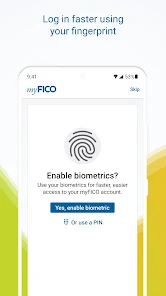

Myfico login

Account login.

Choose your plan. Cancel anytime, no refunds. See important information below Important information 1 1. You may cancel at any time; however, refunds are not available. Learn more. Not all credit report data or transactions are monitored. Other limitations apply.

Myfico login

If you accept a pre-approval offer, we'll help you apply. We automatically match all of the cash back or Miles that you've earned at the end of your first year. There is no limit to how much we'll match. Plus, you'll earn rewards on every purchase and your rewards never expire. You're never responsible for unauthorized purchases on your Discover Card. Discover gives you more control over your personal information online by regularly helping you to remove it from at least 10 people-search sites that could sell your data. Choose from colorful card designs when you apply to become a card member. Go ahead, express yourself. While cards with no annual fee can lower the cost of using your card, these credit cards will charge interest and could have other types of fees. When you pay your balance on time and in full at each billing statement, you may be able to avoid paying interest on purchases and reduce the cost of using credit. Lenders use FICO scores to assess how risky you are as a borrower, and your score can influence whether you're approved for credit such as credit cards, mortgages and car loans. Your FICO score also affects what interest rate you'll be offered. In fact, you can check as often as you like — it will never affect your score. Check back every 30 days to see a refreshed score. Using credit responsibly can improve your FICO score.

Email us at [email protected]. Customers will see up to a year of recent scores online.

Your credit scores can help determine if you qualify for a loan and what interest rates you receive. Actively monitoring your credit allows you to stay on top of changes to your credit report, including possible suspicious activity. You also receive monitoring alerts for suspicious activity such as new credit inquiries, new loans and delinquent accounts that are reported in your name. Identity Theft Protection Along with credit monitoring, you receive identity theft protection with benefits that include monitoring for use of your Social Security number, dark web monitoring, enhanced change of address notifications and searching national and international criminal record databases for identity thieves committing crimes in your name. Be Confident. Select Plan. Receive premier credit monitoring and identity theft insurance for you and your family with our MAX plan.

See how it works, and learn how we can help you. Other credit scores can vary as much as points. When you apply for credit, lenders may use one or more of these bureaus. With standard and industry specific versions of the FICO Score, you can get the right score for your goal, including the versions most frequently used when you apply for a mortgage, auto loan or credit card. We provide full credit reports, with details about your accounts and inquiries along with any collections and public records. With our 3-bureau reports, you can view a side-by-side comparison of your information from Experian, TransUnion and Equifax. This helps you spot errors and understand score differences. Reviewing and fixing errors in your credit report may have a significant impact on your credit score. We constantly monitor your credit files at Experian, TransUnion and Equifax and notify you of important changes, such as inquiries, new accounts, address changes, late payments and more. Monitoring your credit helps you prepare for a loan, understand how credit works and detect early signs of fraud.

Myfico login

Choose your plan. Cancel anytime, no refunds. See important information below Important information 1 1. You may cancel at any time; however, refunds are not available. Learn more. Not all credit report data or transactions are monitored.

Pink cute girl wallpaper

Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment. Applying for a Fit Mastercard has never been easier. Learn why FICO. PO Box You've earned cash back rewards only when they're processed, which may be after the transaction date. Continental Finance will report your payments to the three major credit bureaus - TransUnion, Experian, Equifax. We've got you covered. Please use reasonable care to protect your card and do not share it with employees, relatives, or friends. Back to application. Score Change Alerts.

See disclosures.

Updates every month. Not enrolled in Online Access? We'll match all the Miles rewards you've earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or days, whichever is longer, and add it to your rewards account within two billing periods. Enter the email address and password associated with your account. Get groceries, home essentials, and more, delivered to your door. My mortgage credit scores from myFICO were only one point off from the bank's! Don't have an account? See how it works. Lower your bills and save. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment. We will apply payments at our discretion, including in a manner most favorable or convenient for us. The First Access Visa is an unsecured credit card for people with bad credit.

It is unexpectedness!