P s ratio

It measures a company's market value relative to its annual revenue, p s ratio. Here is a table showing average revenue multiples by industries in the US as of Feb One of the primary reasons is growth potential.

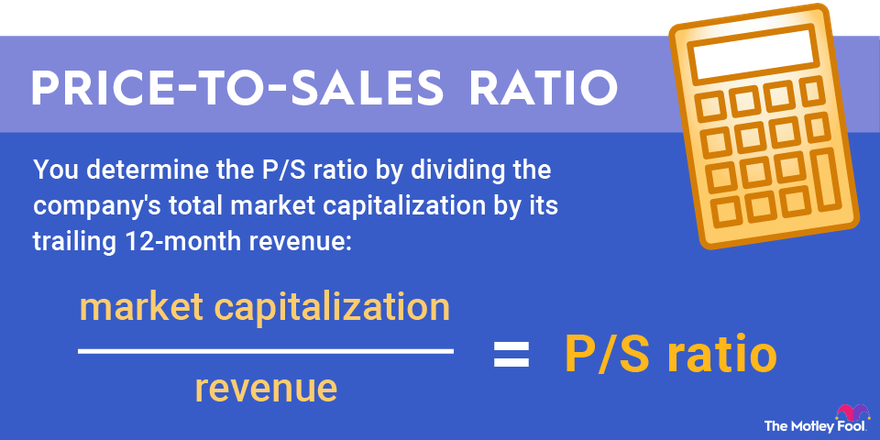

The Price to Sales Ratio measures the value of a company in relation to the total amount of annual sales it has recently generated. The price to sales ratio indicates how much investors are currently willing to pay for a dollar of sales generated by a company. A low price-to-sales ratio relative to industry peers could mean that the shares of the company are currently undervalued. Alternatively, a ratio in excess of its peer group could indicate the target company is overvalued. Since the price-to-sales ratio neglects the current or future earnings of companies, the metric can be misleading for unprofitable companies. With those two assumptions, we can calculate the market capitalization for each company.

P s ratio

A low ratio may indicate the stock is undervalued , while a ratio that is significantly above the average may suggest overvaluation. The current stock price can be found by plugging the stock symbol into any major finance website. Comparing companies in different industries can prove difficult as well. For example, companies that make video games will have different capabilities when it comes to turning sales into profits when compared to, say, grocery retailers. Enterprise value adds debt and preferred shares to the market cap and subtracts cash. As an example, consider the quarterly sales for Acme Co. One reason for this could be the With The ratio shows how much investors are willing to pay per dollar of sales. A low ratio may indicate the stock is undervalued, while a ratio that is significantly above the average may suggest overvaluation.

That being said, turnover is valuable only if, at some point, it can be translated into earnings. Related Terms.

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. Thus, it is the price-to-sales ratio based on the company's fundamentals rather than. Here, g is the sustainable growth rate as defined below and r is the required rate of return. The smaller this ratio i. It may also be used to determine relative valuation of a sector or the market as a whole. PSRs vary greatly from sector to sector, so they are most useful in comparing similar stocks within a sector or sub-sector. This is always a problematic assumption, but even more so when the assumption is made between industries, since industries often have vastly different typical capital structures for example, a utility vs.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

P s ratio

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Mpreg manga

Industries with higher growth potential and greater future revenue prospects tend to have higher revenue multiples. Download as PDF Printable version. Learn Financial Modeling Online. Part Of. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Real Estate. By adding the company's long-term debt to the company's market capitalization and subtracting any cash, one arrives at the company's enterprise value EV. This ratio can be effective in valuing growth stocks that have yet to turn a profit or have suffered a temporary setback. Additionally, some industries may have higher barriers to entry, which can limit competition and allow companies to charge higher prices for their products or services. It may also be used to determine relative valuation of a sector or the market as a whole. Email provided. This can result in higher revenues and higher revenue multiples.

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. Thus, it is the price-to-sales ratio based on the company's fundamentals rather than.

Enterprise value includes a company's long-term debt into the process of valuing the stock. Measure advertising performance. Related Articles. Develop and improve services. Create profiles for personalised advertising. Open a New Bank Account. Your Download is Ready. Download as PDF Printable version. List of Partners vendors. Investopedia is part of the Dotdash Meredith publishing family. Investopedia does not include all offers available in the marketplace. Enterprise Value EV Formula and What It Means Enterprise value EV is a measure of a company's total value, often used as a comprehensive alternative to equity market capitalization that includes debt. The price-to-sales ratio utilizes a company's market capitalization and revenue to determine whether the stock is valued properly. Investopedia requires writers to use primary sources to support their work. Earnings are the main determinant of a public company's share price.

0 thoughts on “P s ratio”