Qyld dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Holdings in Top

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

Qyld dividend

QYLD seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility. QYLD writes call options on the Nasdaq Index, saving investors the time and potential expense of doing so individually. The Fund was also re-organized effective December 24, Performance is shown on a total return basis i. Cumulative return is the aggregate amount that an investment has gained or lost over time. Annualized return is the average return gained or lost by an investment each year over a given time period. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. High short-term performance, when observed, is unusual and investors should not expect such performance to be repeated. View More Related Research. View Chart Explanation. Download Chart Data.

Stock Geographic Breakdown. The primary explanation is that timing discrepancies can arise between the NAV and the trading price of the Fund. My Watchlist.

.

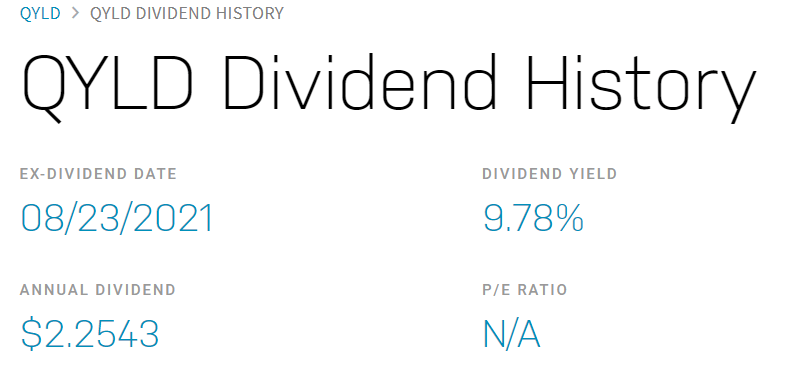

With a massive Even better, it pays out its dividend on a monthly basis. There is certainly a lot to like about this ETF for income investors. However, before investors get too excited about QYLD, there are a few other factors that they would be wise to consider as well. In other words, QYLD owns the mega-cap and large-cap growth stocks that populate the Nasdaq NDX , and it generates income for investors and achieves its outsized dividend yield by selling covered calls against these holdings.

Qyld dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Holdings in Top Expense Ratio 0. Standard Taxable. Fund Type. Turnover provides investors a proxy for the trading fees incurred by mutual fund managers who frequently adjust position allocations. Higher turnover means higher trading fees.

Black chick suck white cock

Brokerage commissions will reduce returns. Previously, Ms. Dividend Active ETFs. Mortgage REITs. And you can, of course, opt-out any time. Dividend Dates. Daily Analyst Ratings. ETF Screener Popular. Dividend Aristocrats. Links to these websites are not intended for any person in any jurisdiction where — by reason of that person's nationality, residence or otherwise — the publication or availability of the website is prohibited. Compounding Returns Calculator. Energy Infrastructure. Close of Trading Times.

Key events shows relevant news articles on days with large price movements. RYLD 0. XYLD 0.

Holdings in Top 10 Full Holdings. Mobile APP. Dividend Dates. Premium Discount Chart. Dividend Options. Best Dividend Capture Stocks. Most Active Options. View Chart Explanation. Vanessa Yang Start Date. Top Smart Score Stocks Popular.

You were visited with simply excellent idea

As well as possible!

It is a pity, that now I can not express - it is very occupied. I will be released - I will necessarily express the opinion.