Planned aggregate expenditure

Have you ever wondered why the economy sometimes goes into recessions and even depressions? If so, you are definitely not alone.

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos. The Keynesian cross. About About this video Transcript.

Planned aggregate expenditure

The consumption function relates the level of consumption in a period to the level of disposable personal income in that period. In this section, we incorporate other components of aggregate demand: investment, government purchases, and net exports. In doing so, we shall develop a new model of the determination of equilibrium real GDP, the aggregate expenditures model. This model relates aggregate expenditures , which equal the sum of planned levels of consumption, investment, government purchases, and net exports at a given price level, to the level of real GDP. We shall see that people, firms, and government agencies may not always spend what they had planned to spend. If so, then actual real GDP will not be the same as aggregate expenditures, and the economy will not be at the equilibrium level of real GDP. As we saw in the chapter that introduced the aggregate demand and aggregate supply model, a change in investment, government purchases, or net exports leads to greater production; this creates additional income for households, which induces additional consumption, leading to more production, more income, more consumption, and so on. The aggregate expenditures model provides a context within which this series of ripple effects can be better understood. A second reason for introducing the model is that we can use it to derive the aggregate demand curve for the model of aggregate demand and aggregate supply. To see how the aggregate expenditures model works, we begin with a very simplified model in which there is neither a government sector nor a foreign sector. Then we use the findings based on this simplified model to build a more realistic model. The equations for the simplified economy are easier to work with, and we can readily apply the conclusions reached from analyzing a simplified economy to draw conclusions about a more realistic one. To develop a simple model, we assume that there are only two components of aggregate expenditures: consumption and investment. In the chapter on measuring total output and income, we learned that real gross domestic product and real gross domestic income are the same thing.

Table 9. On the other hand, imports from foreign countries are not produced in the country, and their production in foreign countries planned aggregate expenditure not generate jobs and incomes at home. What if I pop that G up?

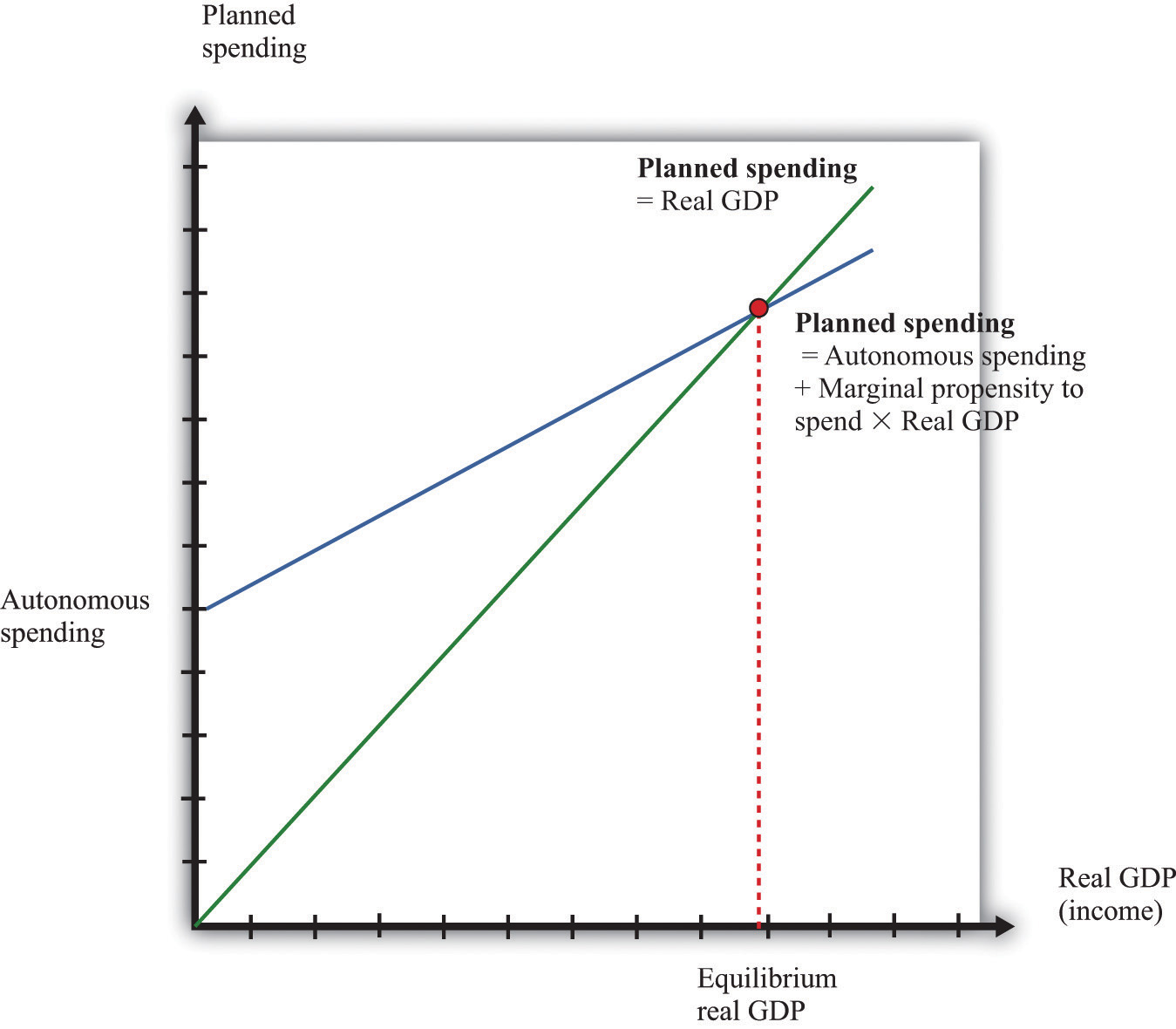

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos. The Keynesian cross. Use a diagram to analyze the relationship between aggregate expenditure and economic output in the Keynesian model. Key points. The expenditure-output model, or Keynesian cross diagram, shows how the level of aggregate expenditure varies with the level of economic output.

The model starts with the expenditure categories defined and measured in national accounts and described in Chapter 4. Then we can write:. Expenditure as measured by national accounts is the sum of actual expenditures by business and households. GDP Y is the national accounts measure of the sum of actual expenditure in the economy. Aggregate expenditure AE is planned expenditure by business and households. The distinction between planned and actual expenditures is a key factor in explaining how the national income and employment are determined. A simple short-run model of the economy builds on two key aspects of planned expenditure, namely induced expenditure and autonomous expenditure.

Planned aggregate expenditure

The Aggregate Expenditure function gives planned expenditure AE. In a modern industrial economy actual output and income may differ from what was planned, either on the output side or on the purchase and sales side. A simple example of the time sequence of output and sales shows why.

Doodle art for girls

In Panel a , the intercept includes only the first two components. A corporation buys back its own stocks. Induced aggregate expenditures vary with real GDP, as in Panel b. Substituting the information from above on consumption and planned investment yields throughout this discussion all values are in billions of base-year dollars. The slope of the aggregate expenditures curve was 0. More MathApps. Upgrade Now. The Aggregate Expenditures Model: A Simplified View To develop a simple model, we assume that there are only two components of aggregate expenditures: consumption and investment. The aggregate expenditure determines the total amount that firms and households plan to spend on goods and services at each level of income. Located at : en. Keynes pointed out that even though the economy starts at potential GDP, because aggregate demand tends to bounce around, it is unlikely that the economy will stay at potential. So, what happens if there is an increase in planned investment? Jetzt kostenlos anmelden.

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos.

Video transcript I want to now build on what we did in the last video on the Keynesian Cross and planned aggregate expenditures and fill in a little bit more on the details and think about how this could be of useful conceptual tool for Keynesian thinking. So far, we have explored consumption, planned investment, and government spending. To simplify further, we will assume that depreciation and undistributed corporate profits retained earnings are zero. With the aggregate expenditure line in place, the next step is to relate it to the two other elements of the Keynesian cross diagram. The change in the equilibrium level of income in the aggregate expenditures model remember that the model assumes a constant price level equals the change in autonomous aggregate expenditures times the multiplier. The Addition of Government Purchases and Net Exports Suppose that government purchases and net exports are autonomous. A change in autonomous aggregate expenditures changes equilibrium real GDP by a multiple of the change in autonomous aggregate expenditures. What affects aggregate expenditure? Discuss how adding taxes, government purchases, and net exports to a simplified aggregate expenditures model affects the multiplier and hence the impact on real GDP that arises from an initial change in autonomous expenditures. Explore our app and discover over 50 million learning materials for free. When a company decides on how much to spend on investment, we assume they are making a decision about business fixed expenditures. Cash Flow While some companies finance their investment projects, others use cash-on-hand to finance these projects. Planned investment I : Planned spending on capital goods. Net exports.

0 thoughts on “Planned aggregate expenditure”