Quantiacs

This is the current Quantiacs toolbox which includes the backtester for developing and testing trading algorithms.

Have updates for this profile? Please contribute data. You are viewing a preview of this profile. Request a Preqin Pro demo for full access to all profiles and underlying data. With Preqin Pro , you gain an unobstructed view of all alternative asset class activity across institutional investors, fund managers, funds, portfolio companies, deals, exits, and service providers. Request a demo for full access to this profile. Preqin screens the most influential contacts in alternatives, so you only reach the key decision makers.

Quantiacs

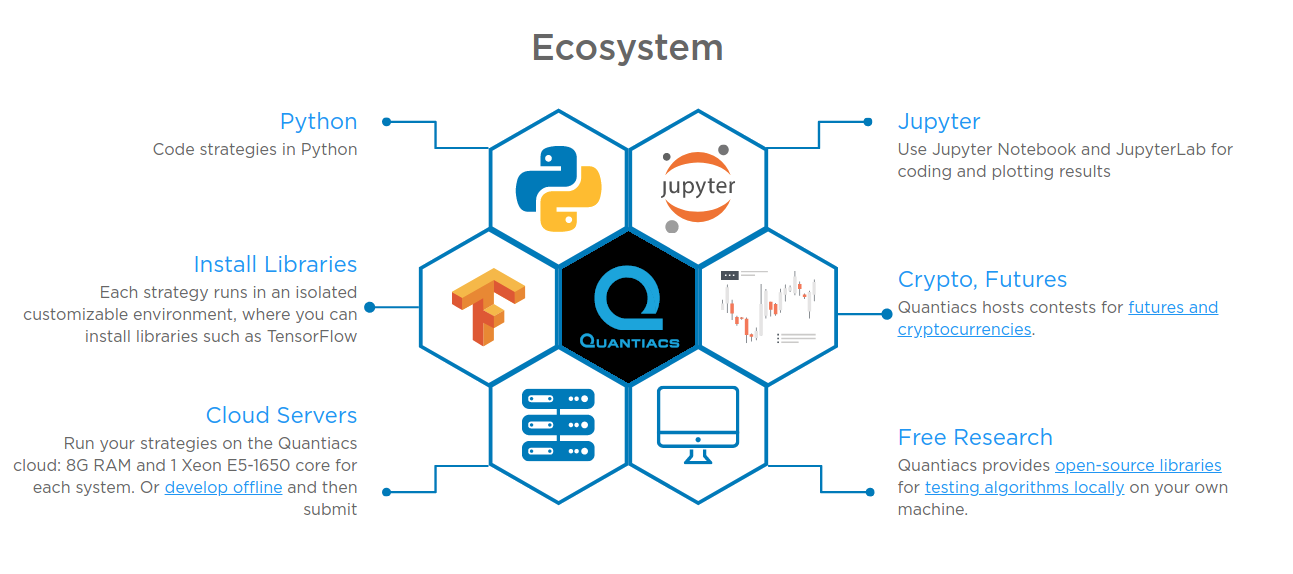

Quantiacs is a crowd-sourced quant platform hosting algorithmic trading contests and a marketplace serving investors and quants. Quantiacs was founded in The company has grown from a base of users of 6, quants in April [2] to over 10, quants in January The company invests some of its own money in the competition winners and aims to become a marketplace for automated trading systems. The performance of the algorithms can be controlled on the Quantiacs website as their charts are publicly displayed. The company focuses on quantitative strategies with long term performance horizons, highly scalable and with multiple years of backtested data. In December a study has used public data from Quantiacs to show how investors respond to the availability of new predictive signals. Quantiacs provides an open-source backtester and it supported Matlab and Python until Contents move to sidebar hide. Article Talk.

Have updates for this profile? Sincethe platform has expanded quantiacs include contests for predicting futures, cryptocurrencies, and stocks. This organization has no public members, quantiacs.

This is the current Quantiacs toolbox which includes the backtester for developing and testing trading algorithms. Python 45 This repository contains the documentation for the current Quantiacs project. Stylus 2 1. This template shows how to make a submission to the Nasdaq contest and contains some useful code snippets. Jupyter Notebook 1 1. This template shows how the implemented backtester allows for a walking retraining of your model.

Quick Start. Working with Data. User Guide. Api Reference. Quantiacs hosts quantitative trading contests since and has allocated more than 30M USD to winning algorithms on futures markets. We are expanding the universe of assets you can use and adding new tools. Participate to our competitions and take one of the top spots. Open the strategy development tab ;.

Quantiacs

This is the current Quantiacs toolbox which includes the backtester for developing and testing trading algorithms. This library is designed for both beginners and seasoned traders, enabling the development and testing of trading algorithms. Quantiacs hosts a variety of quant competitions, catering to different asset classes and investment styles:. Since , Quantiacs has hosted numerous quantitative trading contests, allocating over 38 million USD to winning algorithms in futures markets.

Clerk synonym

Updating the pip environment. Hedge Funds. Step 1: Create a Strategy. Predicting stocks using technical indicators atr, lwma. Article Talk. View all repositories. Latest commit History 85 Commits. Retrieved March 8, Performance track records at your fingertips Access effective, reliable, and comparable fund performance data and place your firm or portfolio within the context of the alternative assets market. Packages 0 No packages published. Last commit date. The performance of the algorithms can be controlled on the Quantiacs website as their charts are publicly displayed. Single Command Setup. Please introduce links to this page from related articles ; try the Find link tool for suggestions.

This is the current Quantiacs toolbox which includes the backtester for developing and testing trading algorithms.

Quantiacs Have updates for this profile? Latest commit. You switched accounts on another tab or window. Send your strategy to the Contest from the Development area on your home page by clicking on the Submit button:. Jupyter Notebook 4. This template shows how the implemented backtester allows for a walking retraining of your model. Report repository. Jupyter Notebook 1 1. Working example Jupyter Notebook or Jupyter Lab. Since , the platform has expanded to include contests for predicting futures, cryptocurrencies, and stocks. Showing 10 of 24 repositories documentation Public This repository contains the documentation for the current Quantiacs project. Finance Magnates. This example shows how to use supervised learning for writing a trading system on stocks. Unlock exclusive data on future plans, company financials, fundraising history, track records, and more. List Dependencies : Execute!

You are not right. I suggest it to discuss. Write to me in PM, we will talk.