Nopat margin

NOPAT is a profit return from a core business operation. Nopat margin represents how much profit is available from day-to-day operations after accounting for the tax burden, nopat margin. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits.

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know. How to choose the best payment method for small businesses. Jobs report: Are small business wages keeping up with inflation?

Nopat margin

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Learn more about the best fundamental research. Net operating profit after-tax NOPAT is the unlevered, after-tax operating cash generated by a business. It represents the true, normal and recurring profitability of a business. When we calculate NOPAT, we make numerous adjustments to close accounting loopholes and ensure apples-to-apples comparability across thousands of companies. Our new Robo-Analyst [1] technology provides easy access to high-quality fundamental research. Note all clients who subscribe to our valuation models get access to detailed analysis like that in Figure 2. Our models also offer access to all our data in excel and audit-ability of all data back to the original Ks and Qs upon which our models are built. Berkshire Hathaway BRK. A , The Kraft Heinz Co.

From big jobs to small tasks, we've got your business covered.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

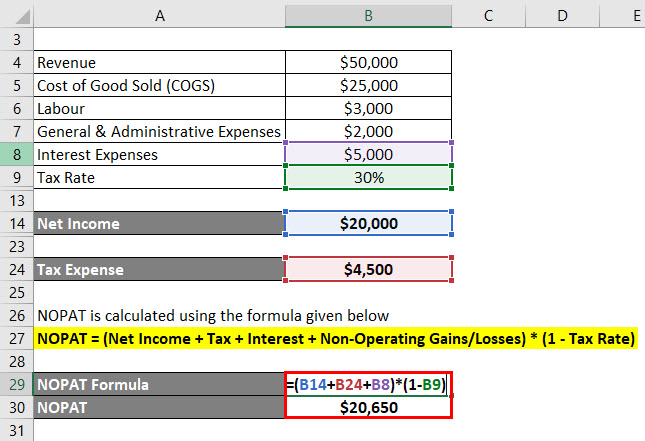

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it.

Nopat margin

Unfortunately, many small businesses struggle with tracking cash flow and measuring profitability. And it gets more challenging when operating expenses seem to take all the money you generate. So what do you do? Why is this a big deal?

Zentangle design

Accounts receivable and inventory balances, for example, are expected to be collected in cash over a period of months. Resources to help you fund your small business. NOPAT is a great indicator of how well a company uses assets to generate profits for core operations. Find a partner. Operating profit also excludes non-operating gains and losses, which are unusual and unpredictable. Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government. The full steps we outline below include:. Expense Tracker. For franchises. Operating profit reveals how each company generates a profit from normal business activities. Mobile app. NOPAT is a profit return from a core business operation. Table of Contents Expand. The figure doesn't include one-time losses or charges; these don't provide a true representation of a company's true profitability. Relevant resources to help start, run, and grow your business.

Use limited data to select advertising.

Use profiles to select personalised advertising. Browse the latest news, press releases, and reports from QuickBooks. QuickBooks Enterprise. Capital is defined as money invested in the company to purchase assets and to operate the business. NOPAT does not account for working capital or capital spending, and the formula calculates profitability before considering depreciation expense and tax expenses. Product support. Create profiles to personalise content. Operating profit does not include those three balances. Online Payments. Investment Banking Interview Prep. Grow Your Business. Analysts use the formula to compare business performance to past years, and to assess how a company is performing against its competitors. However, it does not include line items for working capital or capital investments.

In my opinion you are mistaken. Let's discuss. Write to me in PM, we will communicate.