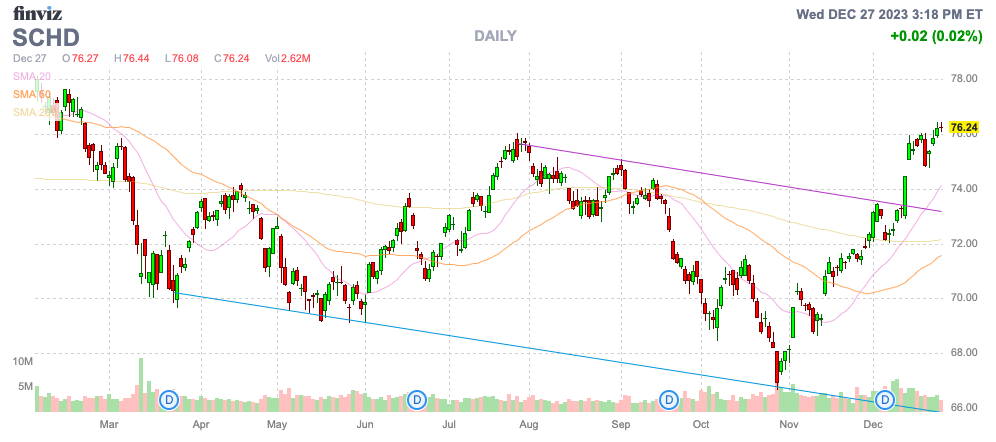

Nysearca: schd

For standardized performance information, click the Summary page, nysearca: schd. Rank within Category compares this fund's total annual return to that of other funds in the same category, and its figures are not adjusted for load, sales charges, or taxes. Exchange traded funds have gained the favor of investors because of their low expense ratios, tax efficiency, nysearca: schd, trading flexibility and liquidity.

Exchange traded funds have gained the favor of investors because of their low expense ratios, tax efficiency, diversification, trading flexibility and liquidity. They offer a lower relative cost alternative to other vehicles such as stocks and many mutual funds. ETFs trade on major U. Equity-based exchange traded funds have a similar risk profile to those of equity mutual funds, while fixed income-based ETFs have a risk profile that approximates bond mutual funds. Performance returns will fluctuate and are subject to market conditions and interest rate changes. ETF shares may be valued more or valued less than their original cost at the time of sale or redemption. ETFs that invest in foreign securities have higher risk characteristics versus domestic securities.

Nysearca: schd

This ETF offers exposure to dividend-paying U. While there are dozens of funds offering exposure to dividend-paying stocks, SCHD offers a somewhat unique approach to this strategy. The underlying index methodology requires a long track record of distributions, meaning that this product is unlikely to include small, speculative firms that are offering an attractive distribution yield because their stock price has been depressed. The methodology also considers multiple metrics, including dividend growth and dividend yield, resulting in a portfolio that should offer a substantial upgrade in payout compared to the broader market. Given the methodology employed by this fund, SCHD can be used in a number of different ways. Though the portfoli ois somewhat shallow, this fund certainly could be used as a core holding for achieving U. Further enhancing the appeal to certain cost conscious investors is the ability to trade this product commission free within Schwab accounts; that feature may have appeal to investors looking to keep a lid on trading-related fees. The adjacent table gives investors an individual Realtime Rating for SCHD on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report. This section shows how this ETF has performed relative to its peers. Returns over 1 year are annualized. ETF Database's Financial Advisor Reports are designed as an easy handout for clients to explain the key information on a fund. Includes new analyst insights and classification data.

Inception Date Oct 20, Mortgage Calculator Popular. Bitcoin Popular.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

Investing in the stock market is one of the surest ways to create wealth over time. But over short periods, there is extreme volatility. The last four years are proof enough of that. One of the best ways to navigate turbulent times is by investing in dividend stocks. They tend to be profitable businesses tested by numerous economic upheavals in the past.

Nysearca: schd

Introduction Desktop Native Mobile Apps. More from Webull. Schwab U. The fund provides exposure to a value-oriented portfolio and has delivered an attractive yield of 3. Many familiar names remain in the fund's top ten, including Coca-Cola and Pfizer.

Marlene santana videos

Total Communication Servic TipRanks Labs. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Equity U. Top Hedge Fund Managers. Source: ETFGuide. Please read the prospectus carefully before investing. Current performance may be lower or higher. Dividends Dividend Center. This ETF offers exposure to dividend-paying U. Responsible Governance Score. Inception Date Oct 20, The ETFs Vitals Issuer Charles Schwab.

Top Analyst Stocks Popular.

Open an Account. Stock Buybacks. Equity-based exchange traded funds have a similar risk profile to those of equity mutual funds, while fixed income-based ETFs have a risk profile that approximates bond mutual funds. The Fly Largest borrow rate increases among liquid names. Unemployment Rate. Top Online Brokers. Catholic Values. You can request a prospectus by calling Schwab U. Penny Stock Screener. Further enhancing the appeal to certain cost conscious investors is the ability to trade this product commission free within Schwab accounts; that feature may have appeal to investors looking to keep a lid on trading-related fees. SCHD Dividend. Compare Category Report. Dividend Calendar.

Exclusive idea))))

What quite good topic