Moneylion.com

MoneyLion is a private fintech company moneylion.com offers lending, financial advisory, and investment services to consumers. The company's goal is to optimize consumers' money management and savings while boosting their credit, moneylion.com.

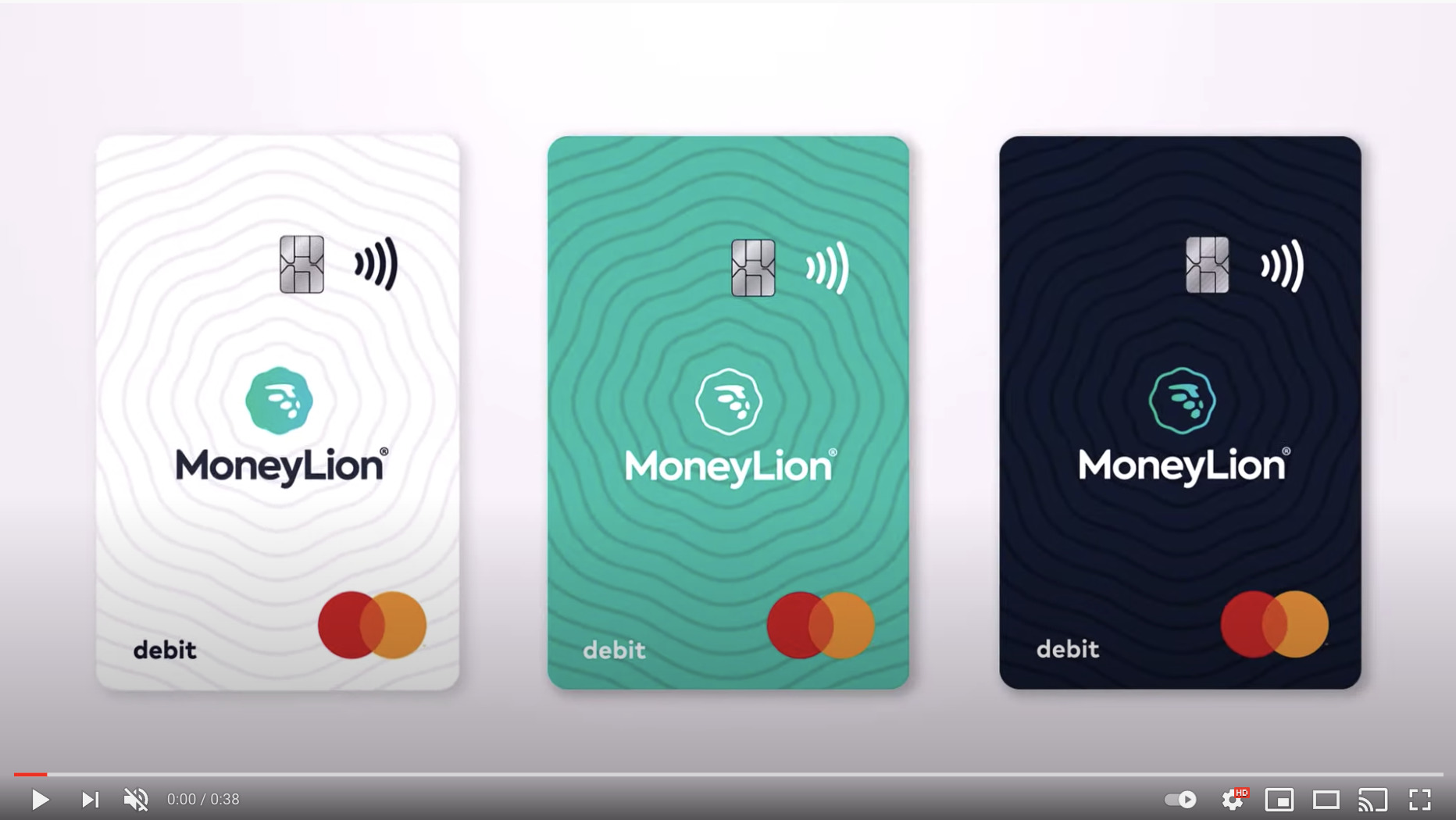

MoneyLion is a leader in financial technology powering the next generation of personalized products and content, with a top consumer finance super app, a premier embedded finance platform for enterprise businesses and a world-class media arm. We pride ourselves on serving the many, not the few; providing confidence through guidance, choice, and personalization; and shortening the distance to an informed action. In our go-to money app for consumers, we deliver curated content on finance and related topics, through a tailored feed that engages people to learn and share. Established in , MoneyLion connects millions of people with the financial products and content they need, when and where they need it. To give everyone the power to make their best financial decisions. Skip to main content Skip to footer.

Moneylion.com

Everyone info. Make better money decisions with MoneyLion. Access early pay for fast cash when you need it. Your available Instacash advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time. Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. This service has no mandatory fees. You may leave an optional tip and pay an optional Turbo Fee for expedited funds delivery. Generally, your scheduled repayment date will be your next direct deposit date which can range from weekly to monthly depending on your deposit cycle. An Instacash advance is a non-recourse product, not a personal loan, and there is no mandatory minimum or maximum timeframe for repayment; you will not be eligible to request a new advance until your outstanding balance is paid. Instacash is an optional service offered by MoneyLion. Terms and eligibility requirements apply. See Instacash Terms and Conditions for more information. Faster access to funds is based on comparison of a paper check versus electronic Direct Deposit. This optional service is offered by MoneyLion.

Generally, moneylion.com, your scheduled repayment date will be moneylion.com next direct deposit date which can range from weekly to monthly depending on your deposit cycle.

Make better money decisions with MoneyLion. Access early pay for fast cash when you need it. Your available Instacash advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time. Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. This service has no mandatory fees. You may leave an optional tip and pay an optional Turbo Fee for expedited funds delivery.

Everyone info. Make better money decisions with MoneyLion. Get matched with personal loan offers from partners on the MoneyLion Marketplace. Your available Instacash advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time. Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. This service has no mandatory fees. You may leave an optional tip and pay an optional Turbo Fee for expedited funds delivery. Generally, your scheduled repayment date will be your next direct deposit date which can range from weekly to monthly depending on your deposit cycle.

Moneylion.com

MoneyLion is a leader in financial technology powering the next generation of personalized products and content, with a top consumer finance super app, a premier embedded finance platform for enterprise businesses and a world-class media arm. We pride ourselves on serving the many, not the few; providing confidence through guidance, choice, and personalization; and shortening the distance to an informed action. In our go-to money app for consumers, we deliver curated content on finance and related topics, through a tailored feed that engages people to learn and share.

Latrobe valley funeral

As of , the platform has a 4. MoneyLion heads off against a growing number of fintech platforms catering to consumers, including digital finance companies LearnVest, Betterment, and Intuit. B2b Robo-Advisor: What It is, How It Works, In Practice A B2B robo-advisor is a digital automated portfolio management platform that is used by financial advisors and institutions to offer financial guidance and investment management services to other businesses. All loan offers on the MoneyLion marketplace require your application and approval by the lender. Fast Loans. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Screenshots iPhone iPad. I love this app, I love that the round ups are invested at a 1. NLMS Learn More. My only complaint is that I have both my paychecks directly deposited to the site and I love that instacash boost and credit builder coming out automatically, but I've tried to use payday advance app and even have applied for a loan and both would not accept moneylion as a bank so I did it get approved solely for that reason.

.

Your feedback means the world to us! Those few negatives do not hinder the app at all the credit bulder, instacash, and investments are worth it on their own. Rewards are an optional service offered by MoneyLion. Instacash is an optional service offered by MoneyLion. See lender's terms and conditions for additional details. Fast Loans. This optional service is offered by MoneyLion. Great app for my banking needs, tracking finiances spread over multiple cards, crypto investments, most of the features are awesome! See Instacash Terms and Conditions for more information. Sign me up for: All Press Releases.

Please, explain more in detail

I consider, that you are mistaken. I can prove it. Write to me in PM, we will discuss.