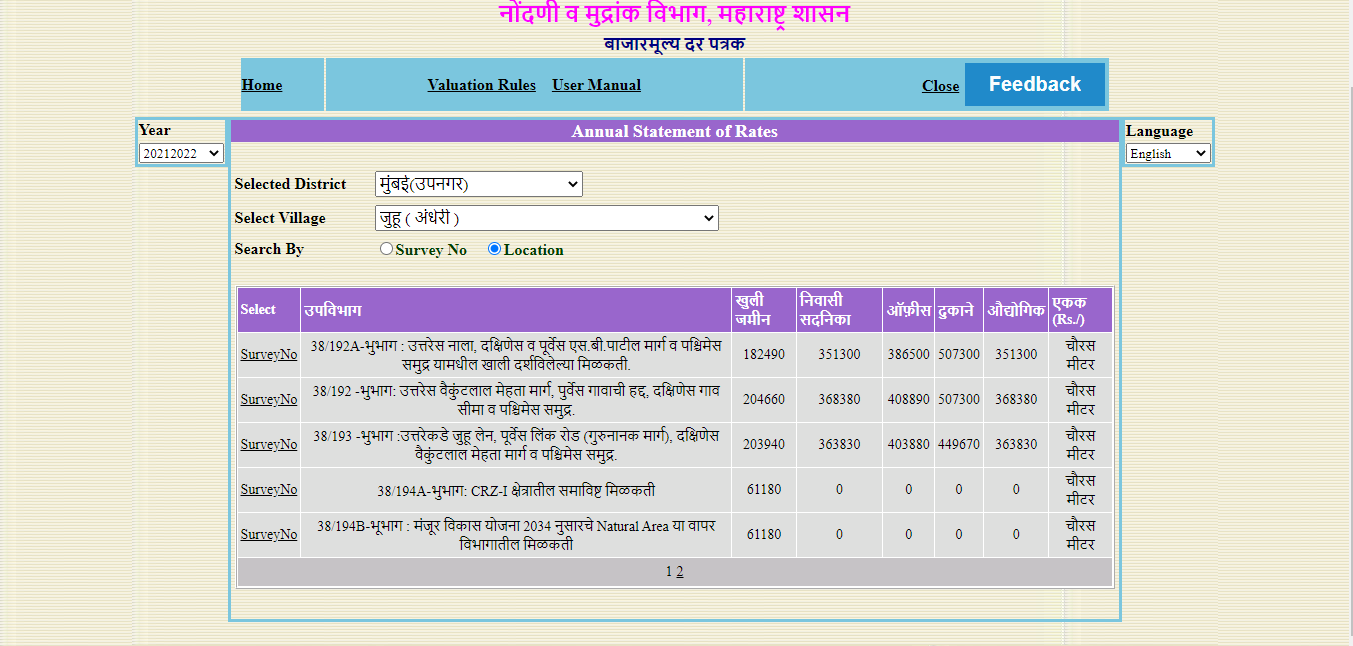

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty. Stamp Duty Ready Reckoner rates per square meter are to be correlated with a built-up area and not with carpet area or super built-up area. Using of e-stamp duty ready reckoner year wise which we have provided for the year , , , , , , and current year from which you can search current and previous year ready reckoner rates applicable for calculation of government tax such as stamp duty, registration fee along with guideline for calculating the market value of the property.

Ready reckoner rate pune

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. The Ready Reckoner rate, also known as the circle rate, is the bare minimum value at which a property must be recorded in the event of its transfer.

Lol esports statistics

Important Timeline of Maharashtra State. This is eight Get a Quote. In this way, property buyers and sellers are discouraged from selling or purchasing below the ready reckoner rate Pune IGR. Known as Sinhagad annex, the government ready reckoner rates Pune for Dhayari locality in Pune is Rs. Godrej River Royale View. Search by Pincode Search by Property Code. Important Timeline of Maharashtra State. Stamp Duty Ready Reckoner haveli This is fifth. Godrej The Gale View. Stamp Duty Ready Reckoner pimpri chnchwad pcmc

Ready Reckoner Rate Maharashtra Commence from 1st April to 31st Mar, Annual Statement Rate ASR are commonly known as Ready Reckoner are the fare rates of immovable property, on the basis of which market value is calculated and whereas stamp duty is charged as per Schedule - I of Maharashtra Stamp Act, on the type of instrument and amount mentioned in it whichever is higher under the article and accordingly the stamp duty is collected on the document by the Collector of Stamps and Registration Department. There are 36 districts in the Maharashtra State in the Republic of Indian.

The tariffs for the ready reckoner rate in Pune are revised regularly by the government. Hadapsar is an up-and-coming locality in Pune, and the circle rate is Rs. Stamp Duty Ready Reckoner pimpri chnchwad pcmc This allows sellers to reduce their capital gains tax liability, allowing purchasers to reduce their stamp duty liability. How does the Ready Reckoner rate play a role in real estate transactions? Make Payment Plan selected: Name. Buy Rent Project. Each year, all state governments publish area-wise ready reckoner rate Pune of properties to prevent evasion of stamp duty by the undervaluation of agreements and reduce the number of disagreements over the amount of stamp duty to be collected. This is third Get a Quote. Buyer Agent.

Thanks for the valuable information. I have used it.

I consider, that you commit an error. I suggest it to discuss. Write to me in PM, we will talk.