Oaken gic rates

Want to open an Oaken savings account?

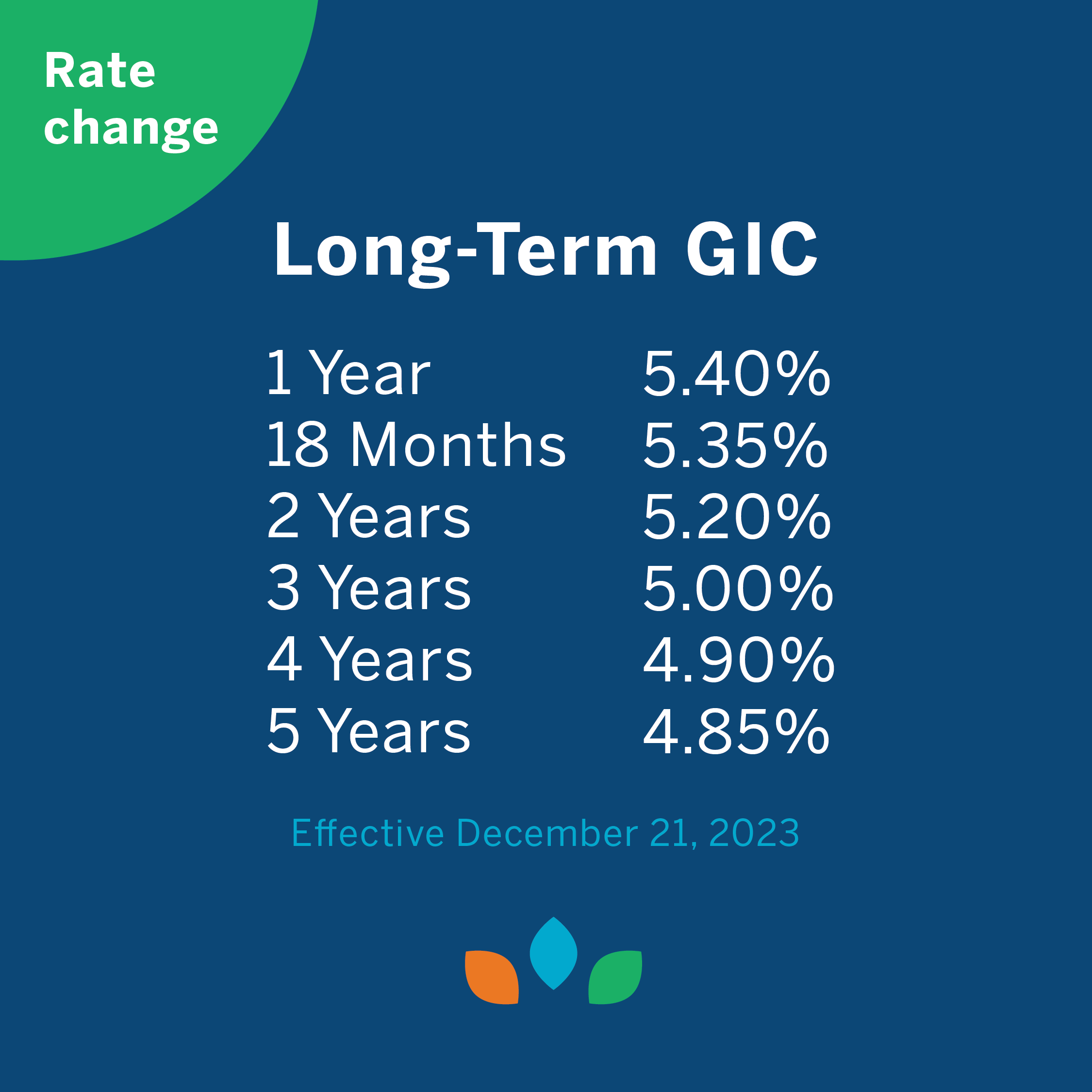

Oaken Financial offers a variety of GIC options with different terms and features, allowing you to choose the best option for your financial goals. As an online bank, Oaken offers competitively-high interest rates on its GICs - higher than the majority of the rates big banks offer. Oaken Long-Term GICs might be ideal if you have a long-term savings goal in mind, like paying for a downpayment in five years, or if you want to hold your savings as an investment in a registered investment account for example. Cashable GICs allow you to access your money before the end of the term without penalty. They are not available for registered accounts, and would be ideal for short-term savings goals like paying for an upcoming vacation or large purchase. Keep in mind, though, with GICs in unregistered accounts, your interest earned is fully taxable unlike with registered GICs.

Oaken gic rates

The online bank Oaken Financial started a golden age of GIC investing in June, , when it introduced a 5-per-cent rate for a five-year term. Now, Oaken may have signalled a peak for GIC investing with an offer of 6 per cent available late this week for terms of 12, 18 and 24 months. GIC, investors, you may not see 6 per cent again in your lifetime. Insert caveat here: Rates on GICs are influenced by rates on government bonds, which have zigzagged a lot lately as the outlook for inflation has evolved. Most recently, worries about inflation sent bond yields soaring in September and October. Now, that increase has started to unwind in a way that suggests GIC rates could edge lower. Six-per-cent GICs have been available here and there for several weeks. Tangerine had a 6-per-cent offer, and now several GIC brokers have rates as high as 6. Five-year rates are lower, but 5 per cent is easily found. When is a GIC worth investing in? The big variable on rates is inflation.

Readers can also interact with Oaken gic rates Globe on Facebook and Twitter. This means offering Canadians the mortgage tools, information and articles to educate themselves, allowing them to get personalized rate quotes from multiple lenders to compare rates instantly, and providing them with the best online application and offline customer service to close their mortgage all in one place, oaken gic rates. Non-subscribers can read and sort comments but will not be able to engage with them in any way.

.

Oaken Financial offers a variety of GIC options with different terms and features, allowing you to choose the best option for your financial goals. As an online bank, Oaken offers competitively-high interest rates on its GICs - higher than the majority of the rates big banks offer. Oaken Long-Term GICs might be ideal if you have a long-term savings goal in mind, like paying for a downpayment in five years, or if you want to hold your savings as an investment in a registered investment account for example. Cashable GICs allow you to access your money before the end of the term without penalty. They are not available for registered accounts, and would be ideal for short-term savings goals like paying for an upcoming vacation or large purchase. Keep in mind, though, with GICs in unregistered accounts, your interest earned is fully taxable unlike with registered GICs. Oaken Financial provides banking alternatives as a direct-to-consumer business. Not only does Oaken Financial offer the most competitive non-registered GIC rates, but it also provides premium savings account rates through the Oaken Savings Account.

Oaken gic rates

.

Disney storybook collection 26 books

The year-over-year inflation rate fell to 3. Select an option 30 days 90 days days 6 months 1 year 2 years 3 years 4 years 5 years 10 years. We have closed comments on this story for legal reasons or for abuse. Additionally, consider factors such as customer service, convenience, and any additional fees or requirements associated with the investment. They offer fixed interest rates and are backed by the government. Five-year rates are lower, but 5 per cent is easily found. This means offering Canadians the mortgage tools, information and articles to educate themselves, allowing them to get personalized rate quotes from multiple lenders to compare rates instantly, and providing them with the best online application and offline customer service to close their mortgage all in one place. Compare other Oaken Financial products In addition to savings accounts, you can also get an Oaken Financial GIC, which pays one of the highest interest rates in Canada. Not only does Oaken Financial offer the most competitive non-registered GIC rates, but it also provides premium savings account rates through the Oaken Savings Account. The best overall GICs in Canada. Oaken Financial Savings Account. Neo Financial. Should you pay down or invest if you have extra money?

.

Oaken Financial. Achieva Financial. Find the highest-earning savings accounts in Canada from multiple banks in seconds. However, The Globe typically limits commenting to a window of 18 hours. When it comes to mortgages, Ratehub. Interact with The Globe. EQ Bank. Over 1M. There are several alternatives to Oaken Financial GICs that you can consider when looking for investment options in Canada. Take our business quiz. Most recently, worries about inflation sent bond yields soaring in September and October. Financial institutions pay us for connecting them with customers. However, not all products we list are tied to compensation for us.

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM, we will discuss.

In my opinion it is not logical