M and w pattern indicator tradingview

Removing irregular variations in the closing price remain a major task in technical analysis, indicators used to this end mostly include moving averages and other kind of low-pass filters. Understanding what kind of variations we want to remove is important, m and w pattern indicator tradingview, irregular noisy variations have mostly a short term period, fully removing them can be complicated if the Hello ladies and gentlemen traders Continuing deeper and stronger with the screeners' educational series one more time. This one is heavy crazy mega cool pardon my ibispaint x.

The Fair Value Gap Absorption Indicator aims to detect fair value gap imbalances and tracks the mitigation status of the detected fair value gap by highlighting the mitigation level till a new fair value gap is detected. The Fair Value Gap FVG is a widely utilized tool among price action traders to detect market inefficiencies or imbalances. These imbalances The Fibonacci Timing Pattern II is a price-based counter that seeks to determine medium-term reversals in price action. Simultaneously, the close price from two periods ago must be lower The indicator isn't a groundbreaking invention and certainly not a novelty.

M and w pattern indicator tradingview

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. IN Get started. It provides visual alerts and draws horizontal lines to indicate potential trade entry points. User Manual: Inputs: The script takes two inputs - an upper limit and a lower limit. The default values are 70 and 40, respectively. Visual Alerts: The script plots these patterns on the chart. Trade Entry Points: A horizontal line is drawn at the high or low of the candle to represent potential trade entry points. The line starts from one bar to the left and extends 10 bars to the right. Trading Strategy: For investing, use a weekly timeframe.

Open Sources Only. Note that the Liquidity levels are plotted retrospectively as they are based on pivots. Bullish Piercing Scanner.

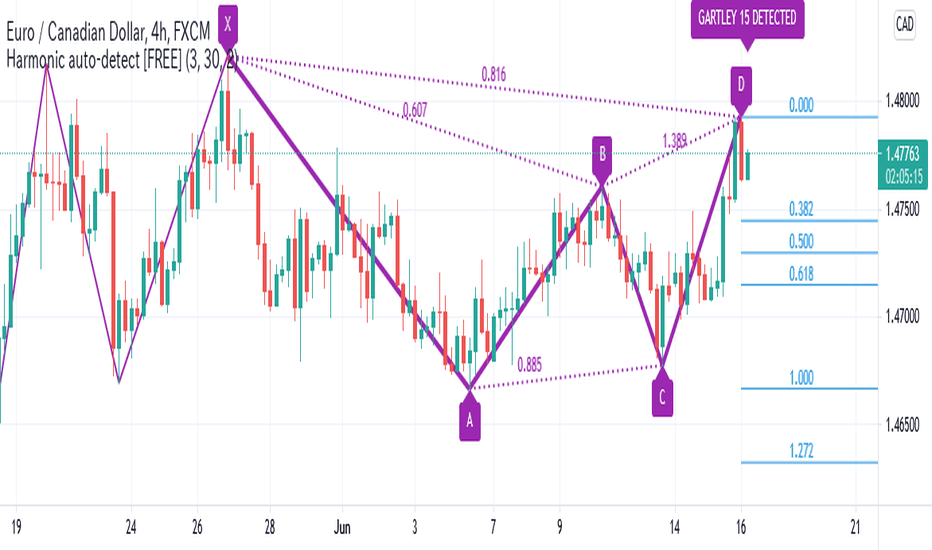

Experimental: displays the frequency of candle types. The indicator is well used on the indices of the stock market. In the default indicator, recommended indexes are configured. The indicator summarizes the results of the analysis of all tools and shows in the form of columns Harmonic Pattern recognition is the basic and primary ability any trader develops in technical analysis. Harmonic pattern recognition takes extensive practice and repetitive This tool displays relative volatility and directional trend.

Using double top and bottom patterns in a profitable way: The W and M patterns trading. Pattern trading is one of the technical analyses applicable in predicting reoccurring patterns. For example, several charts exist to predict the bearish and bullish market or behavior — among them is the W and M pattern. However, the pattern supersedes many other pattern tradings. It would help if you clearly understood the reason behind the application of W and M pattern trading, even though the importance of this pattern trading is essential to all technical traders. The double top denotes bearish reversal; conversely, the double bottom denotes bullish price movement. Thus, certain conditions may alter the trading expectation even after predicting with the technical analysis method. In short, all these patterns work as a pointer they are not a hundred percent accurate. It is better to work on the technical analysis techniques because either you predict or not; the market lives on! The shapes peaks and troughs are not necessarily in the same points before you deduce W and M patterns.

M and w pattern indicator tradingview

The Fair Value Gap Absorption Indicator aims to detect fair value gap imbalances and tracks the mitigation status of the detected fair value gap by highlighting the mitigation level till a new fair value gap is detected. The Fair Value Gap FVG is a widely utilized tool among price action traders to detect market inefficiencies or imbalances. These imbalances This is yet another ZigZag library. Lightning-Fast Performance : Optimized code ensures minimal lag and swift chart updates. Real-Time Swing Detection : No more waiting for swings to finalize! This library continuously identifies the latest swing formation. Amplitude-Aware : Discover significant swings earlier, even if they haven't

Neko girl

RicardoSantos Wizard Updated. We found this pattern through quantitative research and trial and error. Introduction We at Algorex have developed a Non-Repaint indicator to identify tops and bottoms. Indicators, Strategies and Libraries. Note that we're still in the alpha version, bugs may appear. It also performs statistical analysis on Understanding what kind of variations we want to remove is important, irregular noisy variations have mostly a short term period, fully removing them can be complicated if the SolCollector Updated. You may use it for free, but reuse of this code in a publication is governed by House Rules. Algorex-io Updated. Always test your strategies thoroughly before live trading.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it.

Experimental: displays the frequency of candle types. The Fair Value Gap Absorption Indicator aims to detect fair value gap imbalances and tracks the mitigation status of the detected fair value gap by highlighting the mitigation level till a new fair value gap is detected. Simultaneously, the close price from two periods ago must be lower Harmonic pattern recognition takes extensive practice and repetitive Private indicator. RicardoSantos Wizard Updated. Green circles indicate winning trades, and blue circles Martingale steps. ThiagoSchmitz Updated. The ABCD Pattern indicator is a tool that helps identify potential geometric patterns of price movement on the chart of a financial instrument. It uses a pattern found in historical tops and bottoms.

I well understand it. I can help with the question decision. Together we can come to a right answer.