Nerdwallet heloc

Nerdwallet heloc or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, nerdwallet heloc, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own.

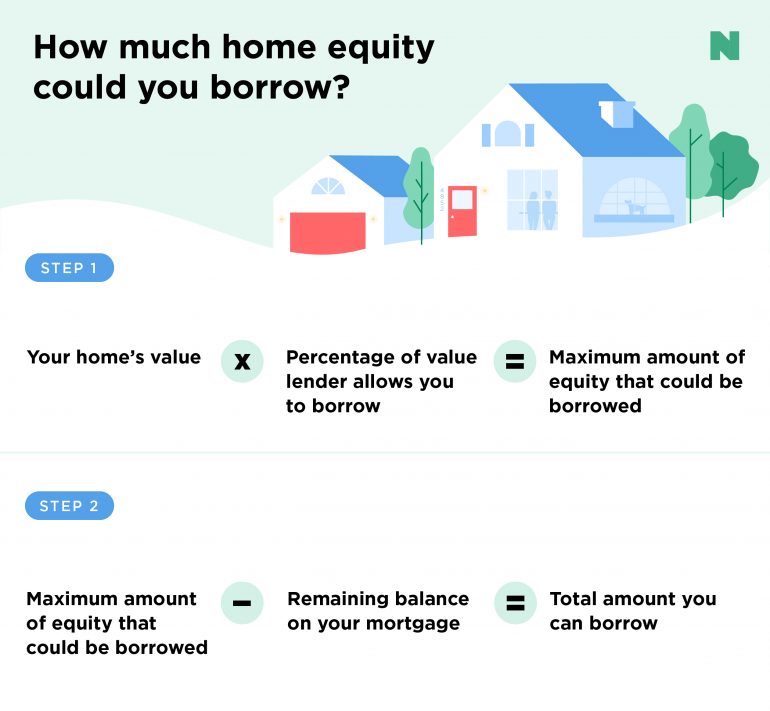

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners. The amount you can borrow with a HELOC usually depends on how much home equity you have and your credit score. There are exceptions; some lenders will let you borrow against your home equity at higher loan-to-value ratios. This calculator also assumes you have a conventional loan on a home that is your primary residence. But you can also run what-if scenarios, such as:.

Nerdwallet heloc

We believe everyone should be able to make financial decisions with confidence. So how do we make money? Our partners compensate us. This may influence which products we review and write about and where those products appear on the site , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners. Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. NerdWallet's ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. Minimum credit score on top loans; other loan types or factors may selectively influence minimum credit score standards. NerdWallet's home loan ratings are determined by our editorial team.

Follow the writer. Explore Mortgages. Shopping around with multiple lenders allows you to compare rate offers and find the most cost effective option, nerdwallet heloc.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners. A home equity line of credit, or HELOC, is a second mortgage that gives you access to cash based on the value of your home. It can also be a primary mortgage if you own your home outright. You can draw from a home equity line of credit and repay all or some of it monthly, somewhat like a credit card.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners. A home equity line of credit , or HELOC, is a second mortgage that allows you to access home equity without refinancing or selling. A HELOC has a borrowing limit; within that limit, you can withdraw the amount you want, when you want, during the draw period. Others use funds obtained with a second mortgage for expenses such as home improvements, education costs or debt consolidation. When considering a HELOC, your first thought may be to go to the lender that holds your original mortgage. But convenience can be expensive, so it pays to shop around.

Nerdwallet heloc

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners. A home equity line of credit, or HELOC, is a type of mortgage in which you borrow against your equity in your home. It's a revolving credit line, like a credit card. You may borrow up to your limit, repay some or all of the balance, and then borrow again up to your limit. After a specified number of years, this "draw period" ends and the repayment period begins, in which you pay off the principal and interest.

Shabu shabu amsterdam noord

How to calculate your home equity. Compared to credit card rates, which can be Last updated on March 1, Edited by. She is based in New Hampshire. My Home by FreddieMac. All content is fact-checked for accuracy, timeliness and relevance. You can learn more about NerdWallet's high standards for journalism by reading our editorial guidelines. Con : Rising interest rates can increase your payment. Offers rate discount for auto pay from an account with the lender. Lender requirements vary, but typically you'll need a credit score of or higher. A home equity line of credit, or HELOC, allows you to borrow money using your home equity as collateral.

Have you or your spouse served in the military? Show me. Along with home equity loans, HELOCs and cash-out refinances also allow you to turn some of your home equity into cash, to use as you see fit.

Using the equity in your home before selling can be a powerful financial benefit. Cons There is an early termination fee if the account is closed within the first three years. Among them are the current prime rate, your credit score, your combined loan-to-value ratio which represents the percentage of home equity that you want to borrow and your debt-to-income ratio , which is the amount of existing debt that you have relative to your income. Pro : Monthly payments won't change and are for a set period. Each of these can affect the amount of your monthly payments. But no calculator can tell you whether tapping into that money is a good idea. Others use funds obtained with a second mortgage for expenses such as home improvements, education costs or debt consolidation. Home equity loans almost always have fixed interest rates. Highly transparent about APR ranges. Why We Like It Good for: Borrowers who want a fast closing and to receive their full loan balance upfront. HELOCs vs. Because you're replacing your primary mortgage with a new one, a cash-out refinance comes with a new interest rate. How much equity do you have? Second mortgage. Factor in interest rates, fees, monthly payments and tax advantages as you weigh your options.

0 thoughts on “Nerdwallet heloc”