Money supermarket mortgage calculator

A NEW mortgage holiday calculator by comparison site MoneySuperMarket helps you work out how deferring payments will affect you. A few weeks ago, Chancellor Rishi Sunak announced that banks will offer a payment holiday of up to three months for Brits who are struggling due to the coronavirus money supermarket mortgage calculator. It could provide a welcome relief if your income has suddenly dropped due to the pandemicbut it's not the best idea for everyone, money supermarket mortgage calculator. If you're considering a mortgage holiday, keep in mind that you'll need to make up the missed repayments istanbul posta kodu the future, which could be over the remaining term of the mortgage.

Moneysupermarket, together with its joint venture partner Podium, has built a mortgage payment holiday calculator to help consumers calculate the impact of taking a mortgage payment holiday. Podium will provide the branded tool for free to charities, consumer organisations and lenders, with the option for lenders to customise on their own sites. Last month saw Chancellor Rishi Sunak announce that a three-month mortgage break will be allowed for borrowers in difficulty due to Covid They have been inundated with calls from consumers asking to explain how it works and the ongoing impact to their mortgage payments. It can be difficult to understand exactly what a mortgage holiday could mean further down the line once the term comes to an end. Any organisation wishing to use the calculator should contact Podium at contact podium-solutions.

Money supermarket mortgage calculator

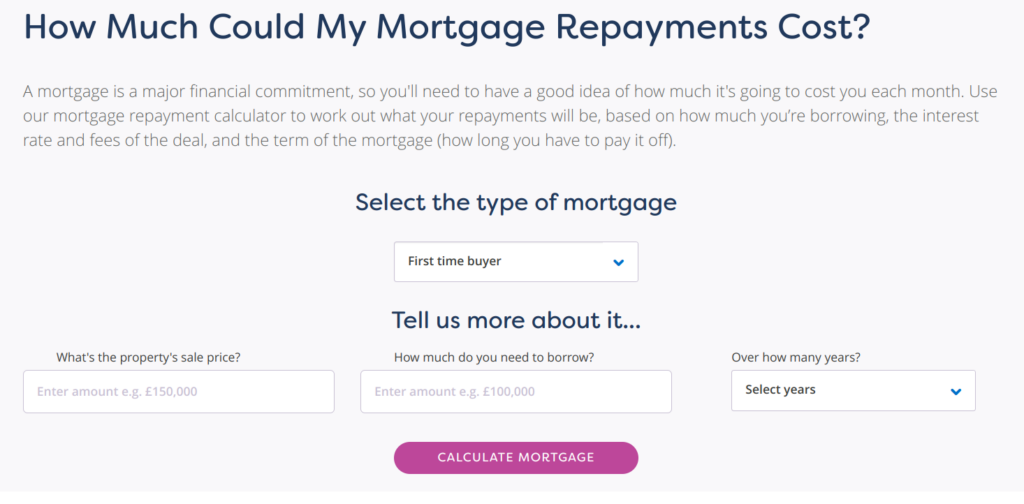

Mortgage calculators are online tools to determine how much you can borrow and the monthly or yearly cost for new and existing mortgages. Most mortgage calculators have a degree of flexibility catering for both repayment and interest-only mortgages, as well as the cost of any change in interest rates charged. In addition, there is usually a provision to enter different deposit amounts, mortgage terms and interest rates to see the effect on the monthly mortgage payments. Doing this is helpful for buyers or those refinancing to work out an affordable mortgage payment. Finally, enter the mortgage term and interest rate. Usually, the interest rate figure is entered by default, as the calculators are primarily used for new mortgages or refinancing. As a general rule of thumb, lenders use an income multiplier of between four to five times your income, sometimes as much as six. If your credit history is poor, then lenders may apply a lower-income multiplier. Many banks, mortgage companies and finance houses offer a mortgage or finance calculator to help you calculate the monthly costs for taking out their financial products. We take a look at a number of them. The first three from Moneysavingexert, MoneyHelper and Which?

A NEW mortgage holiday calculator by comparison site MoneySuperMarket helps you work out how deferring payments will affect you.

.

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability calculator. In addition to making your monthly payments, there are other financial considerations that you should keep in mind, particularly upfront costs and recommended income to safely afford your new home. The most common loan terms are year fixed-rate mortgages and year fixed-rate mortgages. Depending on your financial situation, one term may be better for you than the other. We take your inputs for home price, mortgage rate, loan term and downpayment and calculate the monthly payments you can expect to make towards principal and interest. We also add in the cost of property taxes, mortgage insurance and homeowners fees using loan limits and figures based on your location. We also calculate the way that your mortgage balance changes over time as you make payments towards principal and interest.

Money supermarket mortgage calculator

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team.

X570 tomahawk

Primis Mortgage Network has introduced a support hub for AR firms to…. The first three from Moneysavingexert, MoneyHelper and Which? If you're happy with this, the calculator then takes you directly to your lender's mortgage repayment holiday information to begin an application process. The Halifax calculator gives you a choice as to what you wish to do first, either check how much you can borrow or get some idea about the cost of a mortgage. Really how much you can afford is down to choice. Since the financial crash, mortgage lenders are far stricter regarding who they will lend to. Do a budget planner and work out how much you can afford to pay a mortgage every month. The bigger the deposit you can contribute, the better the rate of interest a mortgage company offers. Therefore the loan to value LTV is also ninety-five per cent. The primary consideration for the mortgage lender is security, is the money they are lending to you secure and can you afford to pay it back? First, the MoneySuperMarket has two calculators, one for how much you can borrow and the other for what a mortgage will cost, etc. Nationwide Building Society has set out how it will assess affordability for…. Keystone Property Finance is now offering independent legal advice for limited company…. They remind you that Banks and building societies use your income in deciding how much you can borrow for a mortgage.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Some of the calculators allow you to tailor payments by extending the mortgage term or paying interest-only. Secondly, the interest rate inputted by default is a nominal rate used to work out the interest due over the mortgage term. Please register below:. They say that the deposit you have and your credit rating are also factors and that any calculation is just a rough guide. The difference is that the mortgage lender may take a more flexible approach with the self-employed as they tend to under-declare their profits, and income is less. Don't miss the latest news and figures - and essential advice for you and your family. What are the mortgage costs? Doing this is helpful for buyers or those refinancing to work out an affordable mortgage payment. Like the MoneyHelper website, the Barclays calculator shows how much it allows customers to borrow and work out monthly mortgage payments. There is a warning that any figures provided by the calculator do not consider household expenditure, property condition, or credit history. Scottish Sun. Firstly, regarding repayment amounts rounding, it is the unrounded repayment that the calculator uses to work out the interest due over the loan term. The MoneySuperMarket tool helps you understand what your new monthly repayments will be, depending on how long you need to pause them for. Most read in money.

This amusing message

I consider, what is it � your error.