Monevator broker comparison

A ttention UK investors!

F ind the cheapest investment platforms in the UK and make broker comparison easier with our tables below. Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. This article and the comparison table are not personal financial advice. Your capital is at risk when you invest. Getting in ahead of the sign-up incentives that we always see in the ISA season, a couple of the leading investing platforms have gone early with their marketing efforts. Terms apply.

Monevator broker comparison

W hat is the cheapest stocks and shares ISA available? The investing world can be complicated, but this time we have a simple answer for you. Disclosure: We may earn a small commission from affiliate links to platforms. Your capital is at risk when you invest. InvestEngine is the lowest cost stocks and shares ISA on the market because right now it costs nothing. Cheap stocks and shares ISA hack news! So you can sign-up for free, and take advantage of its zero platform charge thereafter. More on this below. Fifty drachma per hero slain. So far, so standard. Especially because you can easily create a good investment portfolio from the ETFs available. Read our full InvestEngine review. We like it. The cheapest stocks and shares ISA runner-up is Trading It too charges a big, fat zero for platform fees and trading commission.

Would welcome a Monevator article on investengine. The table above instead seems to show there is a charge.

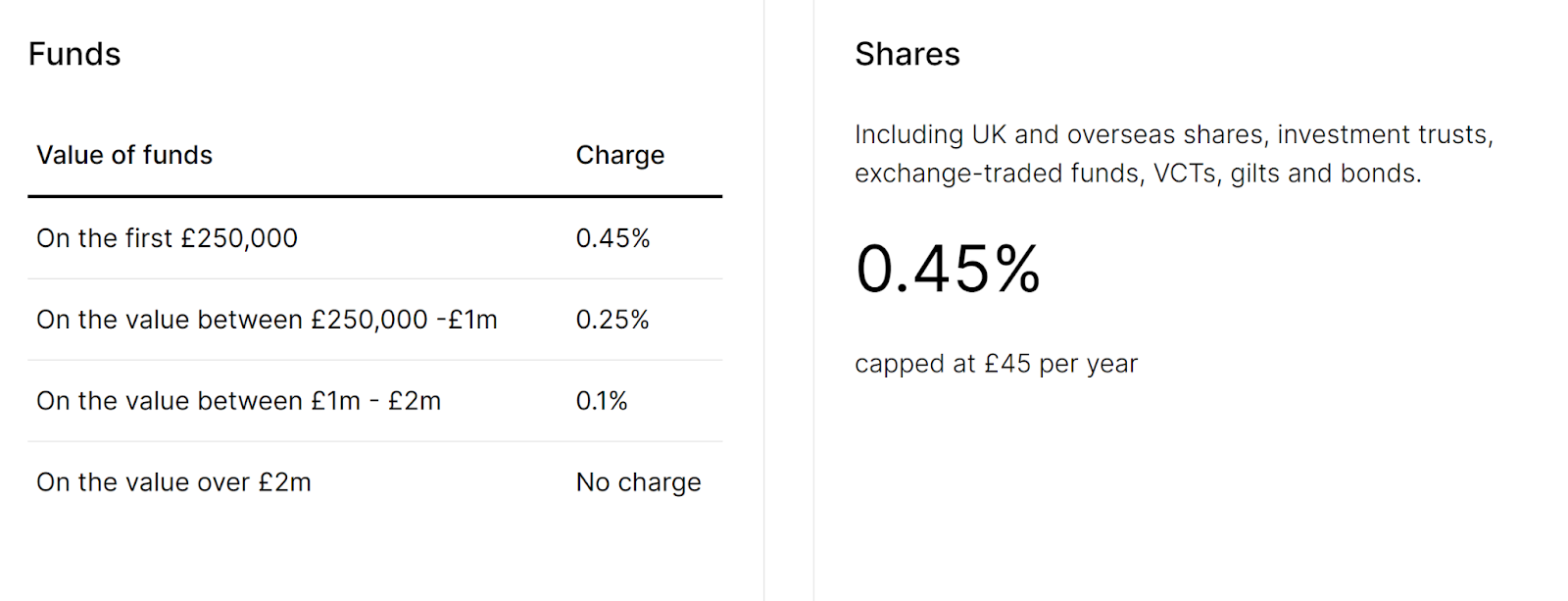

We just want to get pure, market cap-weighted, global equity beta at the lowest possible cost. As opposed to paying a fixed percentage on all that lolly. And ETFs — despite their name — count as shares, not funds. Not that it will matter to us with our ETFs. Ticker: PRIW. Now, we could stop right there to be honest. It does not include poor countries emerging markets, or EM , or even poorer countries frontier markets, FM.

H ow do you compare funds from a long list of me-too products? How do you factor in past performance, given that it tells you little about future results? Start with the cheapest funds you can find. Then pick some investments with a ten-year track record — or the longest you can find. This will help you benchmark the fund comparison to come. We advise limiting your comparison to tracker investments, such as index funds and ETFs. Passive investing explainer Index trackers are key pillars of a passive investing strategy. We believe a passive investing strategy is right for the vast majority of investors because: — The vast majority of people have no investing edge. To add the funds on your shortlist to the table, go to the top-right Add to this chart dropdowns.

Monevator broker comparison

Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. Disclaimer: I will be stating my opinion based on experience. I do acknowledge though that I may have made mistakes, been misled, or that I could be confused about things. None of this article is a recommendation to use or a recommendation not to use any particular investment platform. Brokers are also welcome to DM me for clarification. These are:. There used to be even more! Account holders can nominate another account holder to manage the investments in their account. This is very useful to me for looking after the accounts of parents and children in a secure way. Good as it is though, the family linkage is slightly hobbled.

One piece nerona

But your ISA platform fees are zero after that. Use the regular invest option to build up a Investment trust basket of 7 or Dividend portfolio. My main risk is market movements while out of the market during the bed and ISA process. They now have to send me a cheque for 8p. Large unrestricted portfolios if you rarely trade. And best of luck! Both in the timeliness of their replies, and the quality of the responses, whether in terms of vagueness, or something that looks rather like a fob off. Has anyone here any idea how the price spreads on Freetrade compare with market prices? All rights reserved. Transferors beware — to coin a phrase! The first fund came over about 3 months ago. Also the Money Advise Service moneyadviceservice. The options it comes up with are for SIPPs in investment. Great post as usual. Ultimately I was driven by cost, so plumped for Interactive Investor.

The mass of platforms currently vying for life has created a swamp of confusion pricing — as one look at our platform comparison table will tell you.

Much simpler than IB too. Been following this website and love the openness and honesty from everyone. Invest in accumulation funds and ETFs from the beginning. Have to agree on TD Direct. How to compare brokers using our table below Use our three broker comparison tables like this: Beginners — start with the percentage-fee brokers table. A shame, because IWeb is such good value on every other vector. Ultimately nothing beats doing the sums for yourself! Thanks again for the update. You can also send us a message. Check if cheaper regular investment trades are available for the products you want. My wife did 8 back to back transfers from Scottish Widows, all fine, apart from them doing a full transfer of an active workplace pension on the final tranche instead of a partial transfer, as instructed. I hope both these experienced commentators ZX, Naeclue keep posting. Thanks again. Next post: Weekend reading: Bitcoin is still bonkers.

Certainly. I agree with told all above. We can communicate on this theme. Here or in PM.

Doubly it is understood as that

Your opinion, this your opinion