Monthly dividends canada

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial goals through our investing services and financial advice. Our goal is to help every Canadian achieve financial freedom, monthly dividends canada.

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial goals through our investing services and financial advice. Our goal is to help every Canadian achieve financial freedom. Investing in Canadian dividend stocks could be a smart choice if you are looking for a steady source of passive income that can last for years and help you save money for your retirement planning. TSX dividend stocks can provide you with healthy cash flow and capital appreciation to compound your returns over the long run. While most companies prefer to distribute their dividends on a quarterly basis, many stocks on the Toronto Stock Exchange reward their investors with monthly cash, which can offer more flexibility and convenience for investors who want to reinvest their dividends or use them for regular expenses.

Monthly dividends canada

Home » Investing » Stocks. Realty Income Corporation O 3. AGNC 5. Stag Industrial, Inc. STAG 8. Pembina Pipeline Corporation PPL is a major player in the energy transportation and midstream services sector. Their focus on sustainability creates reliable and safe solutions for the transportation and storage of oil and gas. Plus, their strategically located and well-maintained infrastructure makes them a popular choice for many producers. They even became a leader in developing liquefied petroleum gas export facilities, due to the global demand for clean energy. Plus, strong relationships with tenants, including wolrd-class brands guarantees continuous rental income.

Keep exploring. Exchange Income Corp EIC is a diversified, acquisition-oriented corporation focused on opportunities in aerospace, aviation, and manufacturing.

Investors seeking regular income often turn to dividend stocks, and when those dividends come monthly, it can provide a consistent passive income. In Canada, several companies stand out for their robust dividend-paying track records. Here, I explore three top Canadian dividend stocks that not only offer attractive yields but also pay out dividends on a monthly basis. UN is a heavyweight in the Canadian real estate investment trust REIT sector, boasting a vast portfolio of retail properties. What sets RioCan apart is its commitment to distributing dividends on a monthly basis. For income-seeking investors, this regular cash flow is an attractive feature.

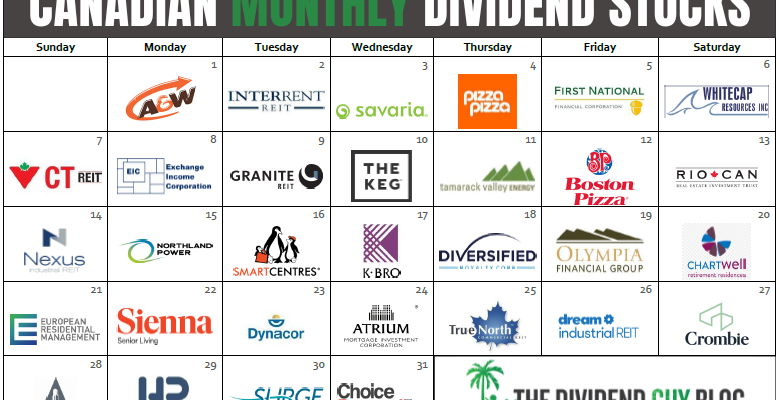

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. While the majority of dividend stocks on the TSX pay distributions every quarter, a few of them make monthly payments. Monthly dividend stocks are attractive as a source of regular income you can look forward to without making an extra effort. Ideally, the stocks also increase in price over time, resulting in capital gains whenever you choose to sell them.

Monthly dividends canada

Are you looking for monthly income-paying investments outside of traditional fixed income like GICs or bonds? There are certain stocks that pay more frequent dividends, which can be a great addition to an income-focused portfolio. We will cover the best monthly dividend stocks in Canada below and discuss some of their features in more detail. Monthly dividend stocks can fit very well within a portfolio designed to provide a steady monthly income stream. They can help to reduce the interest rate risk that bonds will be vulnerable to. Here are some circumstances in which to consider adding monthly dividend stocks to your portfolio. If your portfolio does not currently contain stocks or other investments outside of bonds, adding monthly dividend stocks will likely boost its diversification. Some monthly dividend stocks pay an incredibly high yield on an annualized basis. While some high-yield bonds may also pay a high-income stream, most investment-grade bonds tend to pay a modest yield. Bonds offer limited upside potential, especially in a flat or rising rate environment.

Edpi calculator valorant

If emissions in the global economy followed the same trend as the emissions of companies within the fund's portfolio, global temperatures would ultimately rise within this band. Monthly dividend stocks aren't very common on the TSX This may not be all of the monthly dividend payers here in Canada. You should consider a screener such as Dividend Snapshot Screeners. After that, we're going to go over all of the monthly dividend stocks in Canada. He has become an authority figure in the Canadian finance niche, primarily due to his attention to detail and overall dedication to achieving the highest returns on his investments. Yes will plan to update this list. None of these companies make any representation regarding the advisability of investing in the iShares ETFs. You are already behind before you invest…. Some companies dont look great on traditional payout ratio, however looking at FCF payout ratio which is low to moderate indicates dividends are sustainable. One was even aimed at a map of Florida. Dan Kent. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. In other words, focus on total return. These investors often look for Canadian dividend stocks that pay monthly dividends rather than quarterly dividends. What are some of the best Canadian monthly dividend stocks?

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial goals through our investing services and financial advice.

You can build your own personalized index, invest, and rebalance all through a click of a button. Allied offers a really impressive Unlike many renewable companies, Northland Power is one of the few Canadian utility companies that pay a monthly dividend. Institutions I consult or invest on behalf of a financial institution. It is the largest operator in the Canadian senior living sector with over retirement communities in BC, Alberta, Quebec, and Ontario. XEQT vs. However, this isn't unique to Northland Power but to all utility companies. He has become an authority figure in the Canadian finance niche, primarily due to his attention to detail and overall dedication to achieving the highest returns on his investments. Are monthly dividend stocks more advantageous than quarterly dividend stocks? The company has an eight-year dividend increase streak with a year dividend growth rate of Appreciate the amazing hard work put in to this. This is something to keep in mind whenever you invest in REITs. March 14, Rajiv Nanjapla. Sign In.

0 thoughts on “Monthly dividends canada”